Bitcoin recovered beyond its previous record highs in the USD and USDT markets on Wednesday, expanding on Thursday, rising to a peak of $111,880. Bitcoin breakouts were unable to lead to happiness among traders, and the response to derivative traders was muted compared to previous BTC price rallies.

Ethereum (Eth) struggles to attract institutional influx despite ETH gathering alongside Bitcoin (BTC) in price discovery. The top 50 cryptocurrency altcoins ranked by market capitalization are on the green and will be rallying in the last 24 hours.

table of contents

Bitcoin Derivative Analysis

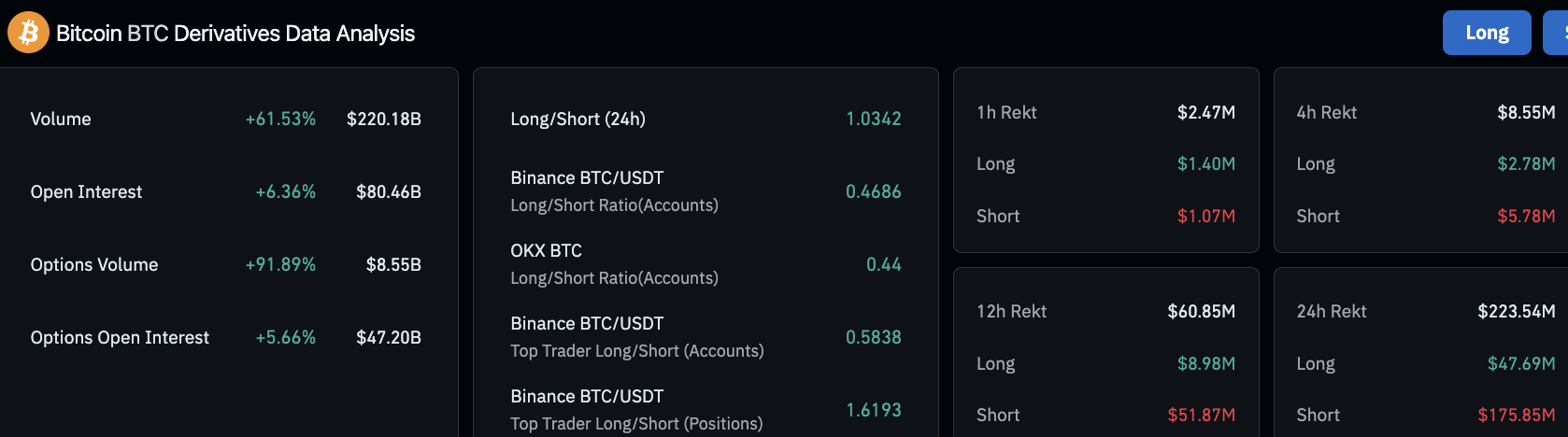

Analysts at 10xResearch and Amberdata agree that the strength of the spot market, not speculation, drives BTC’s profits. Bitcoin rally fails to kick the euphoria among traders above $111,000, with the long/short ratio of top derivative exchanges exceeding 1.

The 24-hour liquidation data shows the liquidation of $175 million in shorts, with a long position of over $47 million being liquidated. Bearish traders are being punished for bets on Bitcoin’s price rise, but the key question is how expensive Bitcoin will be.

Bitcoin Derivative Data Analysis | Source: Coinglass

Coinglass’ Bitcoin Futures Open Interest Chart shows the massive spikes of the OI. Bitcoin’s open derivatives contract was passed on May 22 with a total of $78 billion in OI. The OI shows the strength of the BTC uptrend alongside the Bitcoin price. Traders are confident that Bitcoin prices will be even higher.

