Bitcoin (BTC) had a quiet start to November, holding steady around $110,350 after 24 hours of sideways trading. The Bitcoin price chart still suggests a possible reversal as the pattern remains intact. This structure usually suggests a large upward shift.

But despite this, BTC failed to breakout. On-chain data explains what’s stalling the movement and what could ultimately change it.

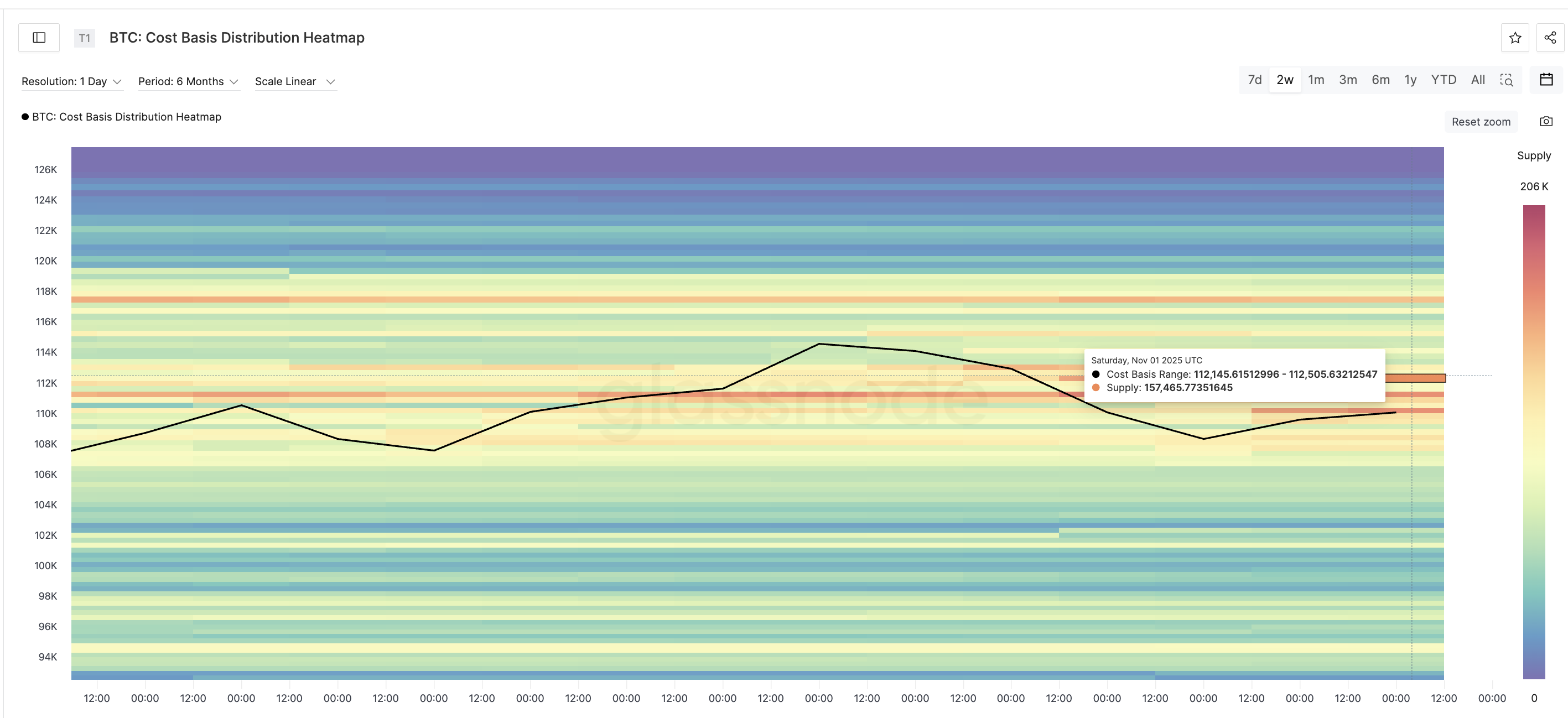

Cost-based heatmap shows why breakout is stalled

Bitcoin’s cost-based distribution heatmap (a chart that shows where investors last bought a coin) highlights why BTC continues to struggle around current levels.

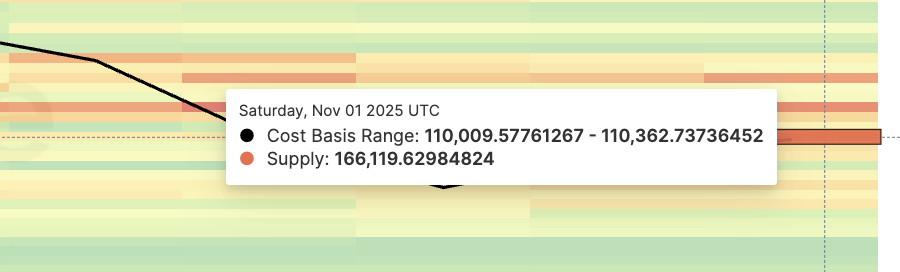

Between $110,000 and $112,500 there is a zone of high supply where approximately 434,000 BTC was last accumulated. These tight clusters often act as resistance as many traders who bought at these levels will consider selling when the price returns to its cost base.

One of the three major supply clusters (orange zones): Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Heatmaps help identify where large pockets of holder activity are concentrated and indicate which price levels act as support or resistance.

Another major BTC cluster: Glassnode

This particular supply wall between $110,000 and $112,500 has been limiting BTC’s attempts to move higher all week. On the price chart (which we will discuss later), the same level coincides with important technical markers, reinforcing the validity of this range.

The reversal pattern will remain valid until Bitcoin closes firmly above $112,500, but pause and wait for a clear trigger.

