The Bank of Japan’s interest rate hike to 1% could cause large fluctuations in Bitcoin prices globally.

Japan holds $1.2 trillion in U.S. debt, and any policy change would have a global impact on Bitcoin prices.

Bitcoin has fallen 3% so far after the Bank of Japan raised interest rates to 0.75% in January.

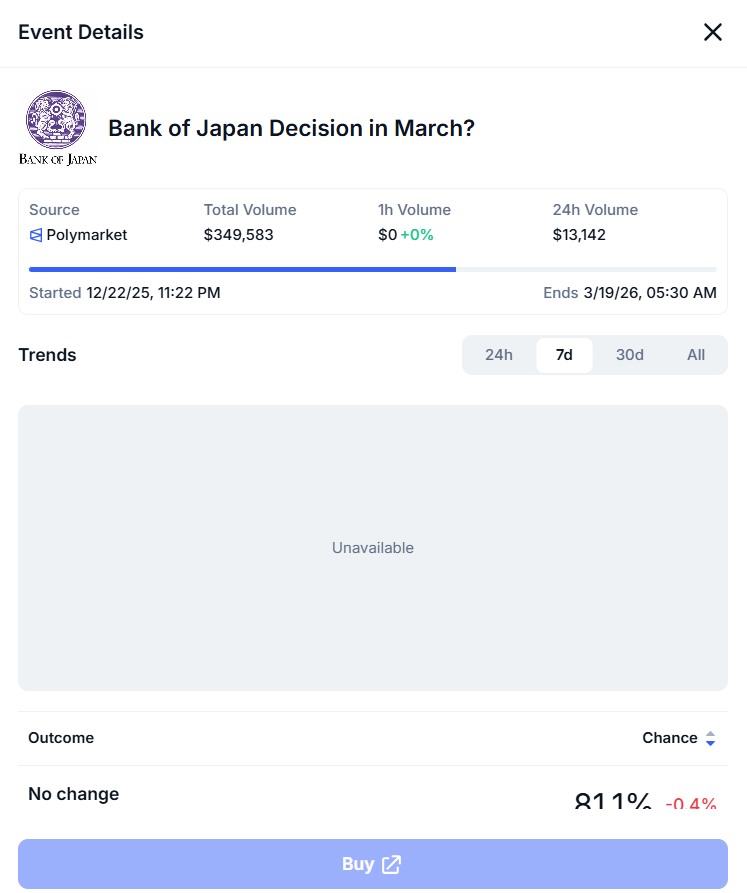

Global crypto markets are under pressure again as expectations grow that the Bank of Japan could raise interest rates to 1% in April 2026. Bank of America has warned that Japan’s policy tightening could reduce global liquidity and cause another sharp decline in Bitcoin, similar to the 3% drop seen after January’s interest rate hike.

Bank of Japan raises interest rate to 1% in April 2026

The Bank of Japan (BOJ) is expected to raise interest rates by 25 basis points, potentially rising to 1% in April 2026, according to Bank of America Global Research.

The Bank of Japan is expected to raise interest rates by 25 basis points, bringing interest rates to 1% in April 2026, according to Bank of America Global Research.

This means that interest rates in Japan will reach their highest level since the 1990s, as Japan has maintained near-zero interest rates for an extended period of time.

Bitcoin price after Bank of Japan interest rate hike

If you look at the data on the Bank of Japan’s interest rate hikes so far, you can see that it is very sensitive to changes in Japan’s interest rates. The price of Bitcoin after the Bank of Japan rate hike in January 2026 clearly reflects this, with Bitcoin falling nearly 3% immediately after the Bank of Japan raised interest rates to 0.75%. This shows how quickly the cryptocurrency market reacts when the global liquidity situation changes.

Rising interest rates increase borrowing costs and reduce the flow of money into risky assets such as Bitcoin.

Analysts have warned that Bitcoin could face further downward pressure if the Bank of Japan raises interest rates again towards 1%. Some estimates suggest a decline of 4% to 5%, which could push Bitcoin prices closer to the $60,000 level.