Bitcoin has experienced consistent profits throughout April, bringing its price closer to its key $100,000 mark. This upward momentum appears to be driven by fresh capital inflows as investors’ sentiment grows stronger.

If this trend continues, it could serve as a catalyst for Bitcoin to reach new heights, with the $105,000 level potentially triggering further rallies in price.

Bitcoin finds investors’ support

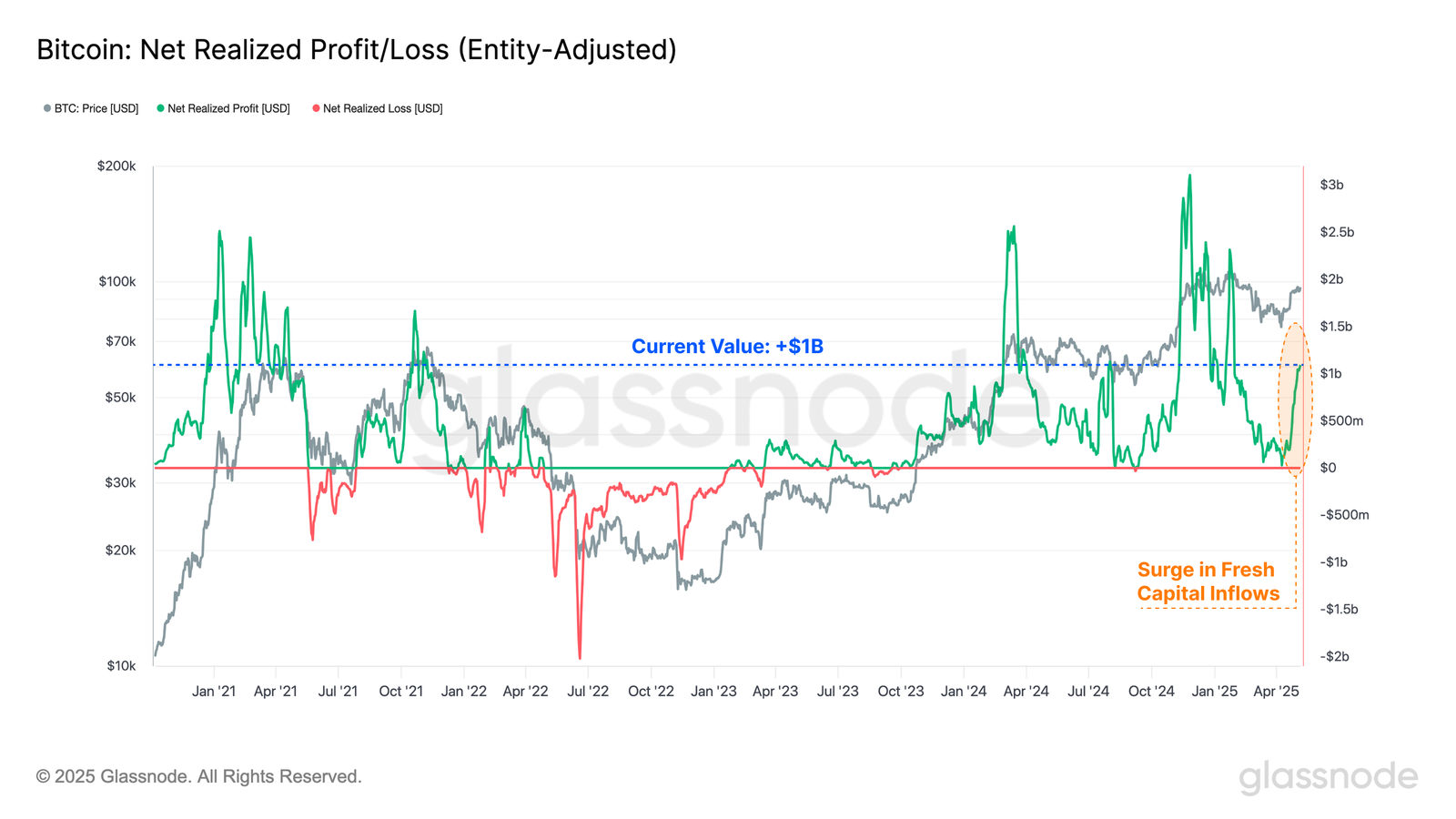

Over $1 billion in net capital inflows have been seen daily in recent weeks, indicating profits from Bitcoin’s demand-side strength. Net realised profit/loss metrics reflect these inflows and indicate that new investors are absorbing supply. Sellers are taking advantage of profits, but buyers continue to buy Bitcoin at current market prices.

Taking large profits is usually seen as a sign of bearishness as they tend to lead to the top of the market. However, in the case of Bitcoin, this is what happens when realised profits exceed $1.5 billion, leaving room for BTC growth now.

Furthermore, since October 2023, the market has maintained a profit-driven structure, with capital inflows consistently exceeding outflows. This steady influx of new capital strengthens positive market sentiment and reflects the bullish momentum seen at the October 2023 rally. This balance between supply and demand shows strong market sentiment, indicating that Bitcoin is poised for further profits.

