The recent recession in Bitcoin has led many observers to wonder about the price floor when BTC will reach it, how prices will rebound. One interpretation requires a continuous dive before recovery.

Bitfinex analysts shared these insights only with Beincrypto. None of this commentary constitutes directly financial advice.

Will Bitcoin hit the price range soon?

Despite the long-term bull running throughout the summer, Bitcoin appears to have hit a barrier. The assets reached an all-time high early last month, but their performance has been historically weak since.

Over the past week, Bitcoin has fallen below the $112,000 support level as whales continue to spin into altcoins, particularly Ethereum. These large rotations support BitFinex analysis.

“Major cryptocurrency assets endured a difficult week as the sale of macro jitters and post-PPIs was heavily overwhelmed by price action. This pullback is consistent with the paper that BTC is likely to be more likely to trade retracement and range over the summer months.

Some of these “macro jitters” are pretty straightforward to explain. The bearish PPI report has caused a massive liquidation across the industry, and Trump’s belligerent trade policy has caused an even more slump.

These and other factors are like low trade volumes, with Bitcoin dropping by 13%, but the floor is not here yet.

Key Altcoin Indicator

Overall, the Altcoin market has attracted a lot of attention, with Ethereum surpassing BTC on several recent occasions. However, only a few Altcoins replicate this success, giving Telltale signs of broader health.

“In (Altcoins), the Major surrendered his recent profits, but the rotation of targets to midcaps and sector play has created a sharp difference, creating both outstanding winners and heavy laguards.

Essentially, even these Altcoin leaders have posted recent losses. These suggest that the entire market supporting the September Bitcoin floor theory is in decline.

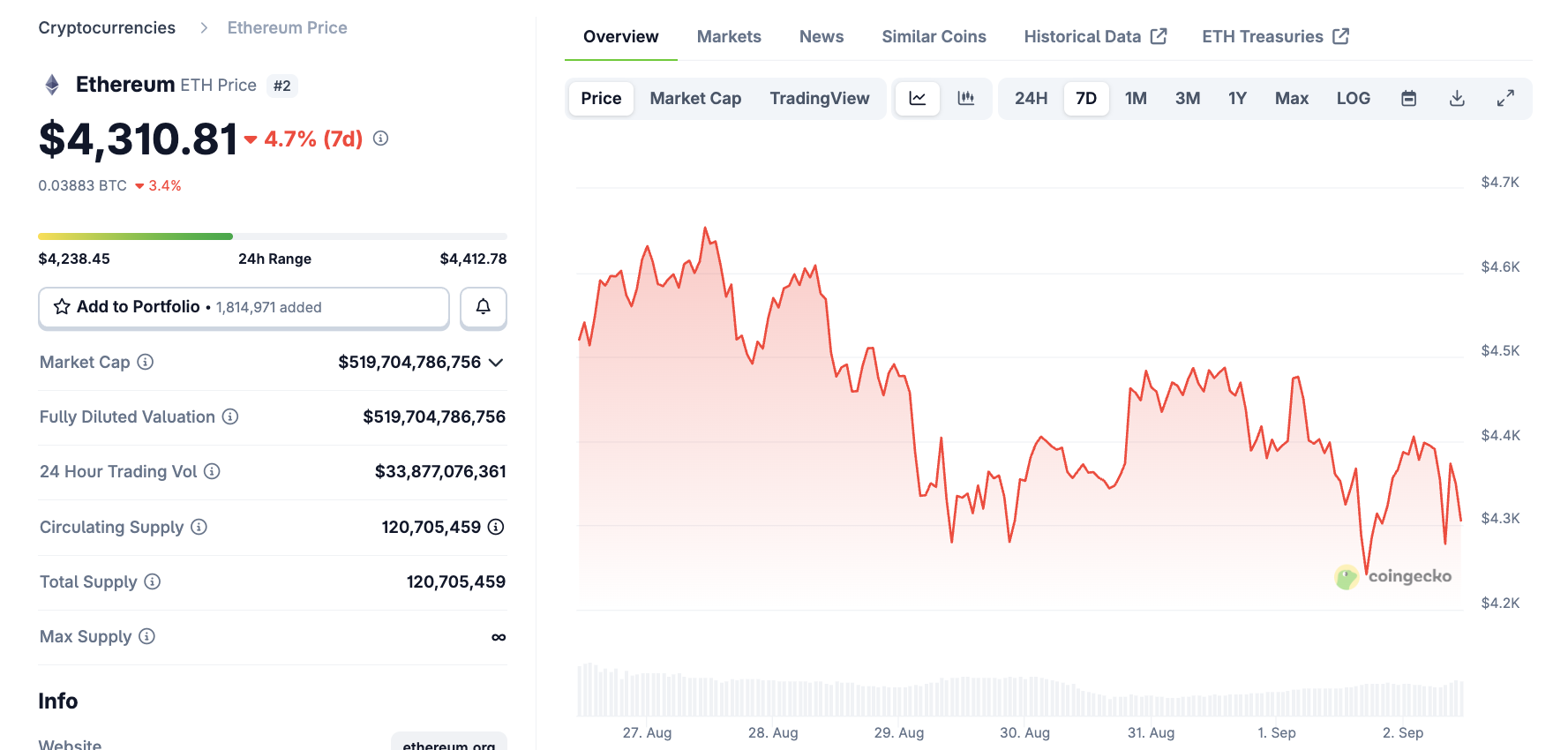

Ethereum price performance. Source: Coingecko

ETFs may power Q4 inflows

However, Bitfinex analysts do not believe this downward trend will last long. They assume that the price floor for Bitcoin will be around $93,000, at which point the institutional ETF investors may begin purchasing DIPs. BTC can effectively benefit from this.

The Ethereum ETF has been attracting a lot of attention these days, but Bitcoin products remain a frightening force. These products have great benefits to the buy-in of the facility. After all, they represented over 90% of Crypto Fund Investments a few months ago.

The broader Crypto ETF rally will almost certainly lift Bitcoin off the price floor.

In short, this read means a profitable run of BTC for the fourth quarter of 2025. To be clear, this is just one interpretation of the data available. Some have argued that it could be a faster recovery or that the Bitcoin floor could exceed $93,000.

Bitcoin prices could fall below $95,000 in September, Bitfinex analysts predicted it was the first to make its appearance on Beincrypto.