Bitcoin has managed to regain the $90,000 level after several days of intense volatility, but upward momentum remains limited as the market continues to battle uncertainty and fear. Although the bulls have regained some ground, selling pressure still dominates the market, and speculation continues to rise that a new bear market is on the horizon. Many analysts have warned that the recent recovery will not be enough to change the overall trend unless strong demand returns.

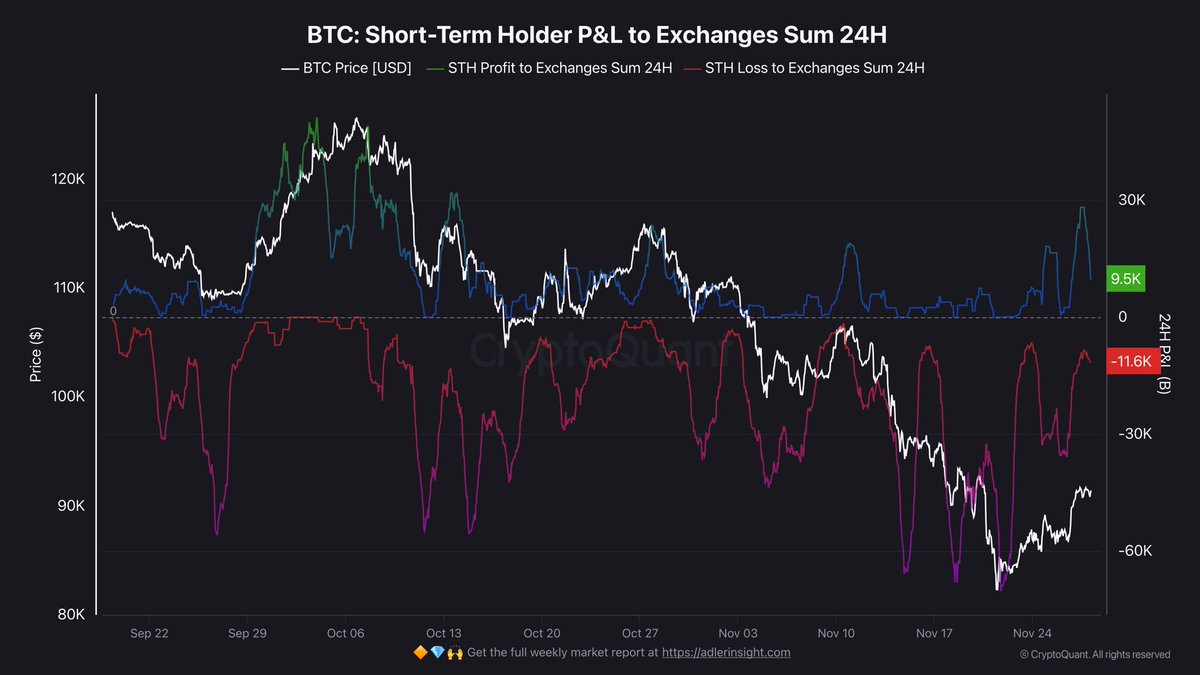

Investors’ short-term stress has eased slightly, according to the latest data from Darkhost. The amount of BTC transferred to exchanges at a loss has declined sharply and is now around 11,600 BTC, which is significantly lower than the extreme 67,000 BTC downward spike recorded on November 22nd. This decline suggests that the panic-driven sell-off may be subsiding, giving the market a temporary moment of stability.

However, despite this improvement, Bitcoin still faces strong headwinds. Investors remain cautious, liquidity conditions are tight and macro uncertainty continues to weigh on risk assets. For now, BTC must maintain above the $90,000 region and show sustained strength to avoid renewed downside pressure. Future sessions may decide whether this rebound signals the beginning of a recovery or a pause before putting his foot down again.

Short-term holders face a key decision point

Dirkforst added that the amount of BTC in profit that short-term holders transfer to exchanges remains relatively low at around 9,500 BTC. However, a slight uptick has been seen as Bitcoin rises again above $90,000, indicating that some STHs are starting to test the market in order to secure small profits or reduce their exposure.

This subtle change highlights Tensions are running high among buyers these days. choose You can either wait for the full return until you break even, or you can sell now to minimize further losses.

This situation creates a delicate environment. Even though selling pressure has eased, STH is still very sensitive to small price movements, and its actions often determine short-term market direction. Compared to the violent surrender seen earlier this month, the past few days have been unusually calm, and that calm is actually constructive. This suggests that the panic has temporarily subsided and the market is trying to find balance.

What is now important is to monitor how STH reacts as Bitcoin approaches its realized price. If BTC holds and confidence increases, BTC could gain enough stability to rise further. If we sell aggressively, downward pressure could return quickly. This group’s next move will likely set the tone for the coming weeks.

Bitcoin tries to recover but faces significant overhead resistance

Bitcoin’s daily chart shows that Bitcoin is attempting to recover after hitting a surrender low near $80,000, but its structure remains fragile. Although the price has regained the $90,000 region, momentum is limited as BTC is trading below its 50-day and 100-day moving averages, both of which continue to trend downwards, indicating sustained bearish pressure.

The 200-day moving average is even higher, reinforcing the broader downtrend that has formed since the $126,000 peak in early October.

Recent candlesticks reflect hesitation on the rebound, with the upward wick indicating sellers are protecting any push towards $92,000-$94,000, but the narrowness of the physical range highlights indecision. Volume is significantly lower than the panic selling in early November, suggesting that while the forced sell-off has eased, strong conviction on the part of buyers is still lacking.

Structurally, BTC remains below the major resistance cluster that formed during the previous consolidation. Retrieving these zones is essential to invalidate the bearish trend. Until then, any pullback risks lower highs within a broader correction structure.

On the downside, the $85,000-$87,000 region remains the most important support. Anything below that could reopen the path to deeper remediation goals. For now, Bitcoin is aiming for stability, but bulls need to regain higher levels soon to change market sentiment and avoid new downside pressure.

Featured image from ChatGPT, chart from TradingView.com