All eyes are in the Fed’s economic outlook, as interest rates are expected to remain untouched. This could have some impact on the price of BTC.

The Fed’s decision will be that Bitcoin will be upward

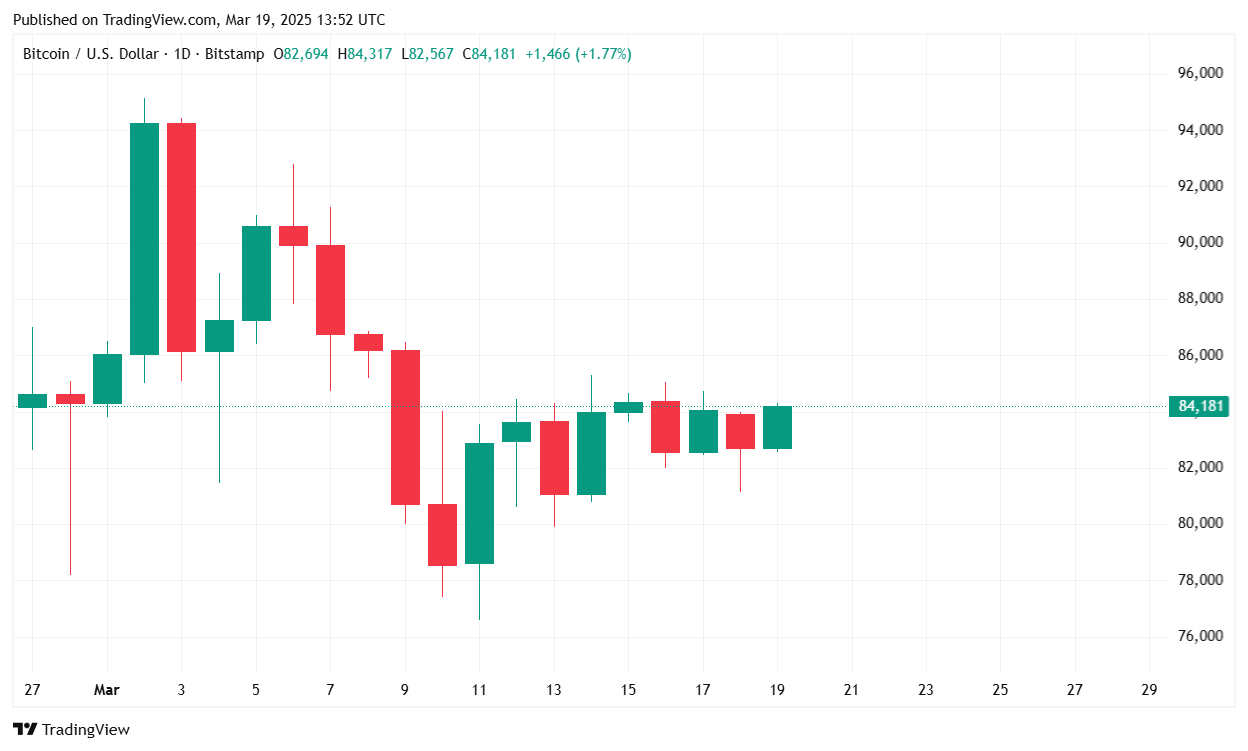

According to CoinmarketCap, Bitcoin (BTC) rose 3.49% in the last 24 hours, reaching $84,191.67 at the time of reporting. Despite this daily increase, the highest cryptocurrency in the past seven days has risen by just 1.20%, as market uncertainty meets today’s Federal Open Market Committee (FOMC) conclusions.

(BTC Price/Trade View)

Important Bitcoin Metrics

- 24-hour price range: $81,179.99 to $84,303.97

- 24-hour trading volume: $242.9 billion reflecting a slight increase of 0.83%

- Market Cap: $1.67 trillion, down 3.54% from yesterday

- BTC dominance: 61.20%, 0.45% decrease over the past 24 hours

- Total BTC futures open interest: $4.971 billion, down 2.43%

- 24-hour Bitcoin liquidation: $38.34 million (long liquidation: $9.89 million, short liquidation: $28.45 million). Liquidation data shows that bear traders faced a major loss as BTC’s upward price movement violates the bets of short sellers.

Focused Federal Reserve Conference

Investors are eagerly monitoring the conclusions of the FOMC meeting, with an official statement expected at 2pm today, followed by a press conference by Federal Reserve Chair Jerome Powell at 2:30pm, but the markets are widely predicting that interest rates will remain the same.

A combination of stable speeds from the central bank and less hawk prospects could provide a bullish catalyst for BTC. However, signals of high rates and economic uncertainty can update sales pressure.

Bitcoin outlook

With BTC showing resilience of over $84,000, traders will closely monitor Powell’s remarks and the broader macroeconomic situation. If sentiment remains in its favor, BTC can attempt to move to recent levels of resistance above $85,000. Conversely, Hawkish’s rhetoric from the Fed could be a pullback below $82,000.