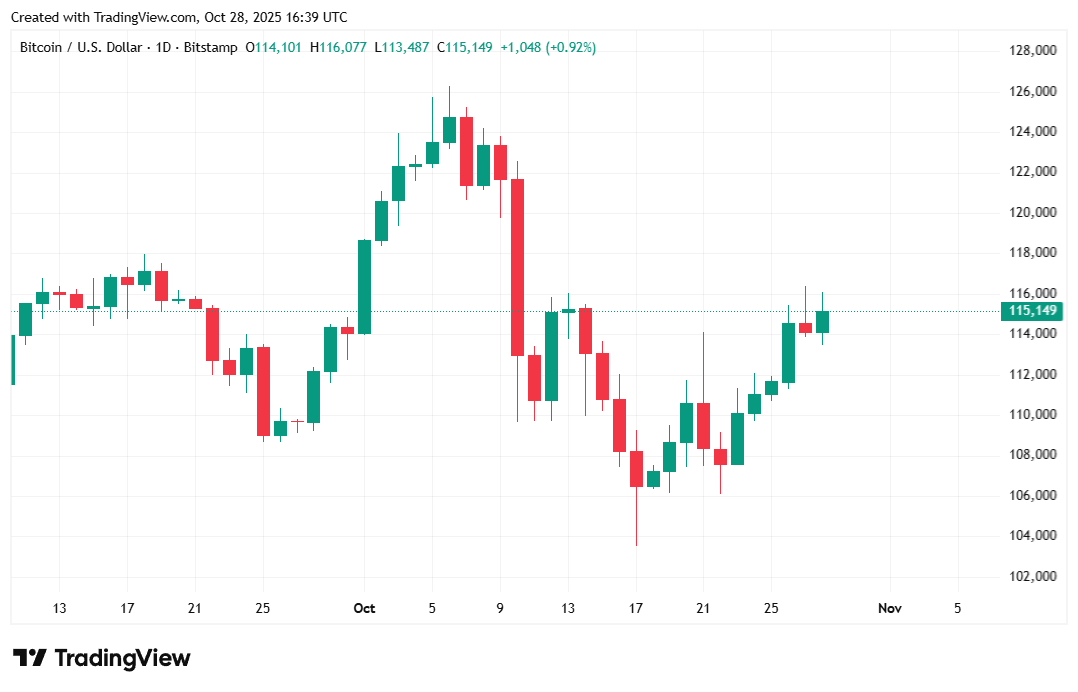

The digital asset briefly regained $116,000 early Tuesday morning after falling to $113,000 overnight.

BTC briefly rebounds as stocks reach new highs

Stock markets were flooded with green on Tuesday as several companies beat analysts’ expectations. The S&P 500 hit another intraday high as companies such as Paypal and UPS reported strong third-quarter results, pushing their stocks higher. Bitcoin fell to $113,000 during after-hours trading, rose to $116,000 in the morning, and settled around $115,000 in the late afternoon.

Private-sector employment growth announced by human resources firm ADP also boosted stocks. The company reported that it added an average of 14,250 jobs in the four weeks ending October 11. The US federal government shutdown began on the 28th.th On that day, the publication of almost all economic data, including employment statistics, was suspended. ADP, which publishes monthly private sector employment statistics, has announced that it will now also publish weekly employment statistics to fill the gap left by the government.

But the real stars of the show were the companies that posted strong financials and announced favorable trades that gave traders confidence that the stock’s price would turn around. For example, Paypal announced a partnership with OpenAI, which will see the payment provider integrated with OpenAI’s platform. Following the announcement, PayPal’s stock price soared 13%.

“We have hundreds of millions of loyal Paypal wallet holders, and now they can click the ‘Buy with Paypal’ button on ChatGPT for a safe and secure checkout experience,” Paypal CEO Alex Chriss said in an interview with CNBC.

Overview of market indicators

Bitcoin was down 0.47% at the time of reporting, dropping to $113,566.80 in the after-hours before rising to $116,078.99 in the morning and trading at $114,732.87. The cryptocurrency performed slightly better on a weekly basis, rising 0.88% from last week, according to data from Coinmarketcap.

(BTC Price/Trading View)

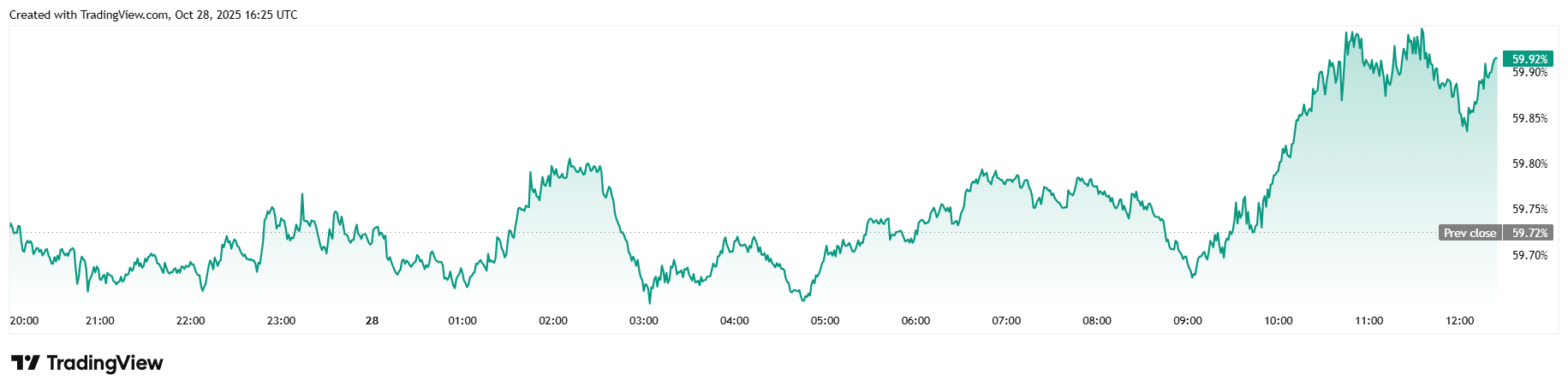

The 24-hour trading volume decreased by 12.37% to $53.05 billion, and the market capitalization, which fluctuates depending on the price, decreased by 0.47% to $2.28 trillion. Bitcoin dominance increased by 0.32% in 24 hours to reach 59.91%.

(BTC Dominance / Trading View)

Total open interest in Bitcoin futures fell by 0.67% on the day to $75.38 billion, according to data from Coinglass. The liquidation proceeded relatively calmly in 24 hours, totaling $72.89 million. Long investors were liquidated the equivalent of $45.2 million, while short sellers lost a smaller amount of $27.87 million.

Frequently asked questions ⚡

- Why did Bitcoin briefly reach $116,000?

Better-than-expected corporate earnings and investor optimism for stocks boosted sentiment in the crypto market. - Which companies led the market’s rise?

Paypal and UPS beat expectations for Q3, with Paypal soaring 13% after announcing its OpenAI partnership. - How did the broader market react?

The S&P 500 hit a new intraday high as traders cheered positive earnings results and private employment growth. - What’s next for Bitcoin and stocks?

Analysts expect both markets to remain strong as risk appetite returns and if earnings momentum continues.