The United States and China have taken a major step toward easing trade tensions, agreeing to suspend several tariffs this year that have roiled global markets.

However, despite the diplomatic breakthrough, Bitcoin’s price does not reflect the optimistic outlook expected from such transactions.

US and China reach historic agreement

On November 1, the White House announced that President Donald Trump and Chinese President Xi Jinping had reached a trade and economic agreement. The agreement was finalized during a conference held in South Korea.

Under the agreement, China will suspend new export restrictions on rare earth elements and grant general permits for shipments of rare earth elements. The Chinese government also pledged to curb fentanyl exports to the United States and suspend all retaliatory tariffs imposed since March 4.

In return, Washington will cut tariffs on Chinese goods by 10% and extend existing tariff exemptions until November 2026.

“(This) is a major victory that protects America’s economic strength and national security while putting American workers, farmers, and families first,” the White House said.

Macroeconomic research firm Covisi Letter said the deal was the most substantial thaw in U.S.-China trade relations in years and could ease tensions in global supply chains.

Bitcoin defies diplomatic optimism

However, financial markets have shown little enthusiasm for the news.

Bitcoin, which often reacts to geopolitical and macroeconomic signals, posted a modest gain of less than 1% over the past 24 hours. At the time of writing, it was trading at $110,785.

Indeed, this subdued reaction is in sharp contrast to the volatility recorded in October. At the time, President Trump’s announcement of new retaliatory tariffs triggered a $20 billion wave of liquidations across the crypto market.

Meanwhile, industry analysts say this slower price reaction reflects deeper structural changes in Bitcoin ownership rather than a loss of macro sensitivity.

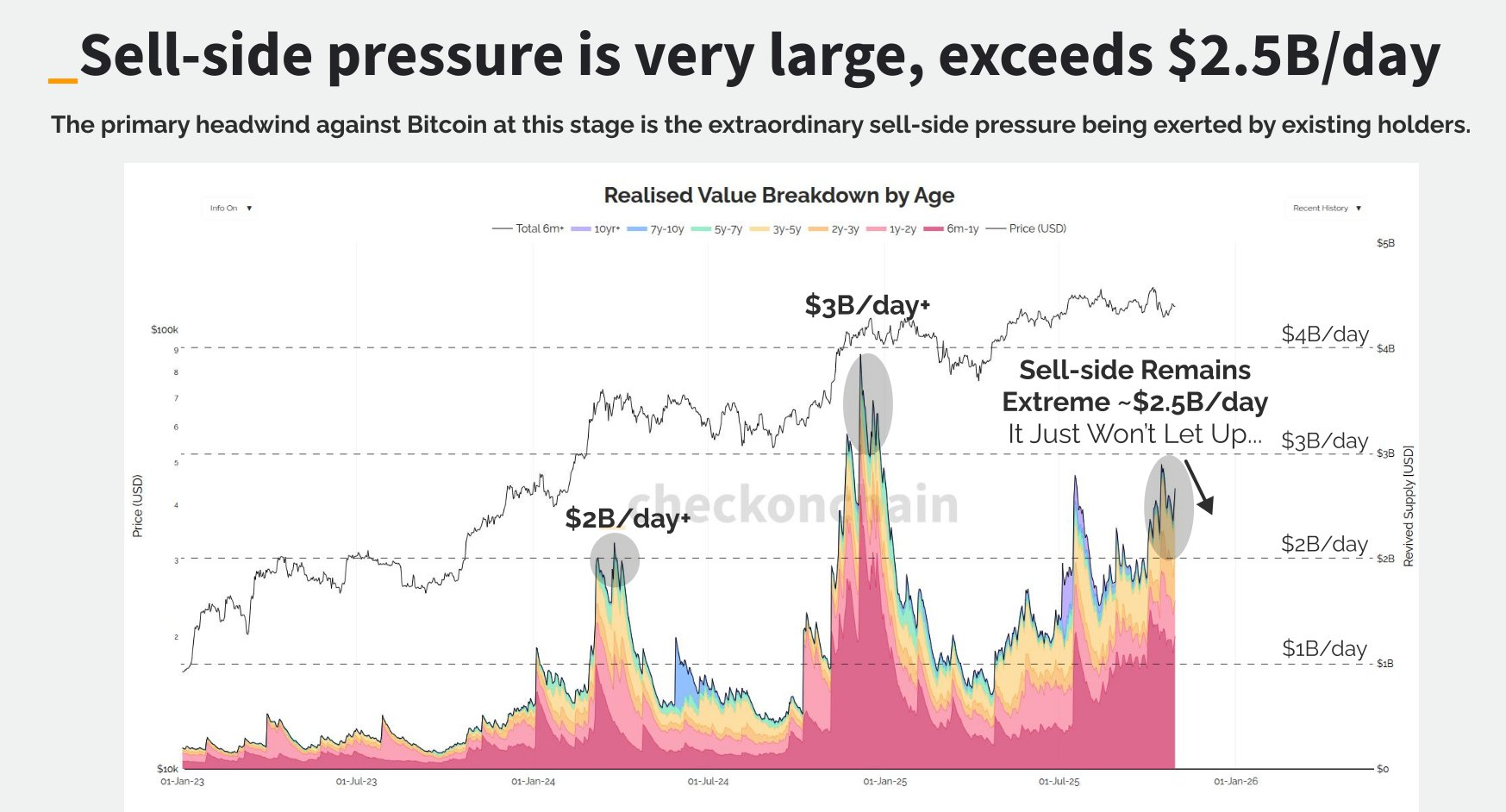

Bitcoin on-chain analyst James Check observed that older holders are offloading their coins at an accelerated rate compared to previous cycles.

He noted that pressure on Bitcoin sellers remains strong, and the average age of coins currently on sale is around 100 days. This represents a significant increase from the prior period’s 30-day average.

Bitcoin selling pressure. Source: James Check

He explained that this change indicates that long-term holders are shifting their positions to patient and well-funded new entrants entering the market.

“We are watching a changing of the guard from the OGs who rode the early dangerous waves to a new class of TradFi buyers who prefer calmer waters,” Cech explained.

Despite the short-term price decline, experts maintain that Bitcoin’s long-term fundamentals remain intact. They argue that the current rotation represents a natural evolution in asset maturity, as experienced traders exit and traditional finance begins to take hold.

The post Bitcoin remains flat despite historic US-China trade deal announcement appeared first on BeInCrypto.