Bitcoin price is undergoing a market correction. On Tuesday, the stock fell to $107,000 after briefly exceeding $111,000 the previous day.

On-chain data analysts now recognize the current price point as a key inflection point. At this point, it is decided whether the asset will maintain its bullish trend or face a moderate correction in the medium term.

Important crossroads of bullish momentum

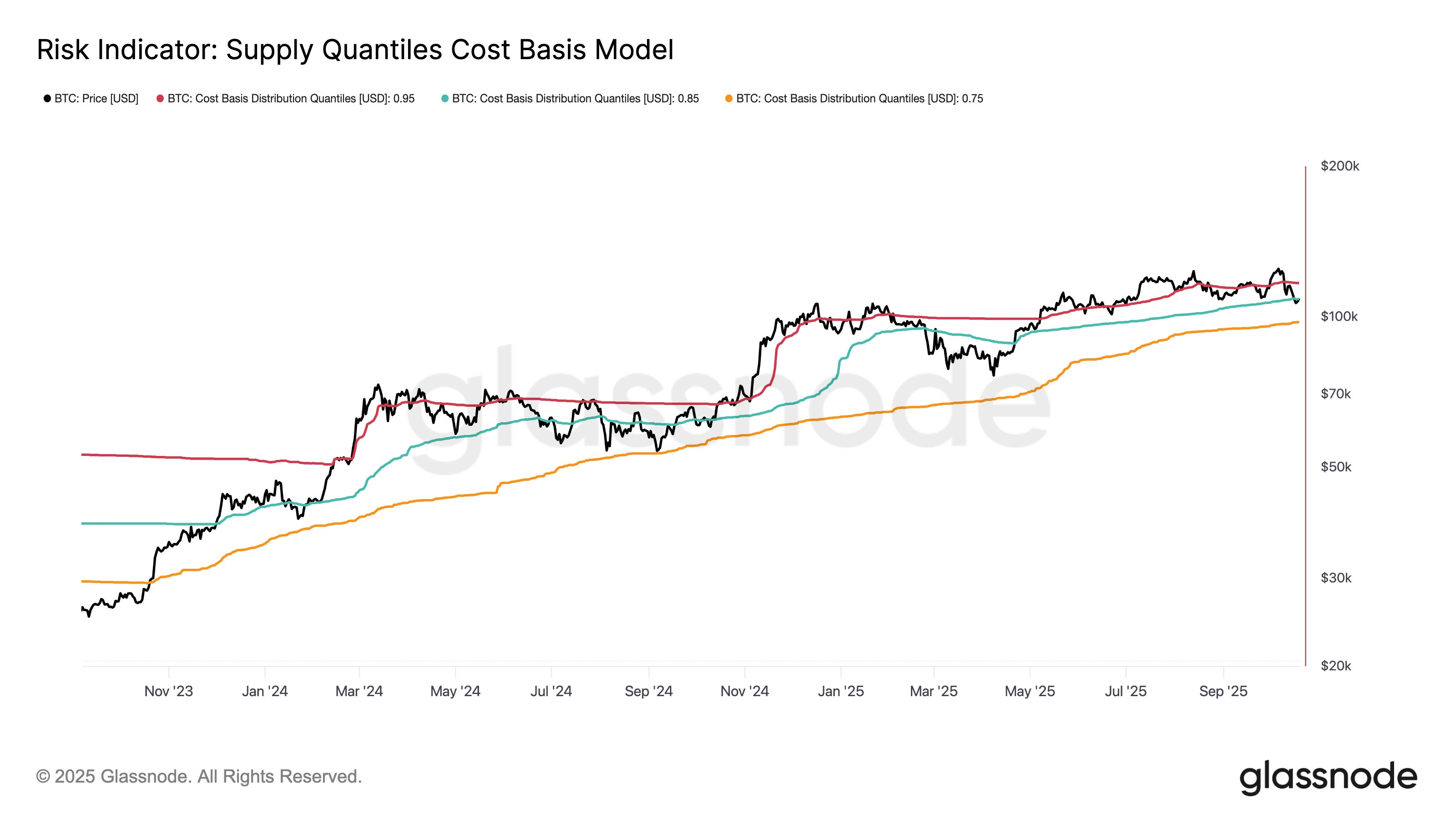

Glassnode, an on-chain data analytics platform, highlighted this situation by sharing a cost-based distribution quantile model chart on X.

This model analyzes the distribution of acquisition costs for Bitcoin investors and assesses the probability of taking profits at current price levels. Unlike traditional technical analysis, this tool uses real blockchain data to identify accumulation patterns and provides a more accurate view of institutional support and resistance zones.

The chart contains several quantile lines, including the 0.95 line (red). This line represents the average price paid by the top 5% of Bitcoin holders, those with the highest cost base.

