Japan’s 10-year government bond (JGB) yield has reached levels not seen since 2008, creating a scenario that puts pressure on Bitcoin through spot depth and order book mechanisms rather than direct correlation.

The long-term sale of Japanese government bonds has raised domestic yields, reducing the incentive for Japanese institutional investors to seek returns in overseas markets.

Life insurers have already shown a preference for domestic yen assets in recent quarters, and the recent spike in yields has accelerated that trend.

Global dollar liquidity has shrunk slightly as Japanese capital retreats from overseas risk positions, weighing on risk assets such as stocks and cryptocurrencies.

How rising government bond yields put pressure on Bitcoin

Buyers have fled Japanese government bonds amid heightened political and financial risks, causing yields to soar and now redirecting the flow of money to financial institutions. The simultaneous depreciation of the yen is adding to the pressure.

A weaker yen keeps the dollar strong, and the combination calls for reducing risk across carry trades and leverage strategies.

Rising hedging costs and widening rate differentials make it more expensive to maintain leveraged positions, drain liquidity from exchanges, and make Bitcoin price movements more mechanical.

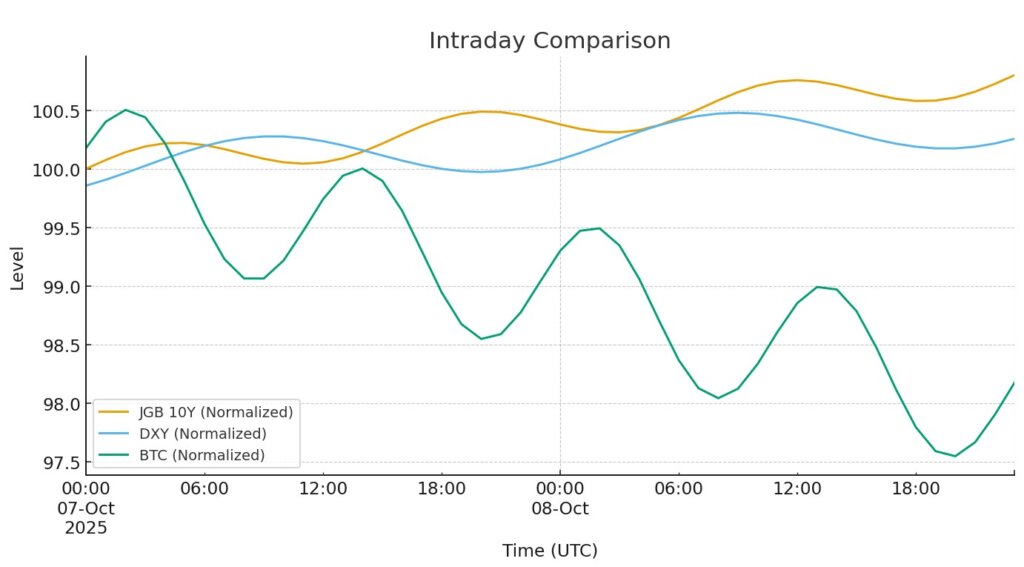

This week, the dollar strengthened as the yen weakened, a move that thinned the spot market and increased volatility.

A strong dollar and tight financial conditions have repeatedly coincided with lower spot liquidity and higher short-term volatility. As a result, dollar strength is inversely correlated with Bitcoin and often causes corrections.

This pattern is important now because the thinner order book makes price movements more flow-driven and less dependent on underlying demand.

If the Bank of Japan escalates its hawkish rhetoric to prevent the yen from weakening, the interest rate differential could suddenly drive prices up, creating new volatility in risk assets.

As Reuters recently reported, a former Bank of Japan executive said the weakening yen could prompt the central bank to raise interest rates in October, a move that could narrow the spread with U.S. yields and ease the dollar bid.

ETF demand will continue for the time being

U.S.-traded spot Bitcoin ETFs recorded net inflows of $2.1 billion from October 6 to October 7, according to data from Pharcyde Investors, showing solid demand even as macroeconomic conditions tighten.

On October 7, the fund rebounded to close at $121,368.23 after withdrawing $875.6 million, even as Bitcoin corrected 2.4% and briefly lost the $121,000 level.

This resilience suggests that ETF inflows can offset dollar strength and liquidity constraints in the short term, but whether that offset is sustained depends on whether inflows maintain their recent pace.

Two countervailing forces determine how long ETF demand can absorb macro pressures. First, if the pace of inflows of billions of dollars per week slows, the impact of a stronger dollar and weaker yen on Bitcoin liquidity will become more pronounced.

Second, if the Bank of Japan tightens monetary policy, the gap between Japan and the US interest rates will narrow and the dollar bid will fall, thereby easing pressure on risk assets and potentially restoring some spot depth. As a result, ETF inflows remain strong but are currently sensitive to changes in the dollar and real yield environment.

The Oct. 8 inflow data will help shed light on how investors are handling the latest developments in rising government bond yields, a weaker yen, and a stronger dollar.