The BTC (Bitcoin) market turned out to be a bit turbulent last week after the price drop of less than $ 75,000 last week rebounded to more than $ 83,000. While the best cryptocurrency shows a continuous rise, the blockchain analysis company Cryptoquant has identified two potential key resistance areas.

Bitcoin shows potential powerful barriers of $ 84,000 and $ 96,000.

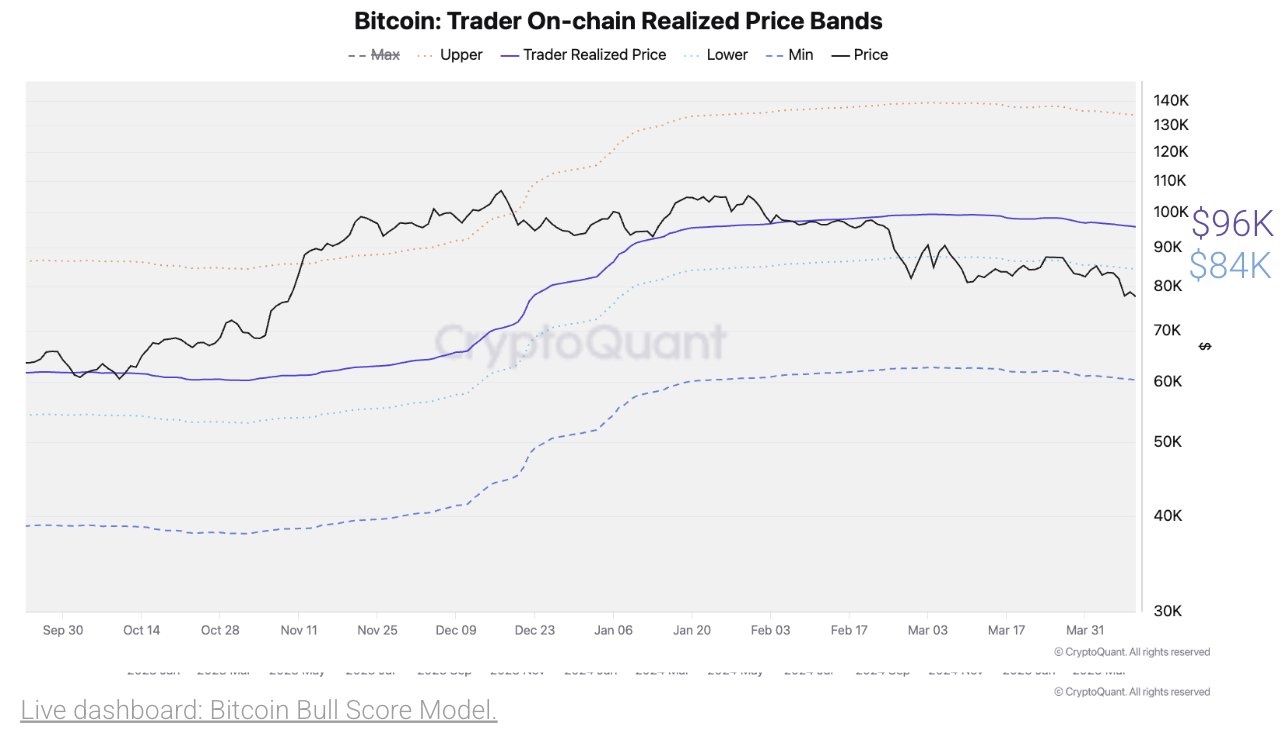

On April 11, in the X post, Cryptoquant shares an on -chain report on the BTC market, showing two major resistance when Bitcoin maintains the current upward trajectory, indicating a potential meeting of $ 84,000 and $ 96,000. These price barriers are revealed by the realization price indicators that determine the overall market standards by reflecting the last average price of BTC’s supply.

When Bitcoin trades above this level, it shows a healthy optimistic propulsion to benefit most of most holders. On the contrary, when the BTC is less than a threshold, most investors have losses, suggesting underwater feelings. Therefore, realized prices often serve as an important market pivot that acts as a strong support in the bull market and a strong resistance in the bear stage. According to Julio Moreno, the research director of Cryptoquant, BTC’s current on -chain realization price is $ 96,000 and an immediate low price band is $ 84,000.

Interestingly, these two price levels have been a major support zone in the initial strength of the market cycle. However, both regions may act as a resistance in the ongoing market revision. But if Bitcoin can exceed $ 84,000 and $ 96,000, the Premier Cryptocurrency can mean the resumption of Bull Market, which is likely to make a high deal of $ 130,000. This expected profit is an increase of 55% of the current market price.

BTC price outline

Bitcoin continues to trade at $ 83,180, reflecting 3.65%of the last day. Meanwhile, daily trading volume decreased 11.99% and $ 391.9 billion.

The encryption market continues to show strong levels of uncertainty in the continuous macroeconomic development led by the US government tariff change, and assets do not establish clear momentum. However, Blockchain Analytics GlassNode reported that Bitcoin Investors had a powerful support area of $ 79,000 and $ 82,080 accumulated with 40,000 BTC and 51,000 BTC, respectively.

In the emergence of all decline, the two prices should provide short -term support and prevent additional prices. Bitcoin, which has a market cap of $ 1.66 trillion, remains the largest digital asset, which accounts for more than 60% of the market cap.

CNN’s main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.