After hitting a new all-time high last Thursday, Bitcoin prices plummeted over $10,000 a week.

The new analysis suggests that sharp corrections are attributable to a key factor: slowing demand across the Bitcoin market.

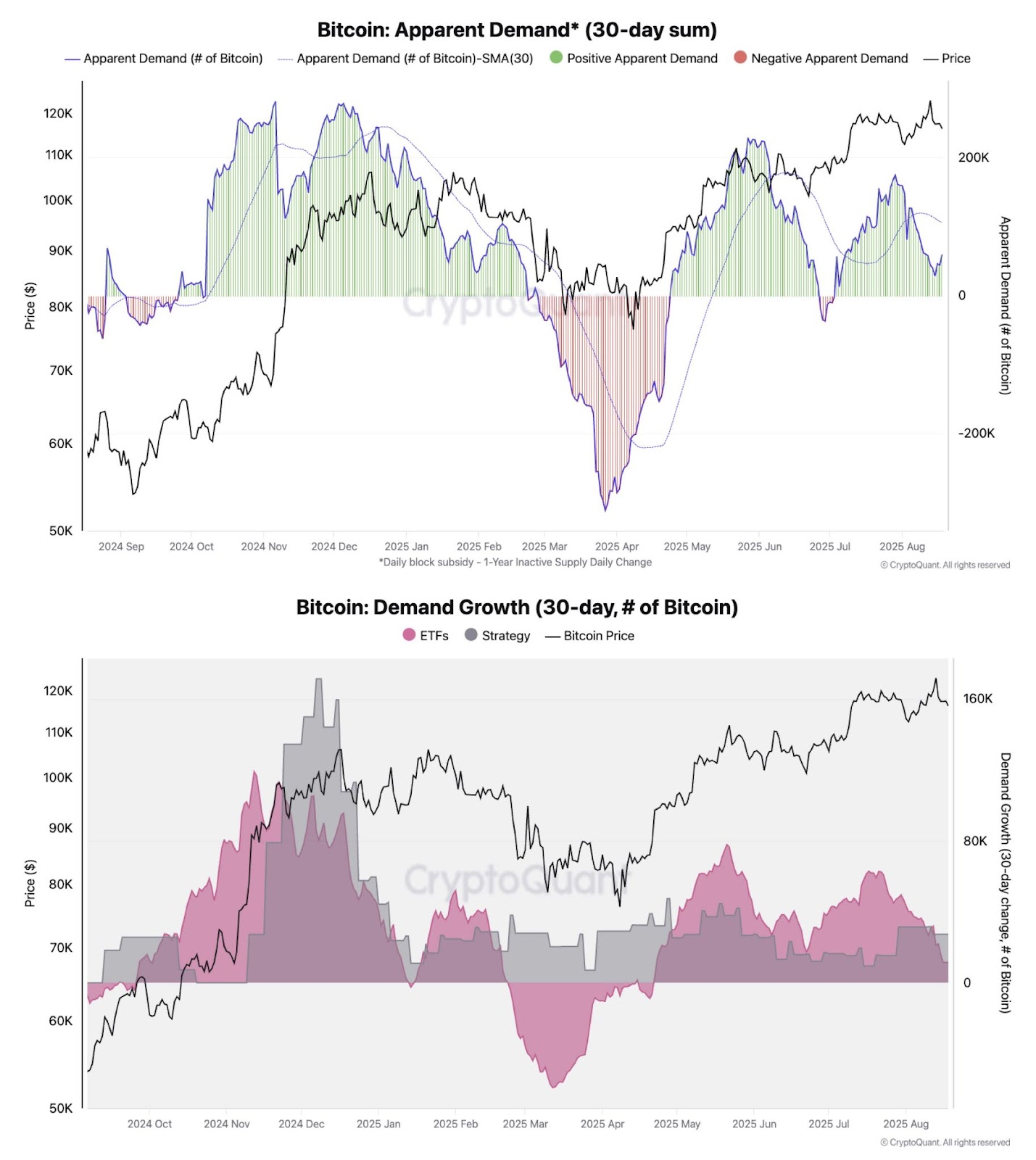

Bitcoin demand slows

Julio Moreno, head of research for on-chain platform Cryptoquant, shared the view in an X post Wednesday. He said, “The slowdown in overall demand growth for Bitcoin, including purchases from ETFs and strategies, is behind the suspension/fixing of current prices.”

Bitcoin prices were temporarily bottomed out when they flare up after US non-farm pay reports, where concerns about the recession were weak. On the same day, US Spot Bitcoin ETF saw a net leak of $812 million, according to SOSO Value Data.

US daily net inflow/outflow spot Bitcoin ETF. Source: SOSO value

However, since August 6th, when the price rally began, ETFs have recorded net inflows for seven consecutive days. This trend reversed last Thursday with the release of the producer price index in July, returning to net spills. The outflow was not that big, but Bitcoin prices fell sharply in comparison.

Moreno explained that on-chain demand metrics reflect this exact pattern. He argues that the revision is not due to sudden actions of a single entity, such as ETFs or microstrategies, but rather to a widespread decline in demand among most market participants.

For example, Cryptoquant Clear demand The metric showed a reading of 147.3703K on August 1st. This was a similar price level. However, on August 20th, the same metric was almost half way to 64.787k.

Bitcoin: Apparent Demand and Bitcoin: Growth of Demand. Source: Cryptoquant

Bitcoin prices have skyrocketed and have returned to their starting point over the past 15 days, but market demand has essentially dropped by half. This suggests that if market sentiment does not recover, Bitcoin could face further revisions.

The market may need macroeconomic catalysts to boost overall demand, including new expectations for Fed rate reductions. Market participants expect two rate cuts of 25 basis points this year at the FOMC meeting in September.

For comparison, last Thursday, when Bitcoin prices approached $124,000, the market was cut three times this year and 98% chances in September.

Bitcoin’s slump demand, which denounced a $10,000 plunge in the week that first appeared on Beincrypto.