Bitcoin (BTC)’s recovery in early 2026 may not last long as new data points to potential increasing selling pressure. Traders holding long positions may need to consider adverse conditions to minimize risk.

On-chain data shows that Bitcoin whales are increasing their activity on exchanges. This behavior is especially dangerous in low volume environments.

Bitcoin whale inflow rate sharply increased in January

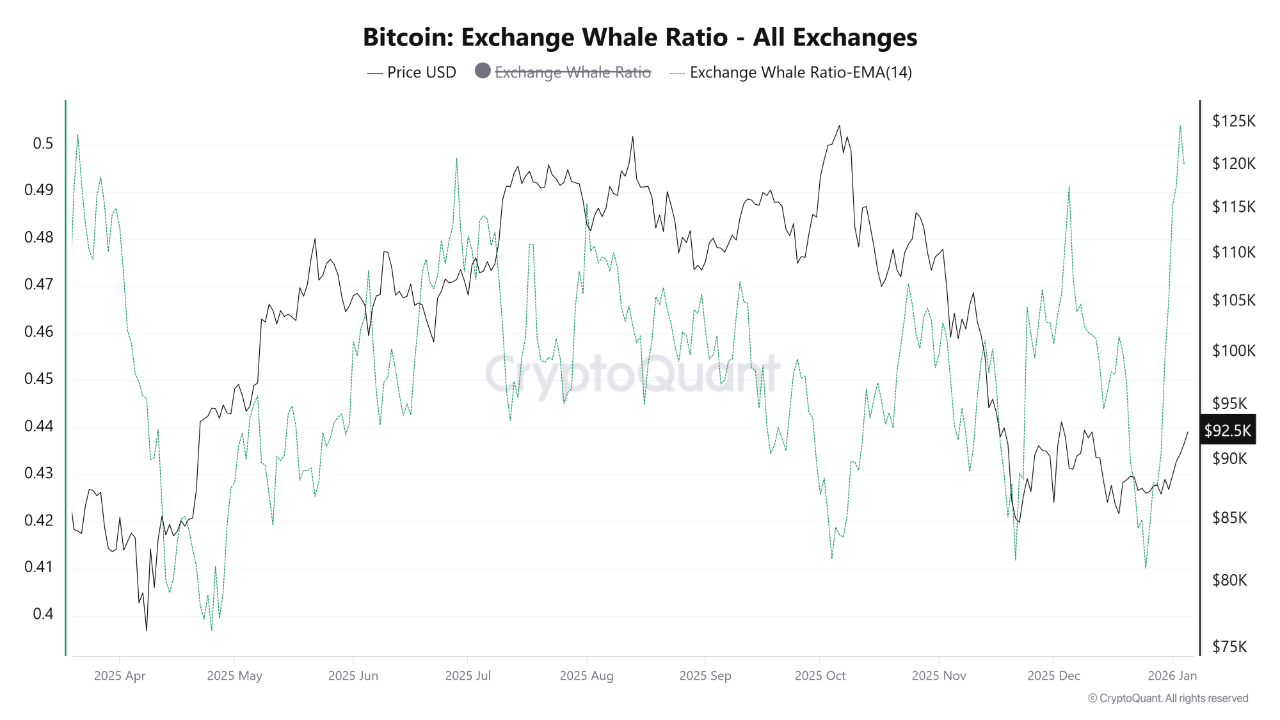

One of the most alarming signals is the all-exchange whale ratio (EMA14), which has risen to a 10-month high.

This metric represents the ratio of top 10 inflows to total exchange inflows. A high value indicates that whales are using the exchange frequently.

Bitcoin exchange whale ratio. Source: CryptoQuant

While Bitcoin foreign exchange reserves continue to decline due to demand from DATs and ETFs, a sudden rise in this ratio could serve as an early warning. This suggests that BTC balances on exchanges may start increasing again.

“This development is consistent with Bitcoin prices attempting to recover after a correction phase,” said CryptoQuant analyst CryptoOnChain. “This pattern suggests a potential strategy for whales to use buy-side liquidity to book profits and use the current market as exit liquidity.”

Additionally, market liquidity has become increasingly fragile, increasing the risk of rapid price changes and increased volatility.

