Bitcoin (BTC) Currently, it is wobbling at a critical edge with the potential for price action signaling, either sharp failures or critical rebounds. Finishing in March 2025, the crypto market appears to be on the rise. Investors look closely at the charts looking for confirmations. Let’s dig into what’s unfolding Bitcoin Price Interpret your daily charts, technical metrics and answer fiery questions. What’s next for BTC?

Bitcoin Price Prediction: Is Bitcoin losing bullish momentum?

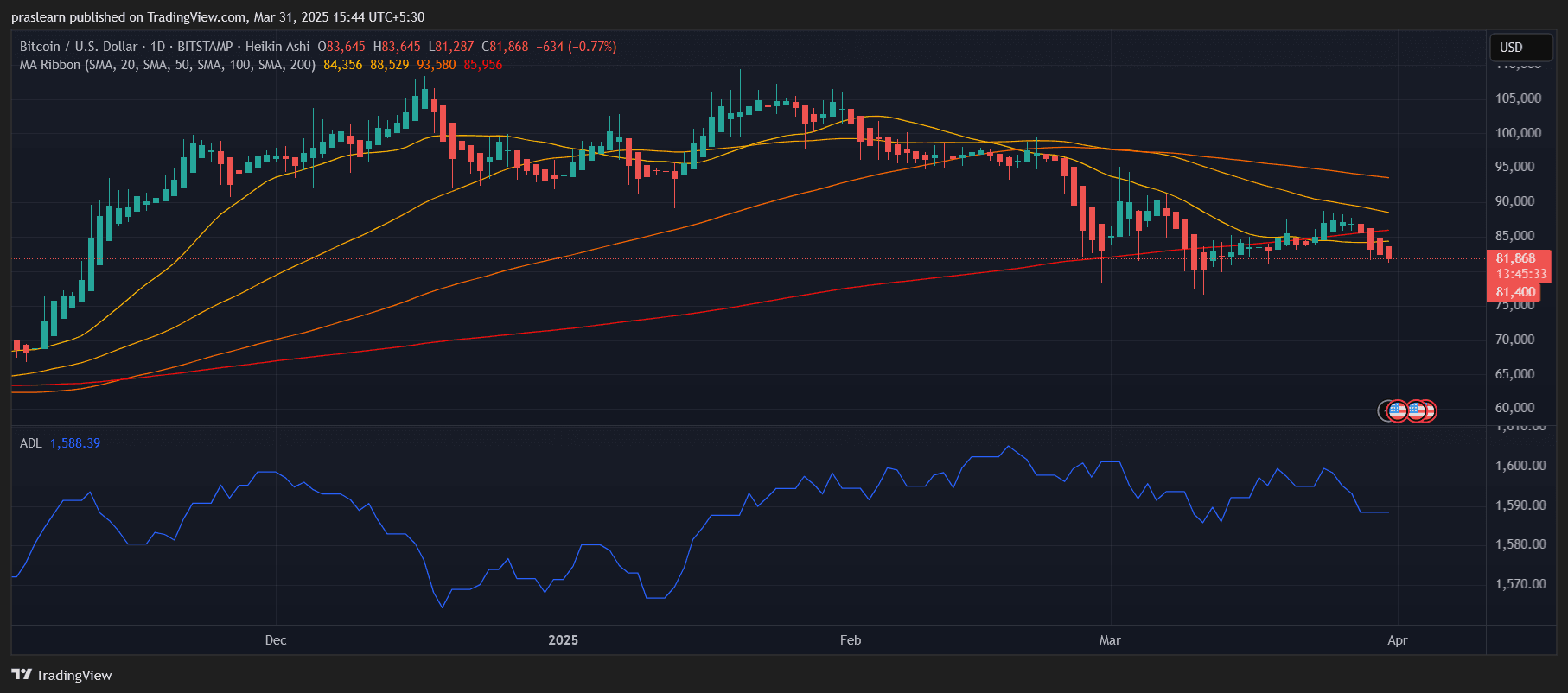

BTC/USD Daily Chart – TradingView

From the daily hikin reed candlesticks, it is clear that Bitcoin has been stuck in dull drift since mid-March. Current prices are around $81,868red candles have gained control and show sales pressure. The candle does not have a long upper core, and does not have a general trait or accumulation of bearish momentum during integration. Prices are currently below all important moving averages. This is a technical warning that the Bulls are losing their grip.

What does the moving average say?

Charts are overlaid with a Moving Average Ribbon It features SMA 20, 50, 100, and 200. There’s a malfunction here.

- SMA 20 ($84,356) and SMA 50 ($88,529): Both short-term MASs are above current prices, confirming short-term bearishness.

- SMA 100 (~$93,580): Medium resistance. Prices have been way below that all weeks.

- SMA 200 (~$85,956): This long-term trend line is currently serving as overhead resistance, bearish development. Ideally, in bull markets, BTC outperforms this.

When Bitcoin prices fall below the 200-day SMA, they often direct macroweekiness. The compression of the moving average above the price suggests a possible “Death Ribbon” effect. Here, unless the Bulls are actively fostered, convergence could lead to continuance of the downsides.

Does the trend of accumulation indicate strength or debilitating?

Under the price chart, the Accumulation/Distribution Line (ADL) provides insight into volume flow. The ADL currently reads 1,588.39, showing flattening and slight down tilt for the last few days while recovering from its January low. This suggests that the distribution is beginning to surpass accumulation once again. Essentially, it means that more traders are offloading BTC over their purchases.

ADL is a volume-based indicator that tracks the flow of ingress and out of assets. A rising ADL signals accumulation, while falling or flat signals distribution. BTC’s current ADL action matches the price that slips under the key SMA.

What is the nearest support zone for Bitcoin?

Bitcoin’s closest support is at the $80,000 psychological level, which previously served as a stepping stone in late January. A breakdown below this level could expose BTC to an even deeper retracement to $75,000 or $72,000, depending on the speed of sale. Conversely, if BTC finds support here and the volume picks up, it could potentially test the 200 SMA again for $86,000.

This zone is absolutely important. It’s not just a technical level, it’s also a trigger for emotions. The bouncing here can rekindle bullish profits.

Will the Bulls be able to regain control in April?

For the Bulls to regain control, they will need to push the BTC price back beyond the 20- and 50-day SMA and turn it into support. This means that a day closure exceeding $88,500 is an early indication of strength. But more than that, a visible rise in volume checks and ADL will be required to support upward momentum.

In that case, the BTC price could return to more than $93,000 and try again for the rally, and regaining the 100 SMA will allow you to open the door to retest the highest ever high.

Bitcoin price forecast: Crash or comeback?

Considering the current trends, Short-term bias is a sloping wimphowever, the structure still exceeds important psychological levels. Closing multiple daily candles with BTC prices under $80,000 can accelerate sales. However, if you hold and bounce back on volume checks, you can witness the April surprise rally.

Short-term bearish targets: $78,000

Neutral Zone: $80,000-86,000

A strong breakout target: Over $93,000

Bitcoin prices are approaching a pivotal moment. Daily candles are cooled down major moving averages and volume trends, so careful emotion is guaranteed. However, cryptography often thrives with uncertainty. And there’s always a sudden reversal on the table. For now, traders should monitor the $80k level like a hawk and prepare for volatility in either direction when April begins.