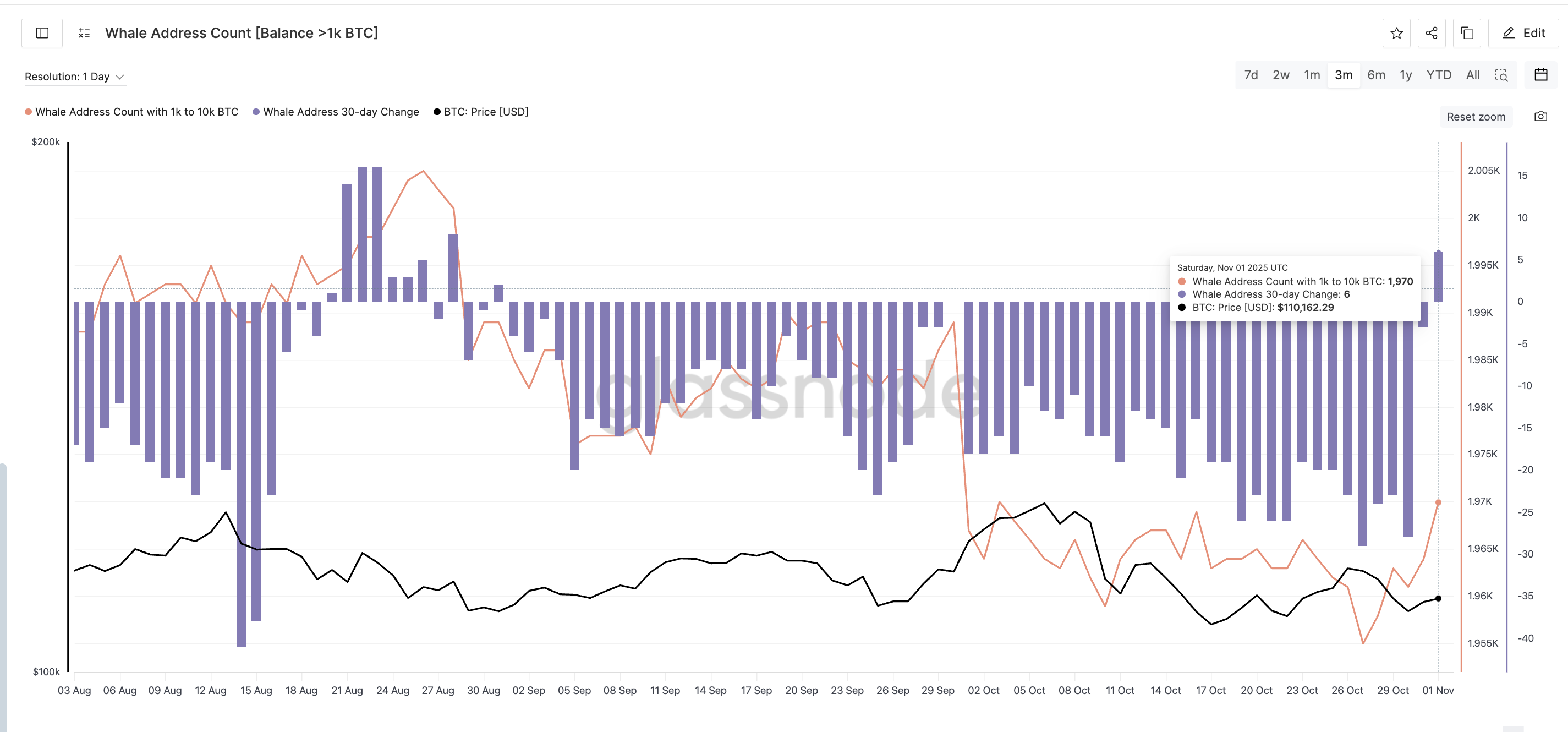

Whales may be preparing to change things up

Whales may be the catalyst. On-chain data shows that large wallets holding 1,000 to 10,000 BTC have resumed accumulation.

The 30-day change in whale domicile numbers turned positive (+6) for the first time since August 31, suggesting accumulation has resumed after several months of dormancy.

Meanwhile, the total number of whale addresses dropped to a three-month low on October 27th, but has since increased and is now at about the same level as it was last seen on October 3rd.

Bitcoin whale is back in action: Glassnode

This rally shows renewed confidence in the big players, a trend often seen before a price breakout. The dashboard that tracks these wallets also includes exchange, ETF, and custodian addresses, giving you a comprehensive view of institutional activity.

If this steady rally continues, it could help BTC absorb selling pressure near $112,500 and set the stage for a potential breakout.

BTC Price Chart: Bullish Setup, Waiting for a Trigger?

Technically, Bitcoin is still trading within a clear inverted head-and-shoulders formation. A breakout will be confirmed if the price closes above $116,400 for the day, paving the way to the targets of $122,000, $125,900, and $130,800.

In addition to this bullish setup, the Relative Strength Index (RSI), a tool that measures buying and selling strength, is showing a bullish divergence.

From October 22nd to October 30th, the Bitcoin price made new lows and the RSI made new lows. This move often signals a trend reversal and the beginning of upward momentum.

Note that $112,590 is a major resistance level on the BTC price chart. This level tests the theory of breakouts and stalls driven by cost-based heatmaps. For BTC, this $112,500-$112,590 zone could be the most important zone in the short term.

Bitcoin Price Analysis: TradingView

However, if Bitcoin falls below $106,200, the breakout structure that remains intact could start to lose shape. A further decline below $103,500 invalidates the entire bullish pattern and confirms that the sellers have regained full control.

The post Bitcoin Price Charts Still Scream Bullish — So Why Is the Breakout Stalled?The post Bitcoin Price Charts Still Scream Bullish appeared first on BeInCrypto.