Bitcoin and altcoin spot volume. Source: Glassnode

According to a post by X’s Glassnode, spot trading volume for Bitcoin and altcoins has fallen to its lowest level since November 2023.

“This weakening in demand is in sharp contrast to the broader market bull run, highlighting the diluted liquidity situation behind recent price increases,” Glassnode reported.

In an illiquid environment, only limited buying pressure can push prices higher. On the other hand, moderate selling pressure can easily cause a large downside price movement.

If exchange whales start selling as suggested, coupled with thin liquidity, Bitcoin’s more than 6% rally and 10% recovery in altcoin market capitalization could end quickly.

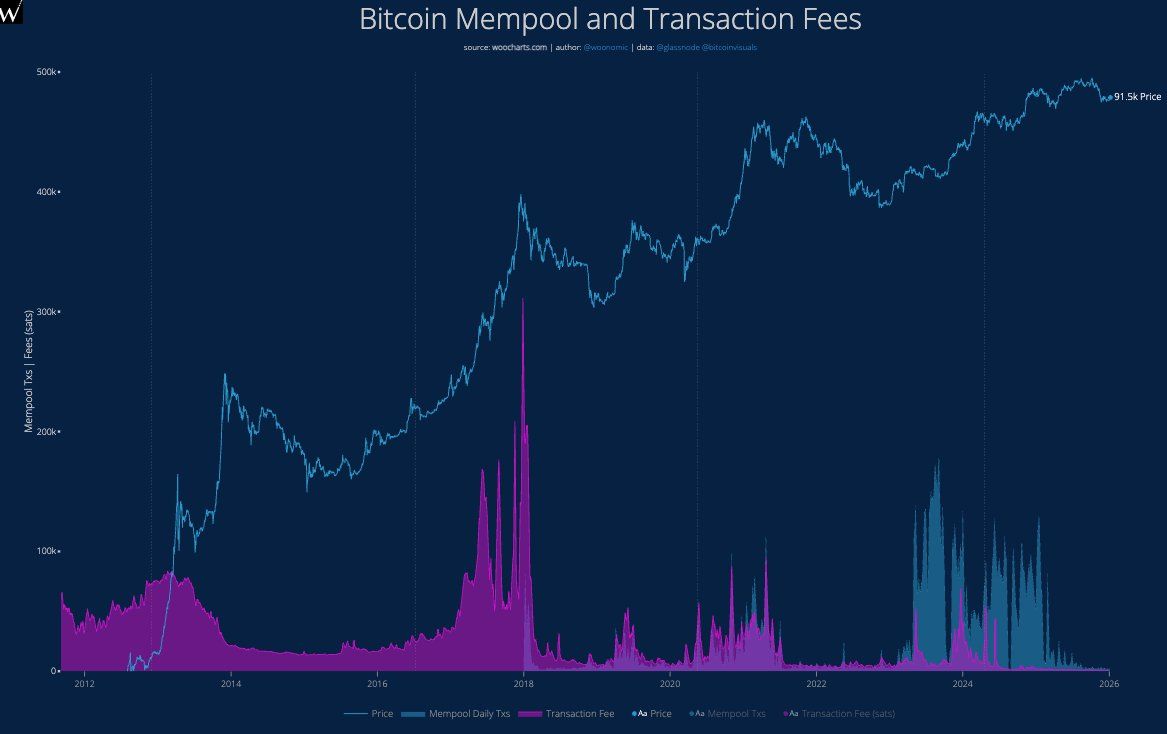

Additionally, analyst Willy Wu pointed to the sharp decline in Bitcoin transaction fees, describing the market as a “ghost town.”

Charts tracking memory pools and transaction fees show on-chain activity at record lows. Both indicators declined significantly, reflecting the decline in transactions. Reduced on-chain activity means weaker capital inflows and outflows, making the market less dynamic.

Bitcoin menpool and transaction fees. Source: Willy Wu

Wu expects a short-term pump could occur in January as liquidity reaches a local bottom. However, the long-term outlook remains bearish due to lack of actual activity.

Some analysts expect Bitcoin to correct towards the $90,000 and $88,500 zones in the short term. These levels also coincide with the newly formed CME gap.

The article “Bitcoin Whales Accelerate Trading Activity in Early 2026 as Liquidity Becomes Increasingly Fragile” was first published on BeInCrypto.