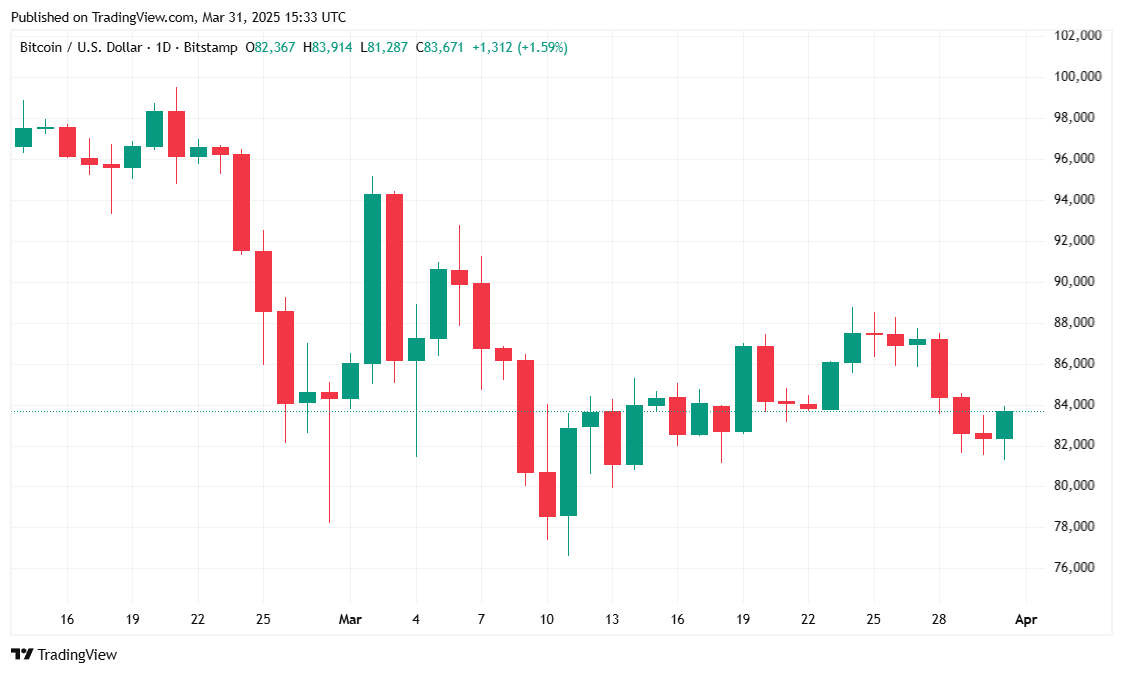

The cryptocurrency fell to $81,000 on Sunday, then returned to $83K as institutional investors rushed up to “buy DIP.”

Bitcoin returns to $83,000 after a tough weekend

While key digital assets were soaked at $81,000 over the weekend, news of the Strategy (MSTR) and Metaplanet (3350) institutional purchases were $1.92 billion and $13.3 million, respectively, which helped BTC surpass the $83,000 threshold.

Bitcoin prices remained suspended for the past 24 hours, trading in the range of $83,557.64 to $87,489.86. According to CoinMarketCap, the flagship cryptocurrency rose 1.01% over the past 24 hours to $83,678.74 at report, but fell 5.07% over the past week.

(BTC Price/Trade View)

Despite the decline over the past seven days, the market has shown signs of new activity. Trading volume rose 90.34% to $27.27 billion, much of this was due to poor weekend trading. Meanwhile, Bitcoin’s market capitalization fell 0.95% to $1.65 trillion.

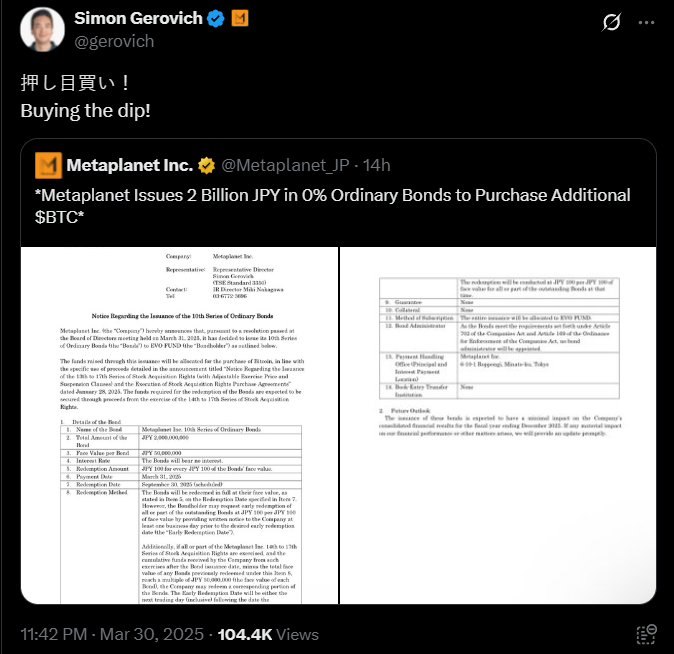

Strategy and Metaplanet double Bitcoin purchases

The two companies that made headlines by successfully pivoting from traditional companies to Bitcoin finance companies, strategy and metaplanets have both announced Bitcoin purchases of 22,048 btc (approximately $19.2 billion) and less than 160 btc (because about $13.3 million or 2 billion degrees respectively). Metaplanet issued a zero coupon bond for purchase on March 30th, but announced that the strategy announced the purchase on March 31stst.

