Bitcoin BTC$122,147.11 It tore around 13% this week and embarrassed a new record of $124,500 on Friday.

According to Jeffrey Kendrick, standard chartered director of digital asset research, the ceiling has become almost clear, so it could be a quick move to $135,000 on the card.

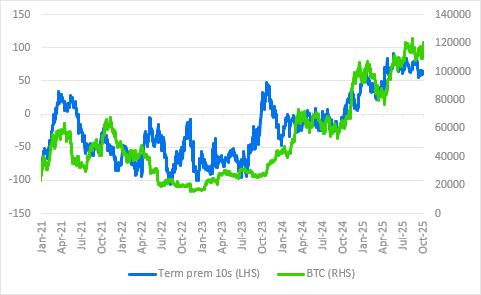

In a memo released Friday, Kendrick argued that the US government shutdown plays a greater role in the market than previous episodes supporting Bitcoin rallies. During the 2018-2019 shutdown, BTC was traded in a different context. Today, the largest ciphers correlate closely with US government risks measured at U.S. Treasury Department’s term premiums.

Bitcoin Price vs. US 10 Years Financial Long-Term Premium (Standard Charter Type)

Traders in the forecast market currently give them a 60% or more chance of shutdowns lasting for 10-29 days. Kendrick’s forecast BTC continues to rise throughout that period.

Kendrick also highlighted future changes in ETF investors’ behaviour. Gold ETF has recently pushed its BTC counterparts to record prices, surpassing BTC counterparts, but Spot Bitcoin ETF flows are poised to provide tailwinds for assets, the report says.

Of the $58 billion in net BTC ETF inflow so far, $23 billion came in 2025, he said. This week alone, they raised more than $2.25 billion without Friday’s session.

Kendrick predicted that the vehicle could attract an additional $20 billion in investor capital by the end of the year.