Bitcoin (BTC) is facing increasing pressure, extending its two-week decline. Cryptocurrencies have struggled to break through resistance levels, suggesting growing investor fatigue.

Market conditions remain fragile due to lower trading volumes and spikes in volatility, and Bitcoin could suffer further losses if sentiment does not recover soon.

Bitcoin holders are losing profits

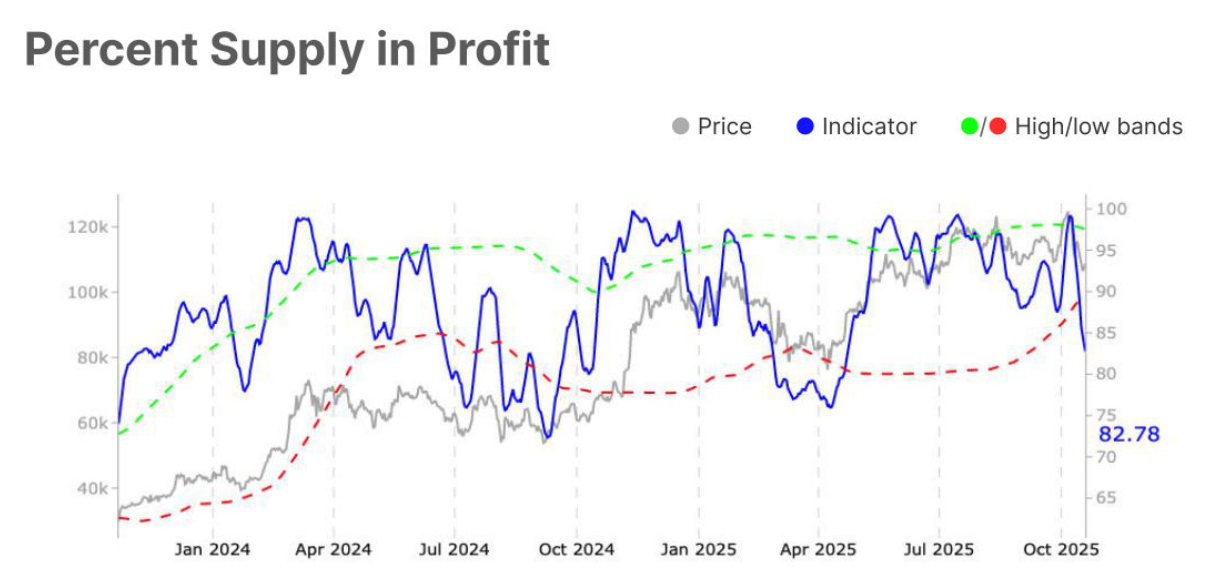

BTC supply as a percentage of profits has dropped significantly, dropping from 98% to 78% within two weeks. The sharp decline reflects widespread unrealized losses and signals heightened investor caution. Such rapid contractions are typically seen during capitulation stages when fear dominates the market and selling intensifies.

The reduced incentive to take profits highlights that most holders are losing money or barely breaking even. This creates a self-reinforcing cycle of hesitation, with buyers remaining cautious but sellers looking to let go at the first sign of strength.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin supply generates profits. Source: Santiment

