According to analysts at Glassnode, Bitcoin spot market conditions are showing early signs of improvement with increased trading volumes and reduced sell-side pressure.

Spot Bitcoin saw a “moderate” rally (BTC)’s trading volume “the net buy/sell imbalance exceeds the statistical upper limit,” Glassnode reported on Monday.

It added that this shows “clearly reducing pressure on the seller side”, but that spot demand nevertheless “remains fragile and uneven”.

As the market continues to digest the fallout from the recent escalation in the US/EU trade war, Bitcoin is down about 3% from its weekend high of $95,450, trading at around $92,550 at the time of writing.

The asset has risen 6% since the beginning of the year.

“Overall, Bitcoin continues to fall in value, but the internal situation is improving,” Glassnode said, adding that the market is gradually rebuilding itself.

“While defensiveness continues, stronger buy-side dynamics and renewed interest from institutional investors suggest a gradual restructuring towards a more constructive market structure.”

Bitcoin treated as a portfolio hedge

OKX Singapore CEO Gracie Lin told Cointelegraph on Tuesday that the report suggests the market has absorbed much of the profit-taking in the second half of 2025, easing pressure on the seller side.

“Long-term holders seem less inclined to sell on every rally, but ETF flows show that institutional investors continue to buy on rallies,” he said.

“New tariff headlines, weakening growth signals across the Asia-Pacific region, and a backdrop of record gold prices make Bitcoin more likely to be treated as a portfolio hedge rather than a short-term trade, even if volatility remains a feature of the asset.”

Related: Bitcoin futures OI rebounds 13% as analysts see cautious risk appetite returning

Network growth and declining liquidity portend an upswing

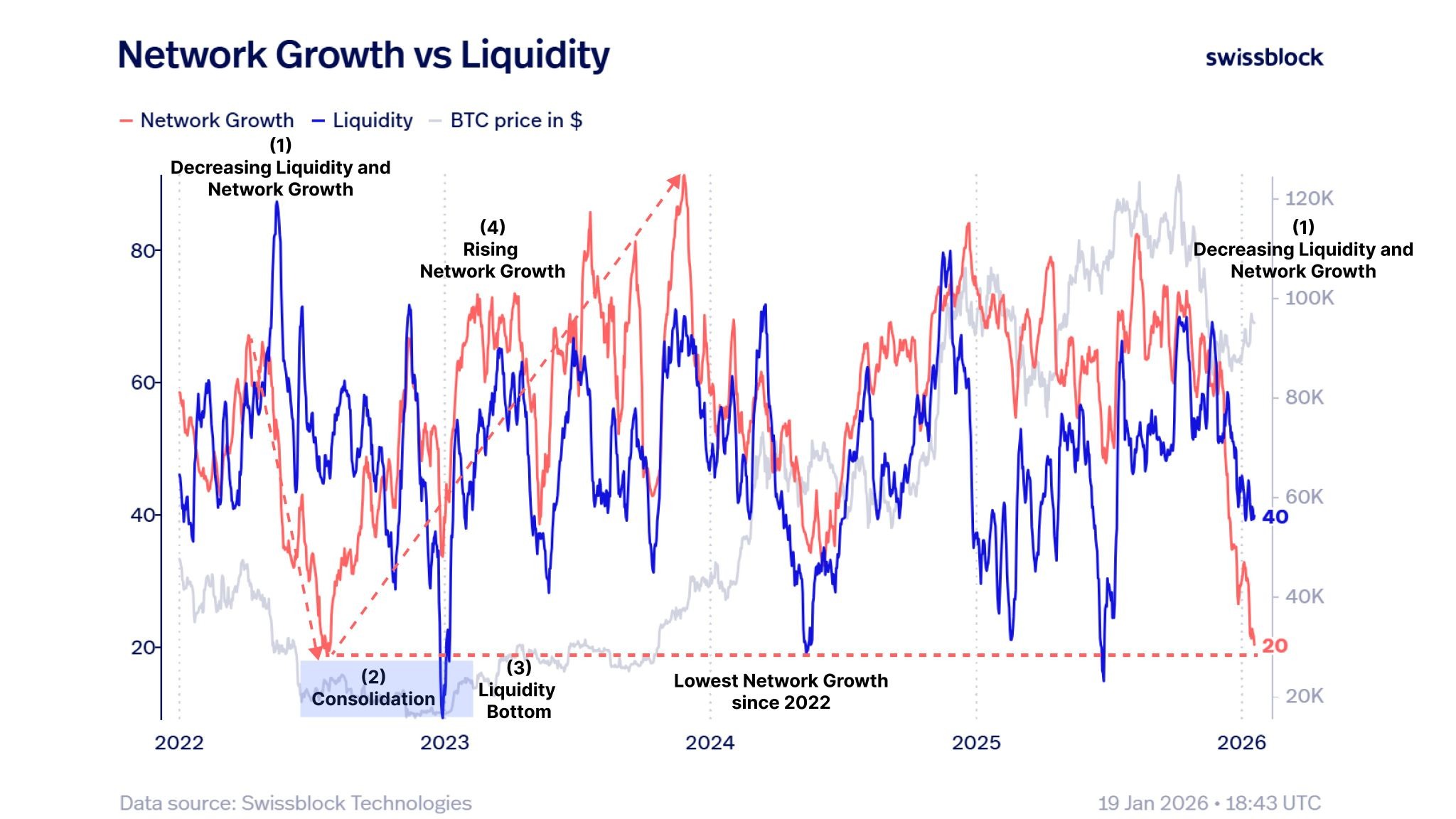

Analysts at Swissbloc said the slowing growth of the Bitcoin network and recent liquidity outflows are similar to the situation last seen in 2022.

A similar network level at the time was “ BTC “We are in a consolidation phase as network growth has started to recover, even though liquidity remains weak and has bottomed out,” they added.

“History shows that subsequent spikes in both indicators fueled massive bull markets,” Swissbrock said.

Network growth and liquidity will decline to 2022 levels. sauce: swiss block

magazine: Wintermute on cryptocurrency recovery, BTC Allocation reduction for quantum risk: Hodler’s digest