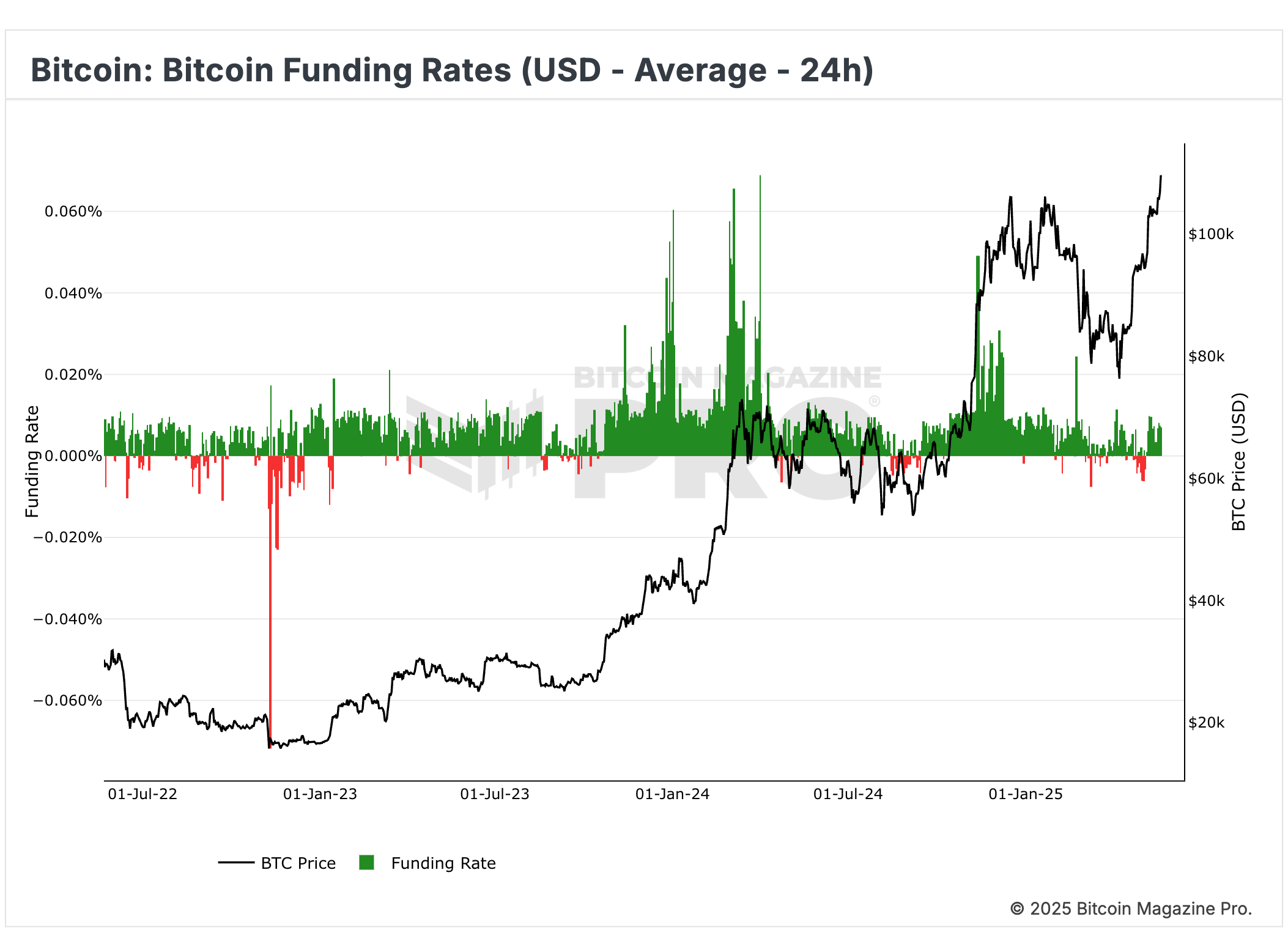

Funding rates have been positive since May 8th, and the consistency of the green bar at the lower funding rate shows that derivative traders are gaining even more benefits with Bitcoin. Positive funding rates are fuelled by a bullish story about assets in Bitcoin. This supports the benefit paper.

