Bitcoin’s price behavior was very powerful last week and showed good signs of recovery at the low last weekend. Premier Cryptocurrency has traveled to $ 108,000 for the last few days, but now it’s about $ 107,000. According to the latest on -chain data, the investor group has been out of the market despite the price elasticity of Bitcoin in recent months.

BTC retail demand decreases by 10% in June. Analyst

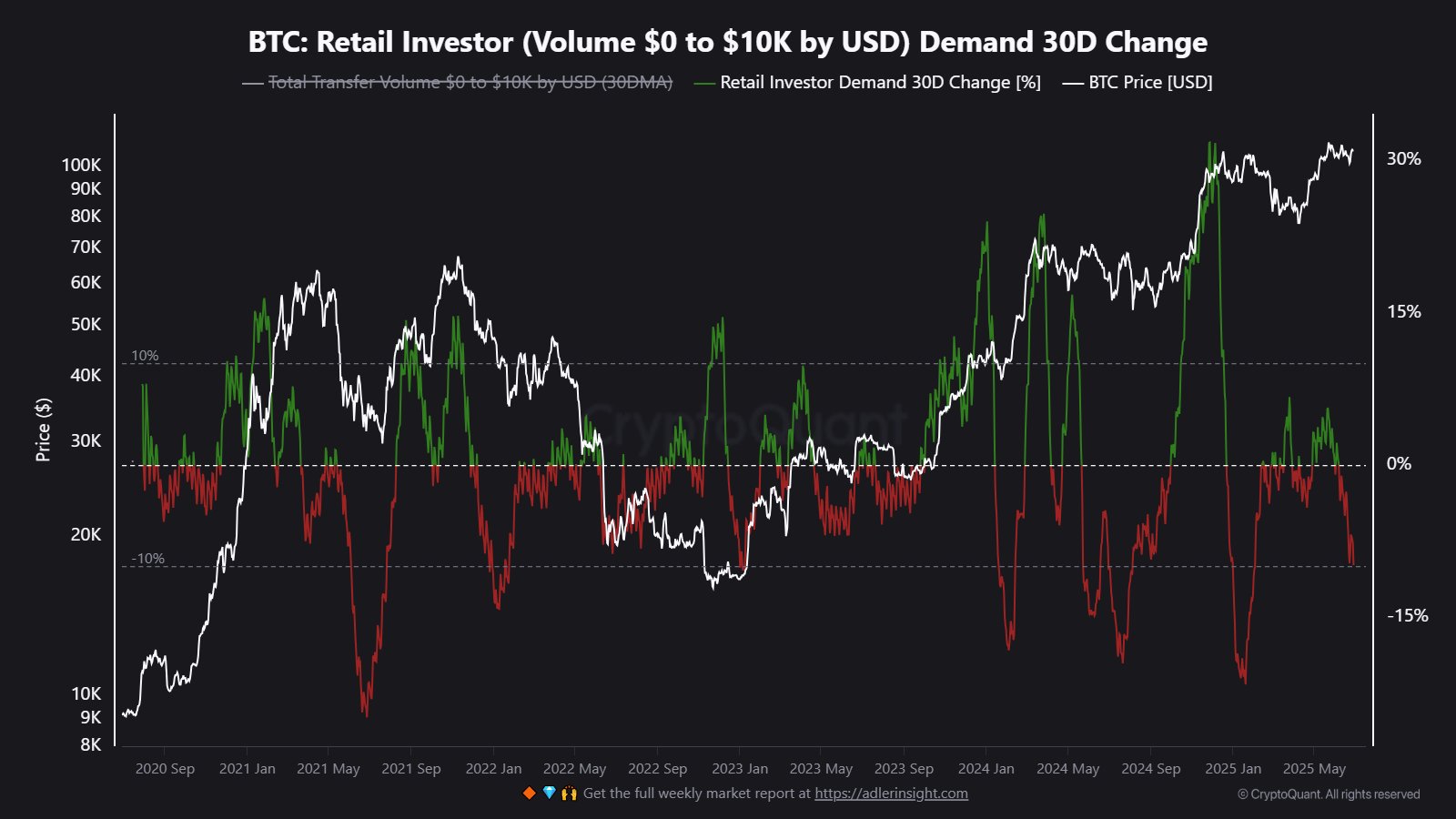

MAARTUNN, a chain analyst from the June 28 post of social media platform Z, said that cohorts of market participants, known as retail investors, have been relatively disabled for the last few months. This warm -chain is based on the indicators of retail investors, which estimates the demand for BTCs among small investors.

In essence, this warm -chain metric usually tracks the activity of a small wallet involved in a small sized transmission. Specifically, this retail investor demand indicator measures the cumulative fluctuations of small trading volume (value of less than $ 10,000) for 30 days.

Source: @JA_Maartunn on X

On the chart emphasized by Maartunn, the 30 -day change of Bitcoin retail investor demands has plunged into negative territory, remaining red from early June. More recently, this metrics have dropped to 10%, which is the lowest level for more than six months.

Considering that the bitcoin price measures are quite steady at this time, it is surprising that small investors have not entered the market. The market seems to be dominated by institutional investors through the Bitcoin Exchange trading funds.

Institutions and Bitcoin ETF investors are responsible for

Burak Kesmeci, a chain analyst from the X platform, has attracted attention, and institutional investors and ETF investors have a strong desire for accumulation of bitcoin. Last week, the US-based BTC Exchange-Traded Funds recorded a total of $ 2.2 billion.

KESMECI also mentioned that Bitcoin prices have become close to the bottom if the retail demand continues to decrease. As a result, the main cryptocurrency can enjoy optimistic momentum and rising prices for the next few weeks.

At the time of this article, the price of BTC is about $ 107,244, which is reflected by an increase of 0.1% over the last 24 hours. According to Coingecko’s data, market leaders have increased more than 4% over the weekly period.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.