South Korean cryptocurrency exchange Bithumb has reported that more than $200 million in customer assets are dormant across 2.6 million accounts, providing a glimpse of how much retail capital remains untouched on its centralized platform.

The disclosure was made as part of the exchange’s dormant asset recovery campaign targeting users who have not logged in or traded in over a year. Bithumb said its dormant assets totaled about 291.6 billion Korean won (about $201.8 million), with some balances remaining unused for more than 10 years.

Bissammu said the largest dormant holding it has identified is worth about $2.84 million. Meanwhile, the longest period of inactivity was 4,380 days, or almost 12 years.

The numbers highlight a phenomenon in crypto adoption, where millions of retail users entered the market during early bull cycles, but then shifted their focus and left their assets behind.

Related: Perp DEX trading volume will nearly triple in 2025 as on-chain derivatives mature

Bithumb said some inactive assets posted gains of 61,000%

According to Bithumb, some of the inactive assets had already returned 61,000%, or more than 610 times their original assets. This reflects holdings acquired during the early cycles of the cryptocurrency.

This means that some of the unclaimed cryptocurrencies on exchanges have outperformed Bitcoin (BTC) in 12-year gains.

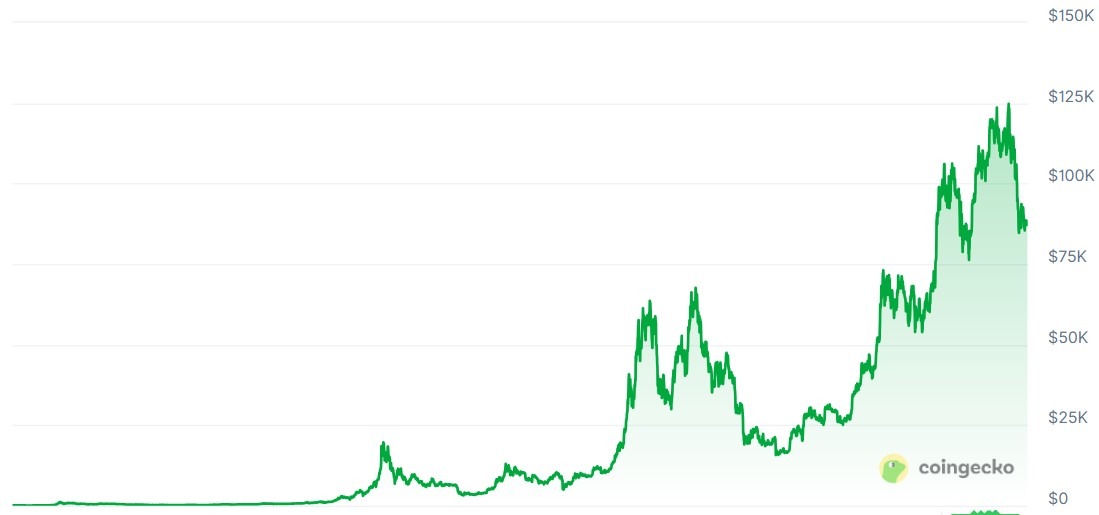

Almost 12 years ago, on January 1, 2014, BTC was trading at around $767, according to data from CoinGecko. As of this writing, BTC is trading at $87,726, an increase of approximately 11,338%, or 114x.

Bitcoin historical price chart. sauce: CoinGecko

The exchange has undertaken similar recovery efforts in the past few years. The exchange announced that 36,000 users claimed about $50 million worth of dormant assets during its 11th anniversary campaign last year.

The exchange said the campaign is part of its broader customer protection efforts and aims to help users rediscover and recover assets they didn’t know they had. The exchange plans to directly notify affected customers and provide assistance with account recovery.

This disclosure has far-reaching implications for the field beyond the individual. Dormant balances represent unrealized liquidity and potential supply that may re-enter the market.

Questions also arise about how crypto exchanges communicate with inactive customers and protect long-forgotten funds.

magazine: South Koreans ‘pump’ alternatives after Upbit hack, China BTC mining surges: Asia Express