The price of Bitcoin was trapped in the integrated range of $ 81,000 to $ 86,000 over the past week, showing a high level of determination between the bull and the bear. Most of the chain indicators draw a weak image for premier cryptocurrency, while the latest data suggests that the bull run is not over yet.

BTC investors are not yet in full panic mode: blockchain company

In a new post on the X platform, GlassNode, a blockchain analysis company, has found that market pressure is increasing. This hotint observation is based on the value of unlimited losses of this investor cohort.

For clarity, unauthorized loss represents the loss on paper because the investor still sells and sells assets. The loss is “real” or “realized” when the holder sells assets at a lower value than the purchase price.

According to GlassNode, Bitcoin investors’ unsuccessful losses have been rising in recent weeks, especially short -term holders with significant +2σ thresholds. The STH opponent loss metrics that hit the extreme +2σ threshold are related to the increase in sales pressure in the past.

But GlassNode mentioned that the size of STH loss is still observed in the bull market. Specifically, the size of these losses has been fired when compared to the selling of the entire market in 2021, which suggests that the bull is yet to be achieved.

Source: @glassnode on X

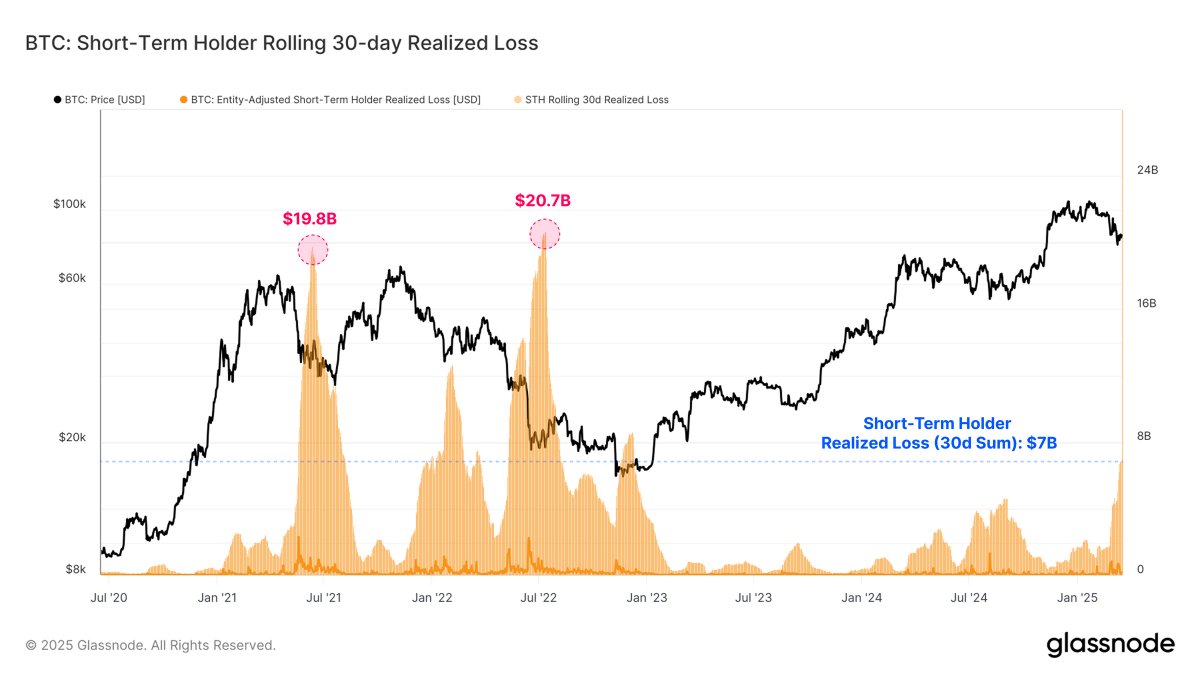

To explain this, GlassNode said that the 30 -day loss of Bitcoin’s short -term holders exceeded $ 7 billion, showing the largest continuous loss in the current period. Despite the importance of this figure, it is still much less serious than the surrender event found at the beginning of the bear market.

For example, Bitcoin’s realization losses increased to $ 19.8 billion and $ 20.7 billion, respectively, in May 2021 and May 2022, respectively. Considering that the realized loss is still much lower than the past surrender, the market is unlikely to reach full panic mode.

Bitcoin price at a glance

At the time of this article, Bitcoin’s price was about $ 84,300, up 0.3% over the last 24 hours. According to Coingecko’s data, flagship cryptocurrency has only reduced 0.6% over the last seven days, emphasizing the uneven condition of the market.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.