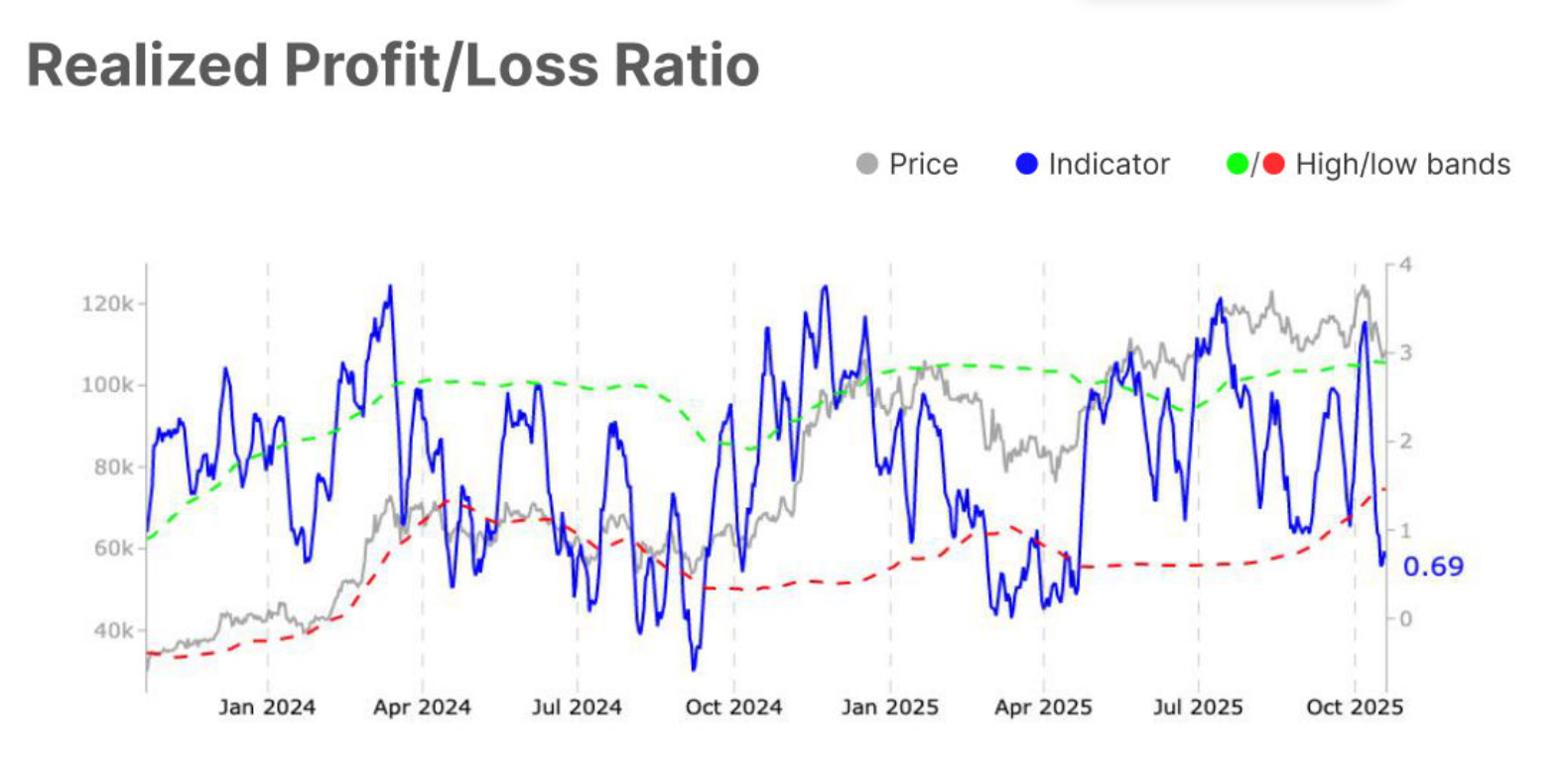

The realized profit-to-loss (RPL) ratio reinforces this capitulation narrative. The indicator, which tracks Bitcoin’s realized gains and losses, fell from 1.2 to 0.7, breaking through the lower bound of 1.5. This means more investors are selling at a loss, indicating a capitulation-like situation for the overall market.

These low ratios reflect the increasing prevalence of loss realization, where participants exit positions in a panic rather than strategic profit taking. The broader macro environment, including tight liquidity, risk-off sentiment and declining capital inflows, is adding further pressure.

Bitcoin RPL ratio. Source: Santiment

BTC price under pressure

At the time of writing, Bitcoin is trading at $107,734, below the $108,000 resistance. The crypto giant has repeatedly failed to break out of its two-week downtrend line, suggesting weakening momentum and growing skepticism among investors.

There are concerns about this week’s low price formation. If Bitcoin fails to regain the psychological level of $110,000, the price could fall further to $105,000 or below, adding to the selling pressure. A sustained bear market could accelerate this movement and push BTC deeper into correction territory.

Bitcoin price analysis. Source: TradingView

However, the technical outlook could improve sharply if Bitcoin is able to regain support at $110,000. This invalidates the downtrend and opens the door for a move to $112,500 and beyond. In that case, a short-term recovery will again be a topic of discussion, but for now, caution remains the dominant theme across the Bitcoin market.

The article Bitcoin profit supply shrinks as price fails to break out of two-week downtrend appeared first on BeInCrypto.