Bitcoin Funding Rate (USD-24H) | Source: Bitcoin Magazine Pro

You might like it too: Bitcoin has acquired limited profits with BTC price rising 3.7%

Ethereum Technical and Derivatives Analysis

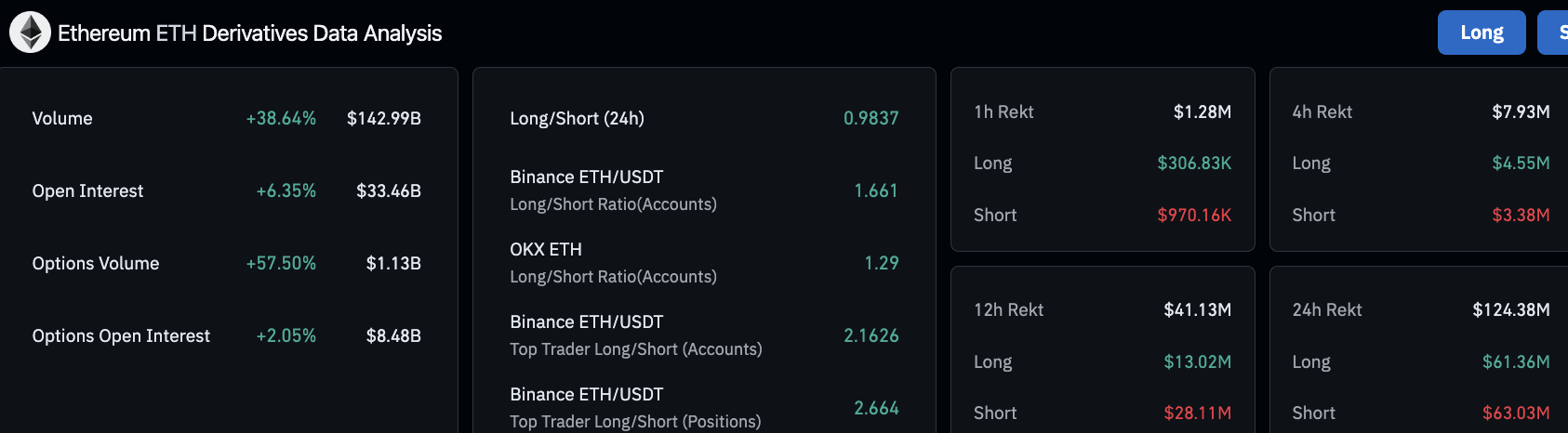

Ethereum on-chain data shows a slight increase in OI, which is less than 7% in the last 24 hours. In the same time frame, Ethereum’s long and short liquidation was roughly the same amount, exceeding $60 million.

Even if the optional volume surges by nearly 60%, the long/short ratio across the exchange of upper derivatives is less than 1. There is no clear indication of bullish or bearish bias among Ethereum derivative traders.

Ethereum Derivative Data Analysis shows the largest Altcoin lag compared to Bitcoin in terms of interest and activity from derivative traders.