(Metaplanet CEO Simon Gerovich announced his company’s latest BTC purchase/Simon Gerovich x)

The acquisition strongly demonstrates sustained institutional interest in digital assets that are likely to be good for medium to long-term price measures.

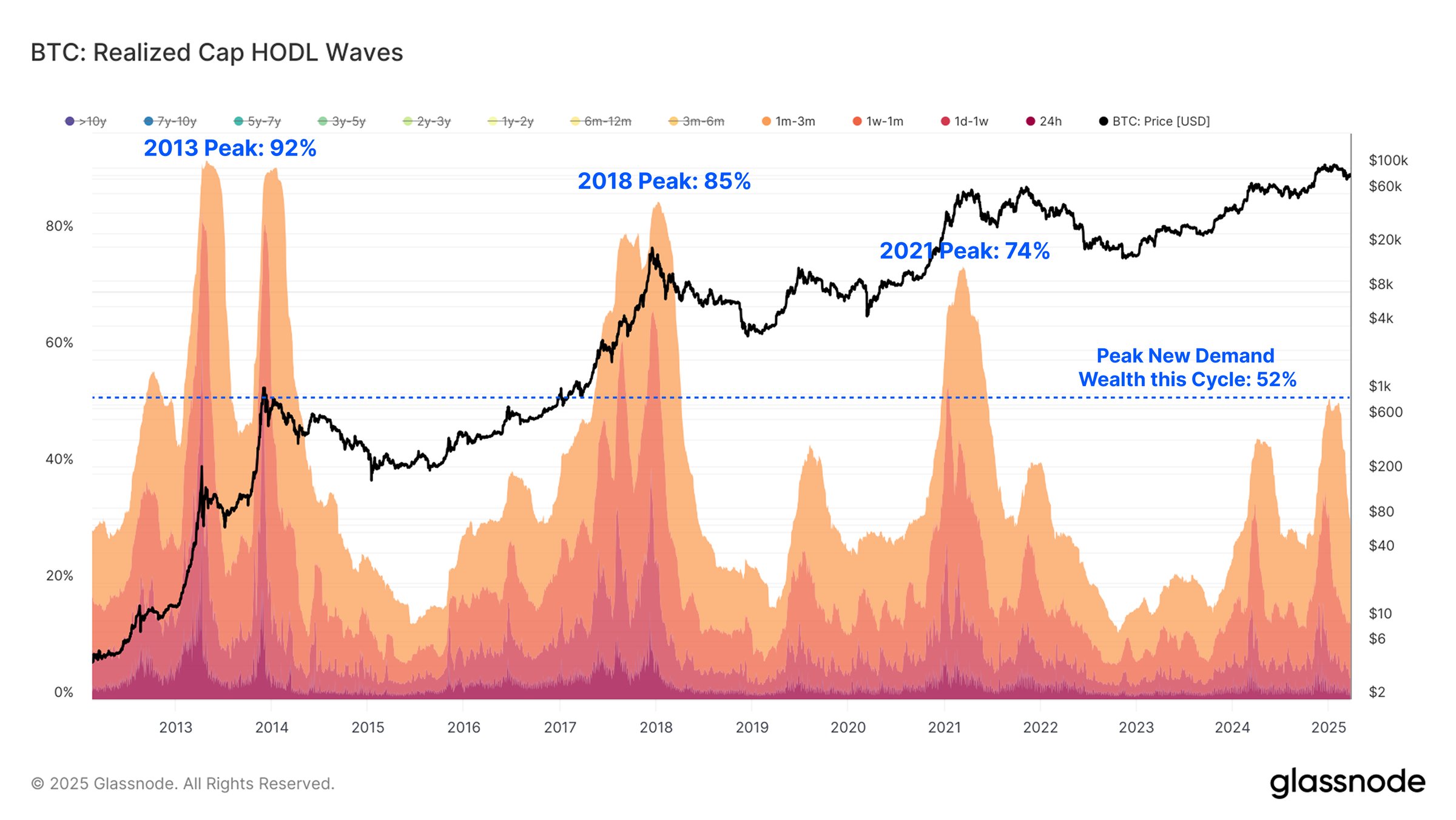

Short-term Bitcoin holders will decrease

An analysis by Crypto Metrics Firm GlassNode shows that only 40% of Bitcoin is holding short-term holders at 50% earlier this year, indicating a low future price rise.

(Currently, short-term holders hold about 40% of Bitcoin.

“This is well below the previous cycle top when new investors’ wealth peaked at 70-90%.

Market indicators and trends

Other important metrics draw complex pictures for the short-term outlook of Bitcoin.

- BTC’s advantage rose slightly to 62.42% (+0.38%)indicating that Bitcoin is held better than Altcoins.

- Open interest on futures was only immersed in $53.74 billion (-0.26%)suggests some cooling of leveraged trading.

- The liquidation totaled $8.19 million over the past day.and Shorts suffering from almost every loss ($8.15 million). This shows that bearish traders were caught off guard by Bitcoin’s resilience.

Bitcoin price outlook

While short-term price action remains volatile, the medium- to long-term foundation of Bitcoin appears to be driven by an increase in institutional adoption and a mature investor base. As long-term holders increase the grip of supply, volatility may gradually subside, allowing them to set the stage for more sustainable price growth in the coming months.