Bitcoin prices have begun a new decline than the $106,800 zone. BTC is currently consolidating and facing resistance near the $106,200 zone.

- Bitcoin has begun a new decline below the $106,200 zone.

- The price is below $106,800 and trades a simple 100-hour moving average.

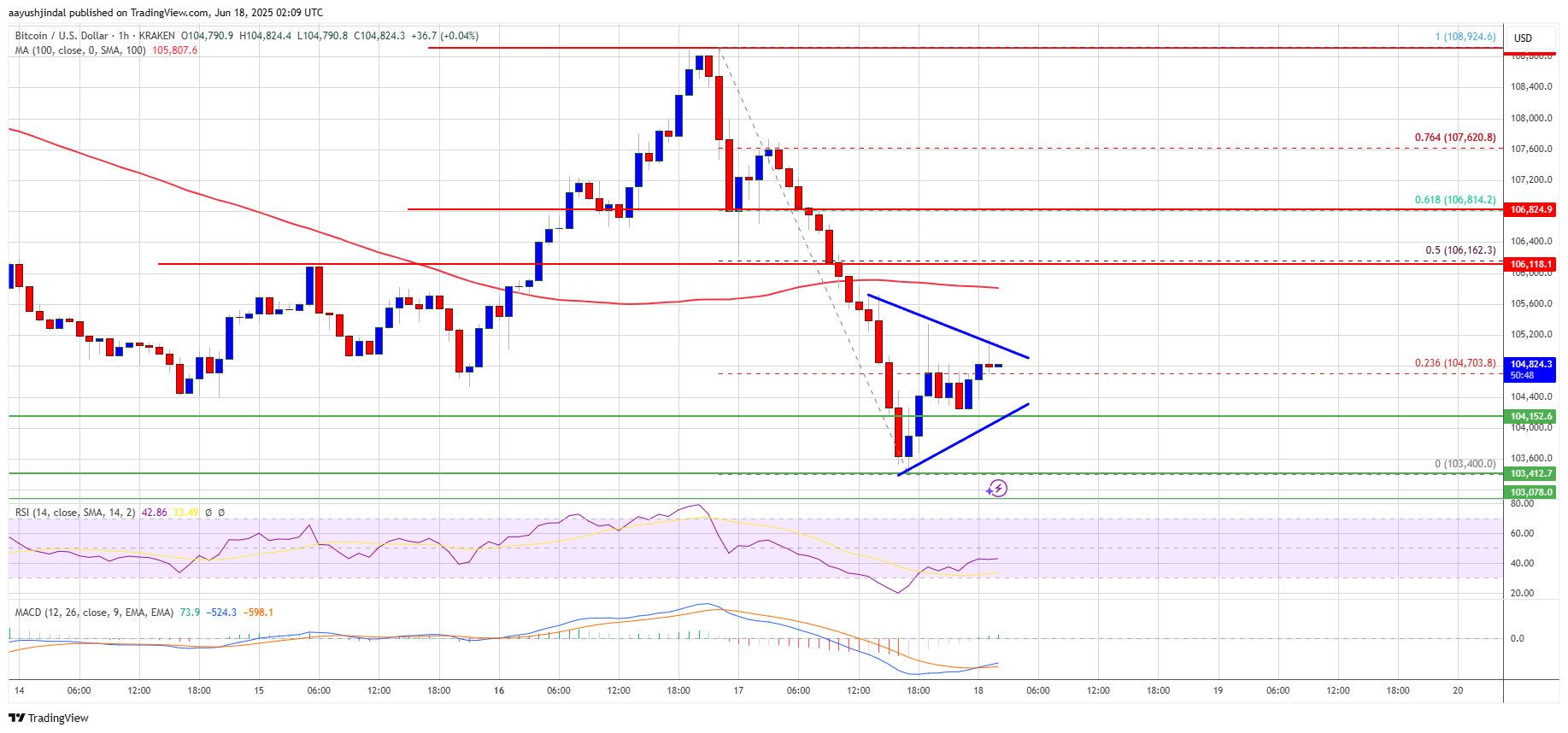

- A hourly chart of the BTC/USD pair (data feed from Kraken) forms a short-term triangle with $104,200 support.

- The pair could begin a new increase if they are above the $103,500 zone.

Bitcoin prices drop again

Bitcoin prices began a new decline after failing to clear the $108,800 resistance zone. BTC went below the $108,000 and $107,000 levels.

There was a clear move below the $106,200 support level. Finally, we tested the $103,500 zone priced. The lowest is formed at $103,400, and the price consolidates the losses. It was slightly above the 23.6% FIB retracement level of the downward movement from the $108,924 Swing High to the $103,400 low.

Bitcoin is currently below $106,800 and trades a simple moving average every 100 hours. What’s more, the BTC/USD pair hourly wage chart forms a short-term triangle with $104,200 support.

The advantage is that immediate resistance is close to the $105,200 level. The first important resistance is close to the $105,500 level. The next important resistance is $106,200. This is close to the 50% FIB retracement level of downward movement, from a swing of $108,924 to a low of $103,400.

Over $106,200 resistance could lead to even higher prices. If stated, the price could rise and test a resistance level of $108,000. Any further profit could potentially send the price towards the $110,000 level.

More losses in BTC?

If Bitcoin does not rise above the $106,200 resistance zone, it could begin another decline. Immediate support is close to the $104,200 level. The first major support is close to the $103,500 level.

The following support is located near the $102,500 zone: Any further losses could send the price to $101,200 in the short term. The main support is $100,000, and below BTC you could potentially gain bearish momentum.

Technical indicators:

HOURLY MACD – MACD is currently losing pace in the bear zone.

Hourly RSI (Relative Strength Index) – BTC/USD’s RSI is below 50 level.

Key support levels – $104,200, then $103,500.

Major resistance levels – $105,500 and $106,200.