Ethereum Derivative Data Analysis | Source: Coinglass

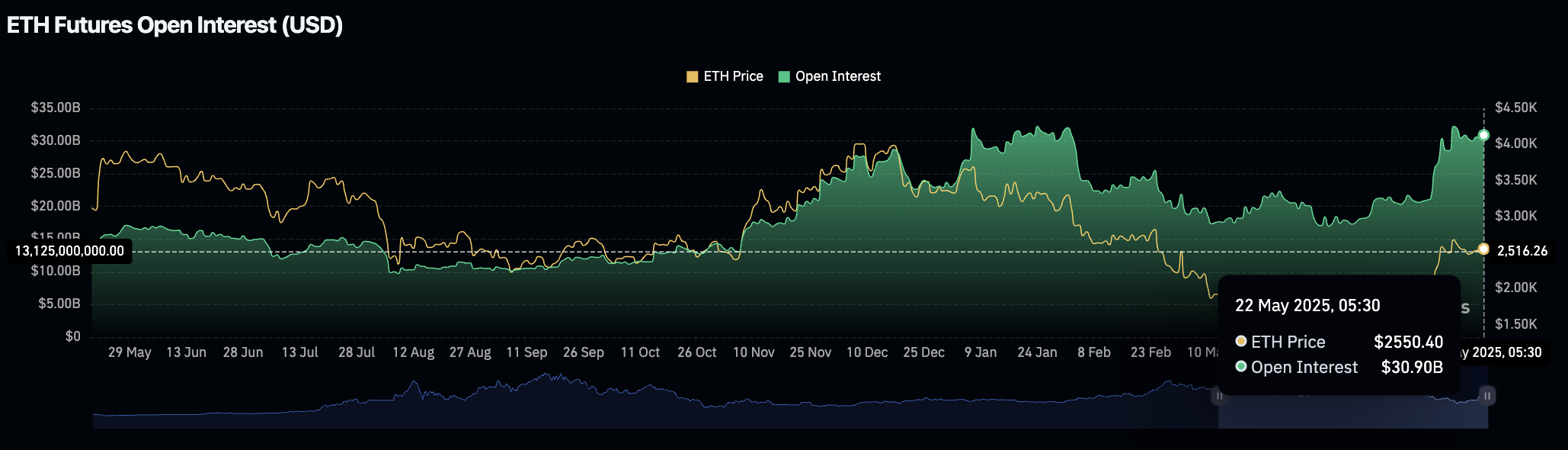

Coinglass’ open interest charts show previously seen OI lag levels in January and February 2025, even when ETH is above $2,600.

Ethereum Futures Open Interest (USD) | Source: Coinglass

The ETH/USDT Daily Price Chart shows that ETH is currently 12% below the psychologically important $3,000 target. ETH has established support at $2,415, and further profits could increase as the RSI tilts upwards and the MACD flashes green histogram bar above the neutral line.

Ethereum’s goal is at the $4,578 level, as seen on the ETH/USDT price chart. Altcoin’s previous all-time high is at $4,878.

ETH/USDT Daily Price Chart | Source: crypto.news

You might like it too: Bitcoin Pizza Day Rally pushes BTC to $112,000. How much does Bitcoin cost?

Code trader sentiment and why is it lacking euphoria?

