BITCOIN continued to impress as one of the best achievements among large assets, which increased almost 25% last month. Even if you jumped more, the price of bitcoin was higher than six picture evaluation critical prices despite the market conditions last week.

After a few weeks of strong behavior, the flagship cryptocurrency seems to have settled within an integrated range of $ 102,000 to $ 105,000. Bitcoin prices seem to face some uncertainty among investors, despite the sound of the highest ever in the market.

BTC prices may be prepared for selling

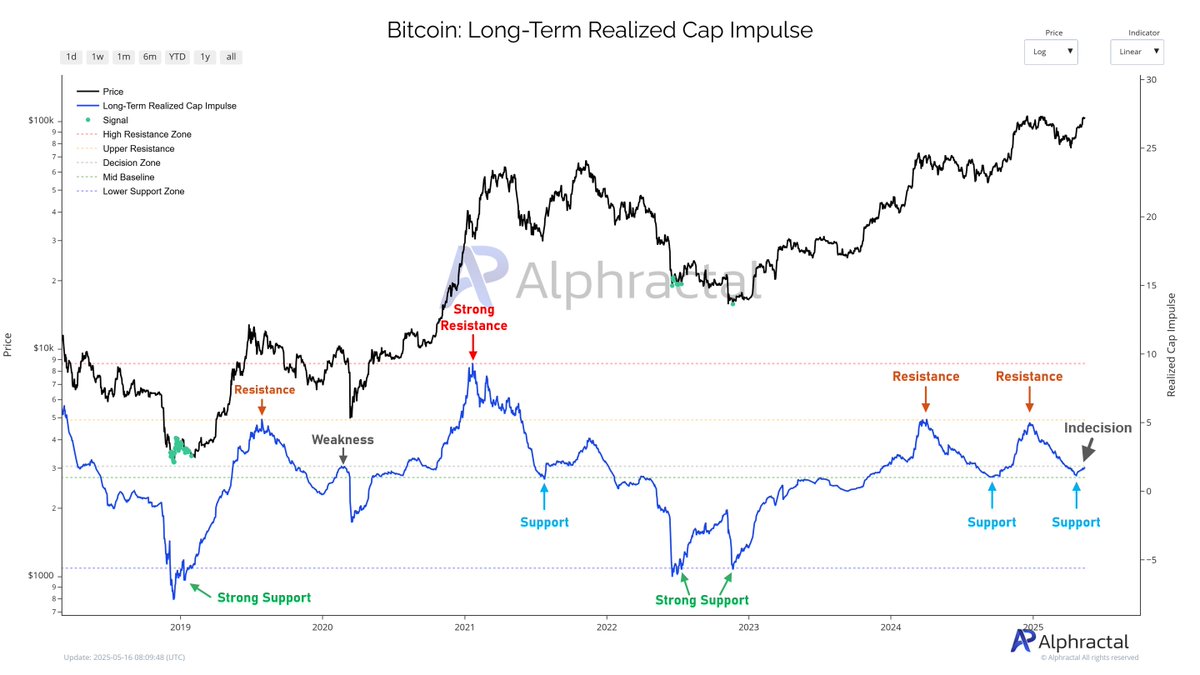

On May 16, Alphractal, a chain analysis company from a post on Social Media Platform X, explained that Bitcoin prices are at a point and may be important for future trajectory. This thermal evaluation is based on long -term CAP impulse.

A positive value for long -term CAP impulse signals for clarity is that long -term investors buy higher BTCs with higher values. This trend generally indicates an optimistic or start of the bull market when a long -term holder is in the accumulation mode.

On the other hand, when long -term realized CAP impulse metrics are negative, long -term holders are off -loading coins at a lower price than cost base. This is generally available in the late Bull and early bear markets, where long -term investors distribute their assets.

In addition, long -term realization CAP impulse indicators provide insight into the supply and demand dynamics of Bitcoin, emphasizing major support and resistance zones. As shown in the chart provided by Alphractal, the price of bitcoin is at the threshold point marked with an unpleasant horizontal line.

Source: @Alphractal on X

Market Intelligence Firm pointed out that the breakout of the CAP Impulse Metric, which has been realized at this level, can be proved to be pivotal to Bitcoin’s long -term health, and signals can express strong demand and potential price audits.

However, Alpha Ractal attached the historical relationship with this level, pointing out that the CAP impulse metrics, which were long -term realized just before the Kovid -19 dump in March 2020, were rejected. If a historical precedent must pass, investors may want to monitor the rejection of this level.

Bitcoin price at a glance

At the time of this article, the price of BTC is about $ 103,713 and it is reflected that it has increased 0.6% over the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.