Risk indicator: supply quantile cost-based model. Source: Glassnode

If the Bitcoin price rises above this 0.95 line, it indicates a high-risk zone where the market is overheated and profit realization (selling) is likely to increase. Conversely, when the price falls below the 0.95 line, the market enters a trend transition or equilibrium state. This is exactly where Bitcoin landed after the flash crash on October 10th.

Pivot point: 0.85 quantile

The current price level is hovering around the 0.85 quantile boundary. This is a kind of key support. A sustained break below this line is usually interpreted as an increase in medium-term correction risk.

Glassnode warned: “If buyers can hold this zone, momentum could recover from here. But if they lose it again, the market is likely to fall back into the downside. This is a very important area to watch.”

Derivatives traders expect further downside

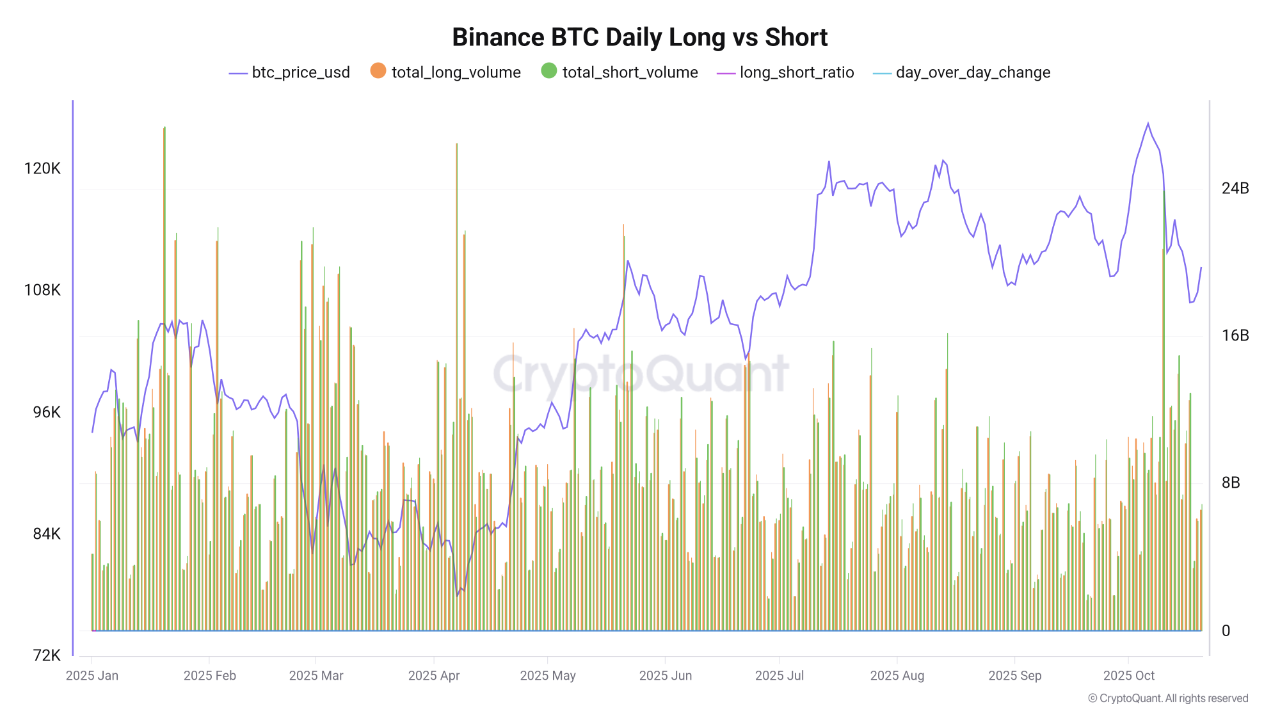

Investor sentiment toward Binance, the largest crypto derivatives platform by trading volume, is also leaning toward expecting further correction.

“Bitcoin futures trading volume on Binance increased in October, with sellers dominating most days until yesterday,” said Arab Chain, an analyst at CryptoQuant.

Binance BTC Daily Long and Short. Source: CryptoQuant

Binance’s Bitcoin futures position is currently tilted slightly to the sell side from an almost 50:50 balance. The current long/short ratio is 0.955, and the day-over-day change (DOC) of -0.063 indicates that the positive momentum is slowing down.

Arab Chain concluded: “Overall, the current data reflects a fragile balance between buyers and sellers, tilting slightly in favor of selling pressure. If this trend continues, it could pave the way for further correction unless the market shows renewed buying activity or strength in institutional demand in the coming days.”

Article after Bitcoin hits major support. The post Analysts Warn About Deeper Correction appeared first on BeInCrypto.