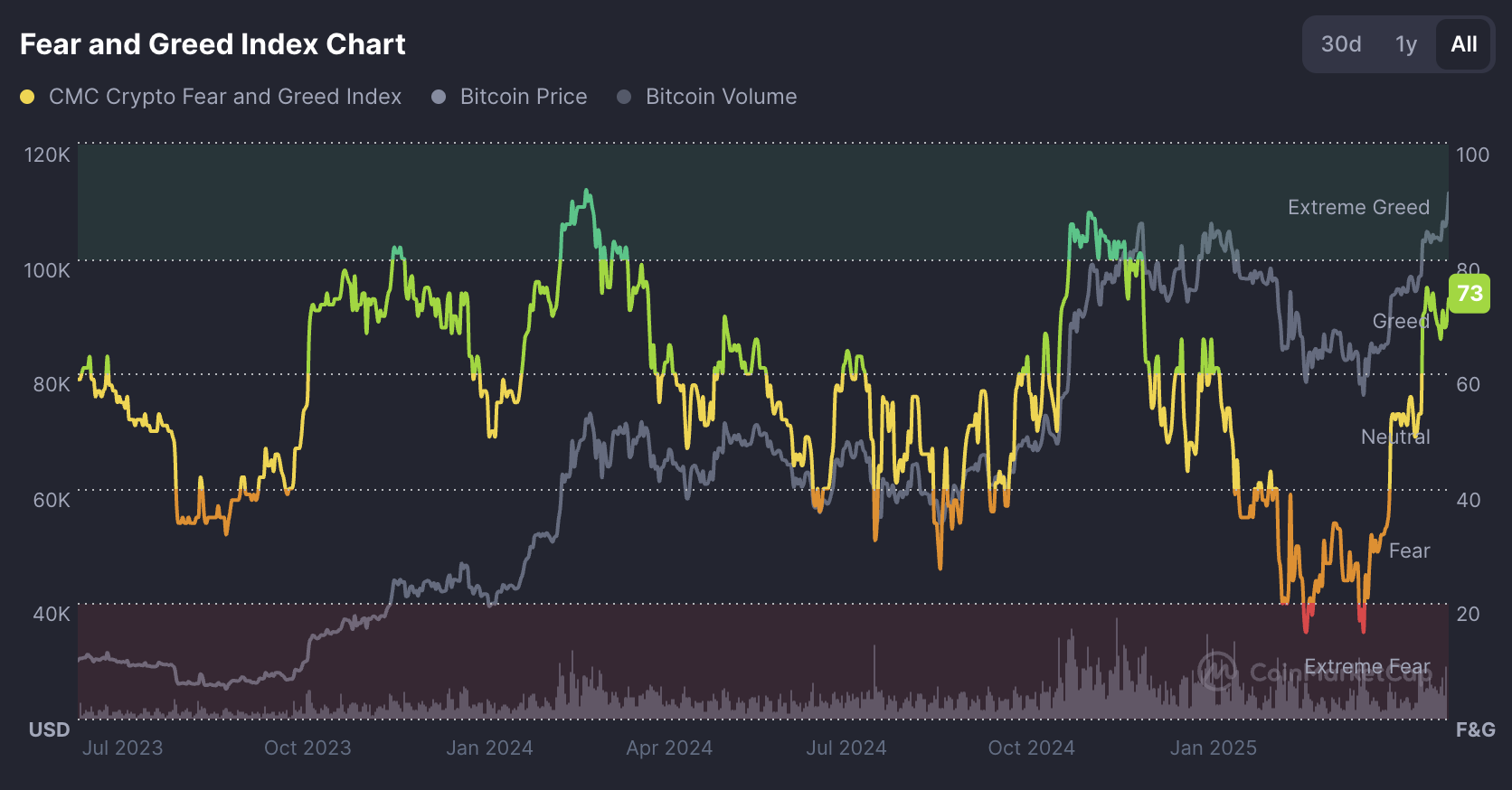

CoinmarketCap’s Fear and Greedy Index Chart shows that even if Bitcoin enters price discovery, the highest level of “greed” observed in November 2024 is the highest. Trader Sentiment is not as euphoric as you would expect at the time of writing 73.

Extreme greed is usually correlated with cycle peaks or annual tops. Bitcoin exceeds $110,000 remains behind in terms of bullish sentiment among traders.

This may be a positive indication as it supports the paper that the cycle top is still far apart and traders are likely to be waiting and watching for the next pullback and rally in BTC.

Fear and Greedy Index Chart | Source: CMC

How much does Bitcoin cost?

