Hyperscale Data revealed that the value stored in the company’s Bitcoin vaults currently accounts for approximately 66% of the company’s market capitalization based on its previous stock closing price.

summary

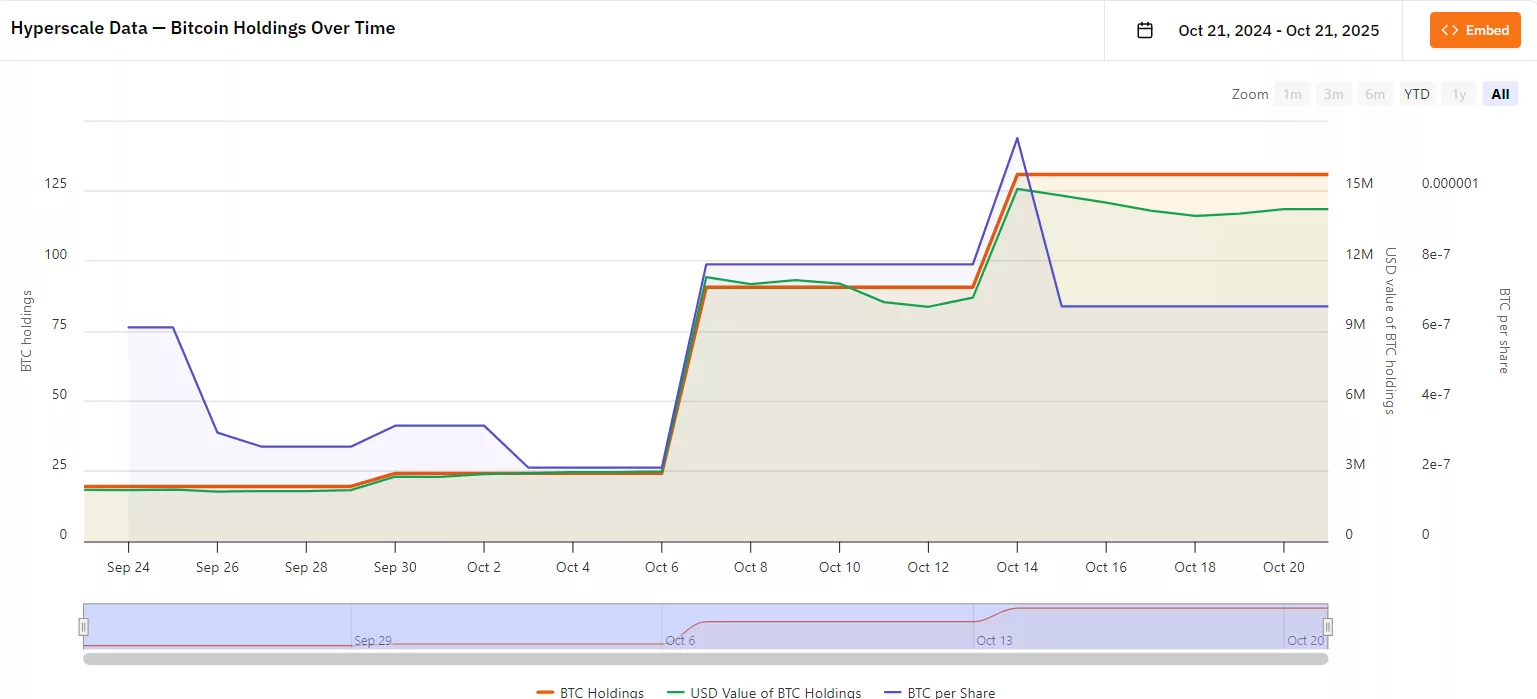

- Hyperscale Data’s Bitcoin holdings amount to approximately 150.21 BTC ($16.3 million) through mining and open market purchases, with additional funding of $43.7 million.

- The company aims to build a $100 million Bitcoin vault, representing 100% of its market capitalization, and reports on its progress weekly. So far, the company has been able to rank among the top 100 listed companies in terms of Bitcoin holdings.

According to a press release shared by the company, its Bitcoin vault holds approximately $60 million worth of assets and funds earmarked for purchases. The company claims this amount represents about 66% of its market capitalization, which the Bitcoin Treasury puts at $75 million.

As of October 19, the company’s Bitcoin (BTC) treasury subsidiary Centinum reportedly held approximately 150.21 Bitcoin ($16.2 million). This amount consists of Bitcoins acquired from mining operations (32,632 BTC, or worth $3.52 million) and Bitcoins purchased from the open market.

So far, the company has purchased 117.58 BTC. The most recent purchase took place during the week of October 19th, when the company purchased 15.88 BTC. Based on Bitcoin’s closing price of $108,666 on October 19, 2025, these holdings are valued at approximately $16.3 million.

Hyperscale Data’s total Bitcoin holdings reached $60 million | Source: Bitcoin Treasury

You may also like: Michael Saylor hints at Strategy’s next Bitcoin purchase

Additionally, the company claims it has allocated approximately $43.7 million in corporate funds to Centinum to purchase more Bitcoin on the open market. The company said it plans to continue investing funds using a so-called “measured dollar-cost averaging approach,” which aims to increase the value of long-term reserve holdings while limiting the impact of market fluctuations.

“Bitcoin price volatility has provided us with a meaningful opportunity to build our position systematically and with advantageous long-term averages,” Hyperscale Data Executive Chairman Milton “Todd” Ault III said in a statement.

Hyperscale Data plans to hold 100% of its market capitalization in BTC

Hyperscale Data said it will continue to acquire additional Bitcoins to achieve its long-term goal of building a Bitcoin vault with a value equal to 100% of market capitalization. As part of a broader digital asset treasury strategy, the company aims to stockpile $100 million worth of Bitcoin from open market purchases and self-mined BTC.

“Hyperscale will continue to publish a weekly report detailing its Bitcoin holdings every Tuesday morning as we progress towards our $100 million DAT goal,” the company said in an official statement.

According to data from Bitcoin Treasuries, Hyperscale Data has been acquiring BTC for less than a month. I started holding BTC on September 23rd this year. So far, the company’s Bitcoin holdings are 130.8 BTC, or the equivalent of $14.18 million. The average cost was $115,460, and the company accumulated a loss of about 6.02% after Bitcoin’s value plummeted below $110,000.

Compared to larger, more established Bitcoin finance companies like Strategy, Metaplanet, Tesla, and Galaxy Digital, it still has a long way to go. However, despite being a latecomer, the company was able to enter the top 100 listed companies that hold Bitcoin. Bitcoin Treasuries ranks Hyperscale Data at #98 with 131 BTC, ahead of Mac House and Bitcoin Depot.

At the time of writing, Bitcoin is down 2.5% in the past 24 hours, continuing its downtrend of 2.75% over the past week. The largest cryptocurrency by market capitalization is currently trading at $108,153 and is trying to get back to the $110,000 threshold.

You may also like: Bitcoin price remains flat as old wallets are sold due to demand from institutional investors