Bitcoin Net has achieved profits/loss. Source: GlassNode

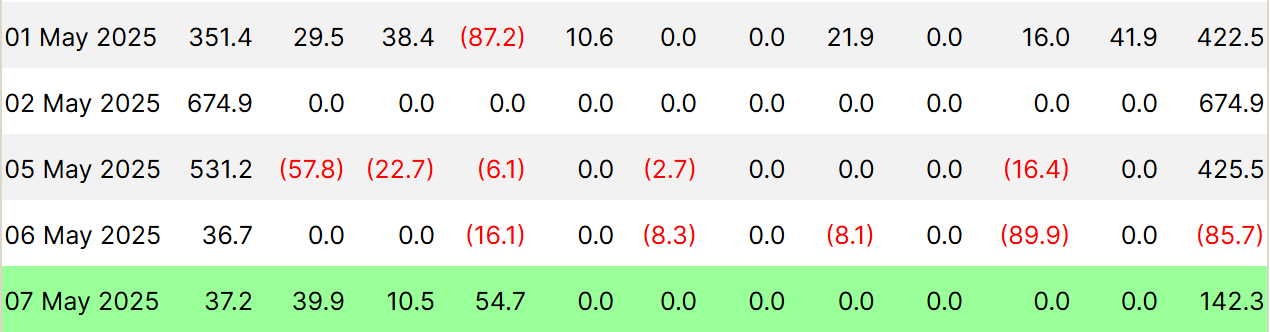

In addition to strong market sentiment, Bitcoin’s overall macro momentum is supported by positive spot ETF flows. These influxes remained pretty much positive over the past week, except on May 6, when a $85 million outflow was recorded.

This DIP was related to the uncertainty surrounding the US Federal Reserve decisions regarding interest rates. However, the overall trend in Spot ETF flows continues to suggest strong demand that will help support Bitcoin price movement.

Bitcoin Spot ETF Flow. Source: Farside

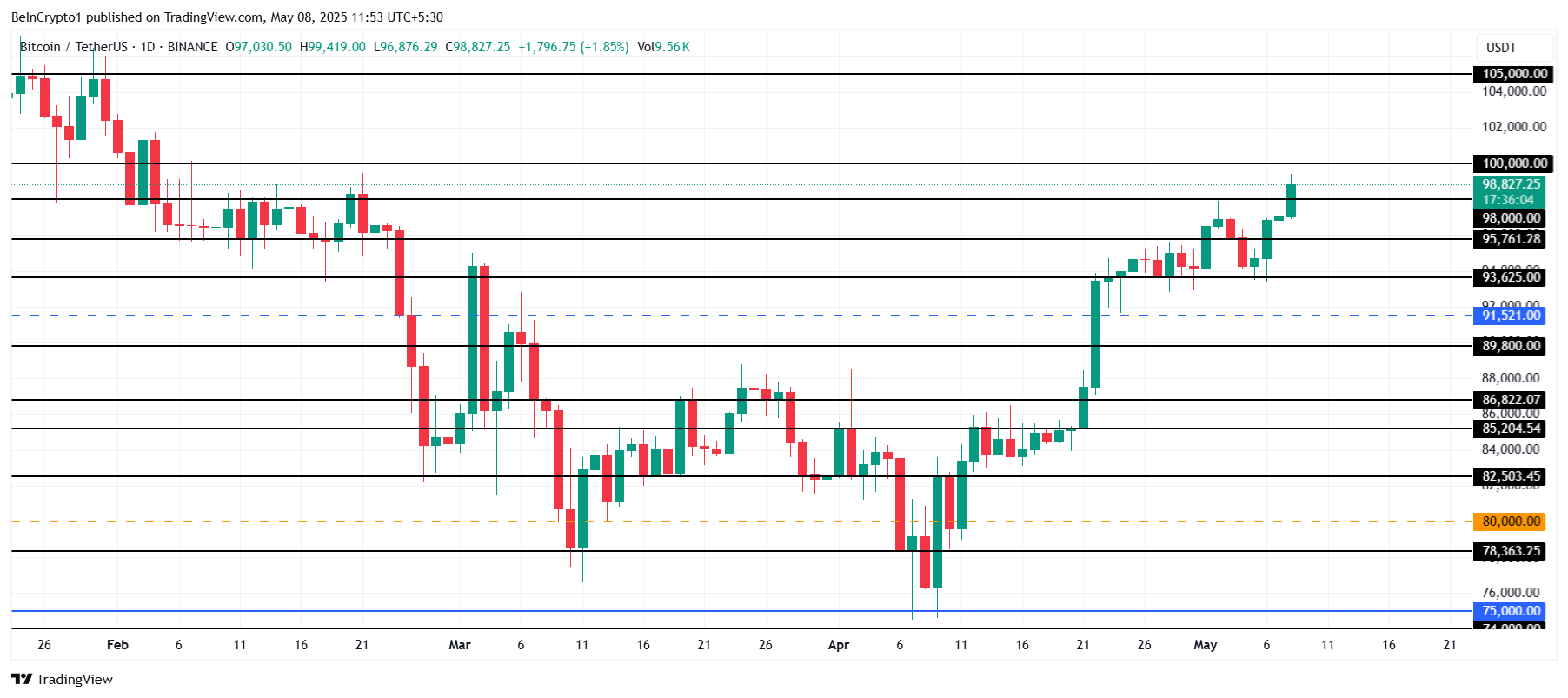

BTC price shows strength

Bitcoin’s prices currently trade at $98,827 on the daily chart, representing a two-month high, just a small amount of a significant resistance level of $100,000. If the market continues to show strength and investors’ trust remains solid, Bitcoin can support $100,000 and pave the way for further profits.

Bitcoin’s next major target is $105,000. Violating this level is important for Bitcoin to maintain its momentum and stay firmly in the six-figure range. If Bitcoin can secure this level, it would ultimately end up being $110,000, potentially extending the bullish rally.

Bitcoin price analysis. Source: TradingView

However, if the market situation becomes a recession and investors’ sentiment weakens, Bitcoin could struggle to break through the $100,000 resistance. In this scenario, the price could return to $93,625, which could negate the current bullish outlook and slow the recovery.