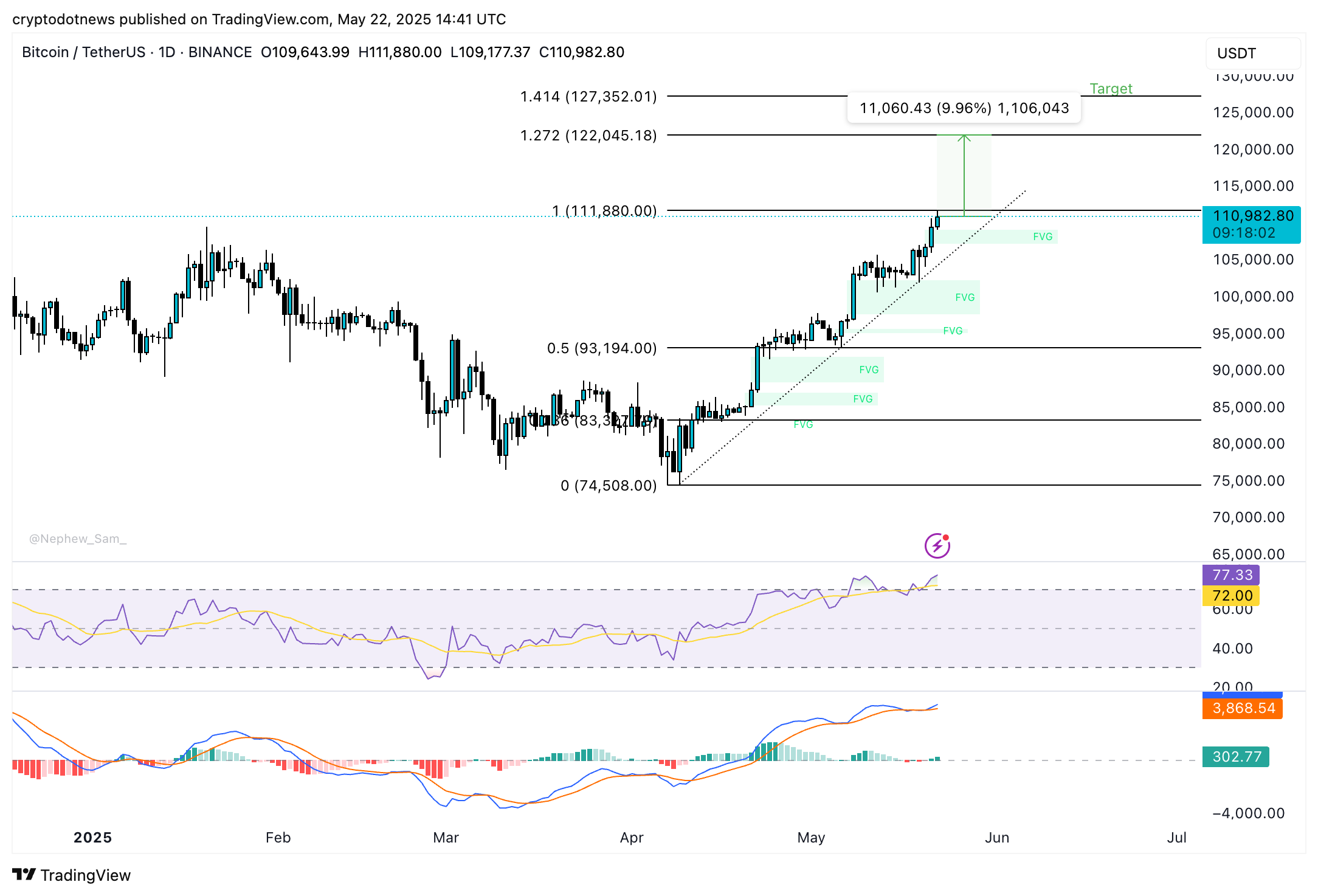

Bitcoin’s goal is a $122,000 level, consistent with the 127.2% Fibonacci retracement of 50% meetings from April 7th to May 22nd. BTC is currently less than 10% off its target, and the technical indicators on the daily price chart support the potential for further profits.

The RSI is tilted upwards, across the “overrated” zone, and the MACD flushes the continuous green histogram bars. If Bitcoin tests resistance for $122,000 and breaks beyond this level, the next goal of $127,352 appears.

The $127,352 target is the Fibonacci retracement level of 141.4% for Bitcoin on a continuous upward trend. Bernstein analysts pushed their Bitcoin target to $200,000 in 2025, but based on profits since April 2025, BTC could be above the $127,000 level by June 2025.

BTC/USDT Daily Price Chart | Source: crypto.news

Expert commentary

Shubh Varma, CEO of Hyblock Capital, told Crypto.News that from a technical standpoint, he is looking at the most reliable support zones, ranging from $101,000 to $102,500. Exchanges like Binance and Bybit saw “heavy open interest entries that lock in shorts and attract fresh longs” in this zone.

Bitcoin outstripped resistance between the $105,000 and $106,000 levels early Thursday. It is still unclear how much Bitcoin will hold above FVG in the daily time frame.

Bitfinex analyst told Crypto.News in a memo that wrote that the team is looking at a minor liquidity barrier between $114,000 and $118,000, and that the $123,000-$125,000 zone is building open interest for large options. These are important areas that traders will watch in the coming weeks of May 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.