Bitcoin’s open interest in centralized exchange and CME has returned to election levels in November 2024, signaling market stabilization as BTC rebounds to $83,400 following its recent low of $76,600.

Bitcoin bounces back to $83,000 amid open interest, normalization of futures bases

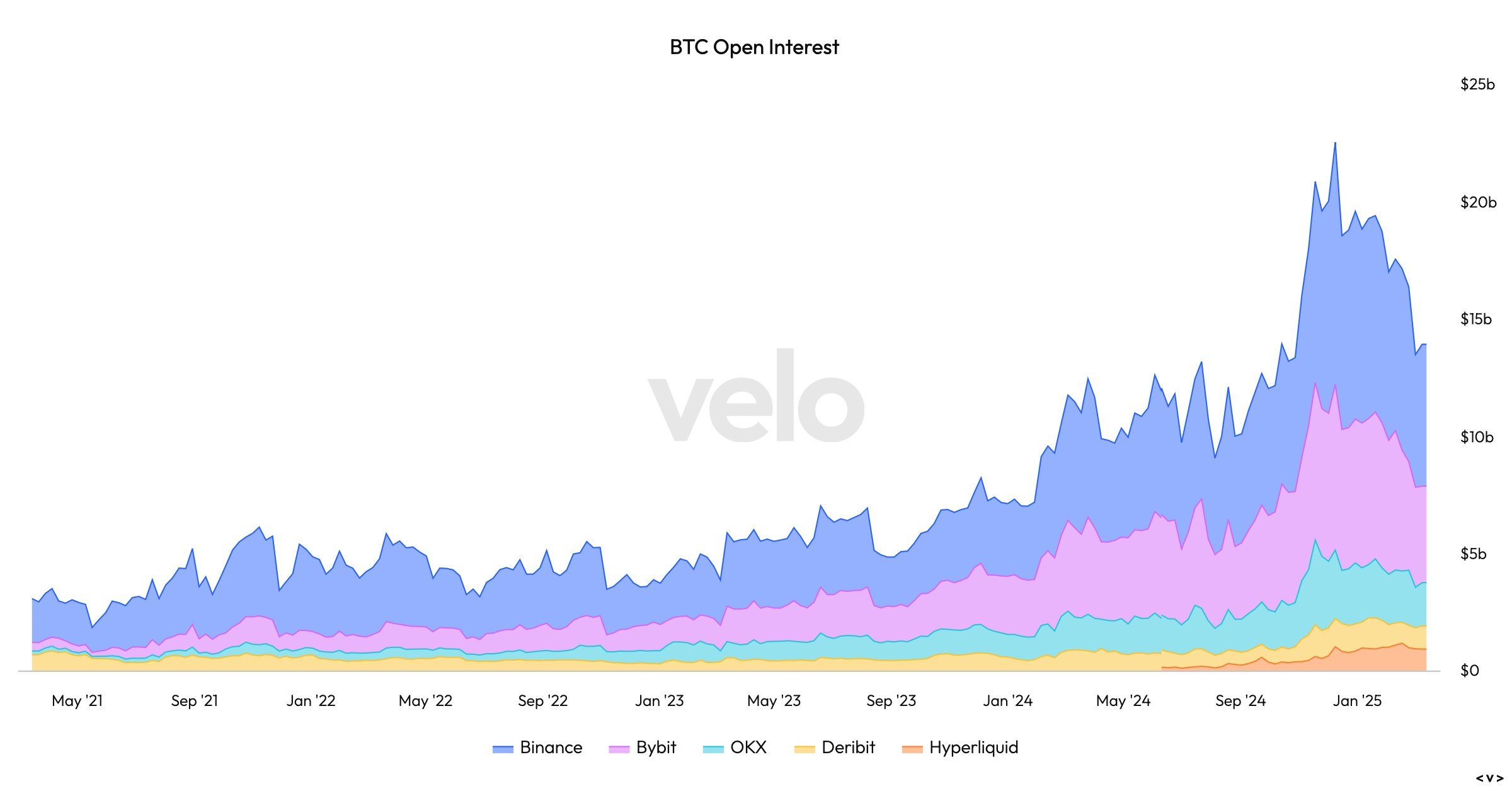

Recent data shows signs of stabilization as Bitcoin market activity returns to levels seen before the major 2024 events. Open Interest – Total of Unstable Futures Contracts – Centralized Exchange (CEXES) and Chicago Mercantile Exchange (CME) boosted this month, ALIGNumbers for the US presidential election before November 2024

Bitcoin Open Interest (OI) on March 14th, 2025 via velo.xyz.

Similarly, Bitcoin’s futures base (the gap between futures and spot prices) has been normalized to zero near the level of agreement observed in January 2024 before Spot Exchange Trade Funds (ETFs) approved by the US Securities and Exchange Commission (SEC).

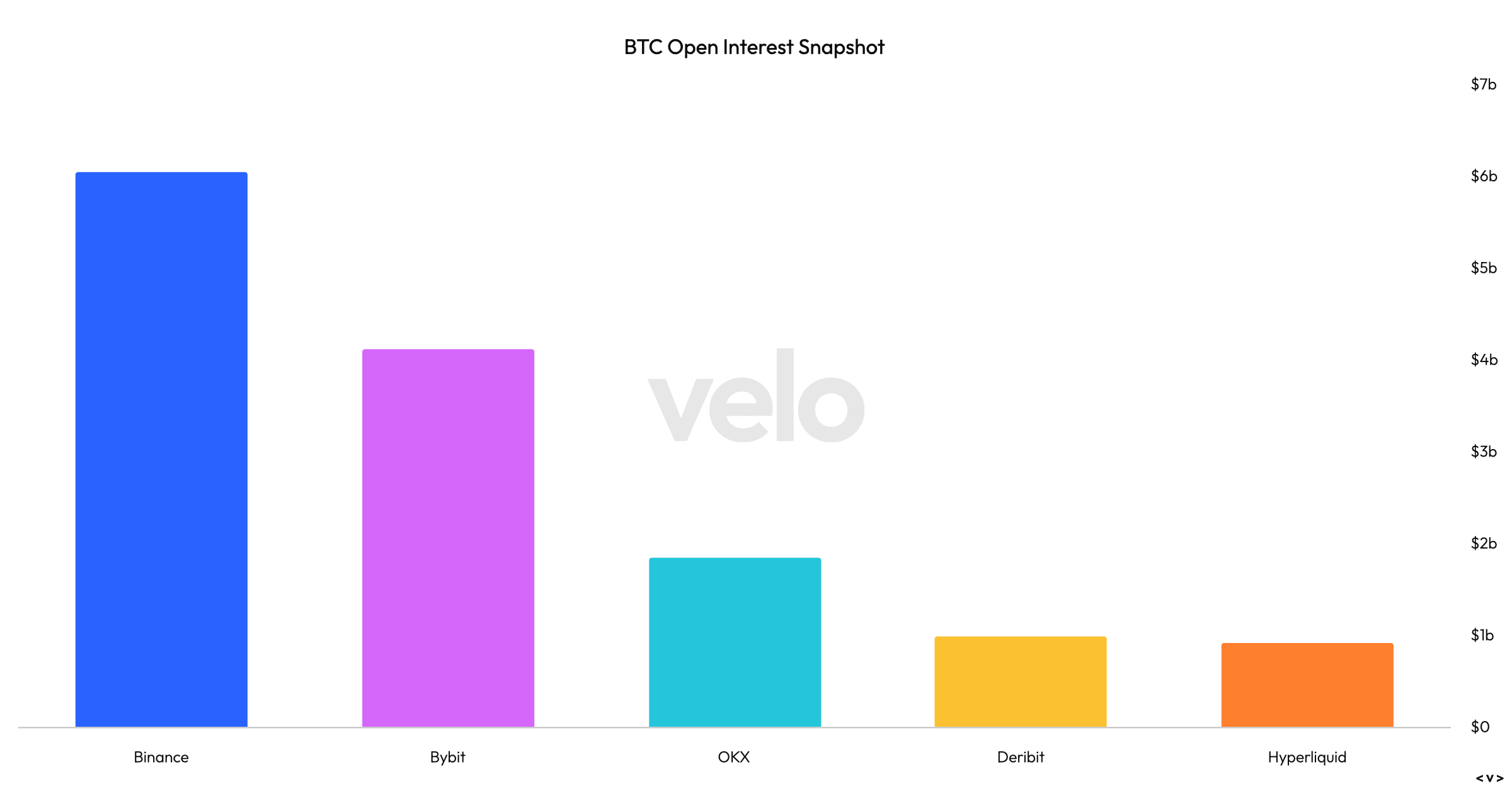

Bitcoin Open Interest (OI) snapshot on March 14th, 2025 via velo.xyz.

Before the ETF, the base hovered at about 0.556%, but reduced the reduction after approval as institutional inflows increased liquidity. The current foundation reflects the restored price efficiency between the spot market and the derivative market.

BTC/USD Spot Price via BitStamp on March 14th, 2024, via Bitcoinwisdom.io.

On March 14th, 2025, Bitcoin price recovery reached $83,400. It contrasts with the $76,600 drop last week, showing resilience despite recent volatility and Trump’s tariff threats. In particular, spot prices remain significantly higher than the $42,265 Pre-ETF level per Bitcoin, suggesting that a wider range of macroeconomic or regulatory factors will affect the valuation.

Altcoin’s open profit advantage has also declined from its peak, indicating a decline in speculative activity in non-Bitcoin assets. This can be attributed to BTC and ETH prioritization among the stabilization metrics. Market participants view open interest and normalisation of futures standards as positive indicators. A return to pre-event levels could reduce sudden price fluctuations and provide a more predictable environment for in-house and retailers.

The $83,400 BTC spot price ignores expectations set by normalized metrics, but experts cite ongoing macroeconomic trends as potential drivers, including inflation cooling and regulatory advances from the Trump administration. For now, the ability of Bitcoin to readjust after major events have shown their evolving maturity as an asset class. Primarily speculative forces have been removed from the market.