Bitnomial Clearinghouse LLC has received approval from the U.S. Commodity Futures Trading Commission (CFTC) to clear fully collateralized swaps, allowing parent company Bitnomial to launch prediction markets and provide clearing services to other platforms.

According to Friday’s announcement, Bitnomial’s prediction market will cover cryptocurrencies and economic events in addition to existing Bitcoin (BTC) and crypto derivatives products. The contract is designed to allow traders to take positions based on outcomes such as the token’s price level and macroeconomic data.

This approval expands the range of trading products offered by Bitnomial. The Chicago-based company’s exchange and clearing division offers perpetual contracts, futures contracts, options contracts and leveraged spot trading. The company’s clearinghouse also supports crypto-based margining and settlement, allowing approved products to be margined and settled directly with digital assets.

Bitnomial President Michael Dunn said the approval will allow the company to “build a clearing network that serves both our own exchanges and external partners, strengthening the entire prediction market ecosystem.”

Bitnomial Clearinghouse operates as an infrastructure-only clearing provider, not a retail competitor, providing approved partners with access to margin and payment systems and allowing collateral to be exchanged between USD and cryptocurrencies.

This approval follows the recent green light to launch a CFTC-regulated spot crypto trading platform in the United States, allowing customers to buy, sell, and trade leveraged and unleveraged crypto products on federally supervised exchanges.

Event contracts at Polymarket. sauce: Polymarket

Related: Coinbase May Debut Prediction Market, Tokenized Stocks on Wednesday: Report

Polymarket gains momentum in the US

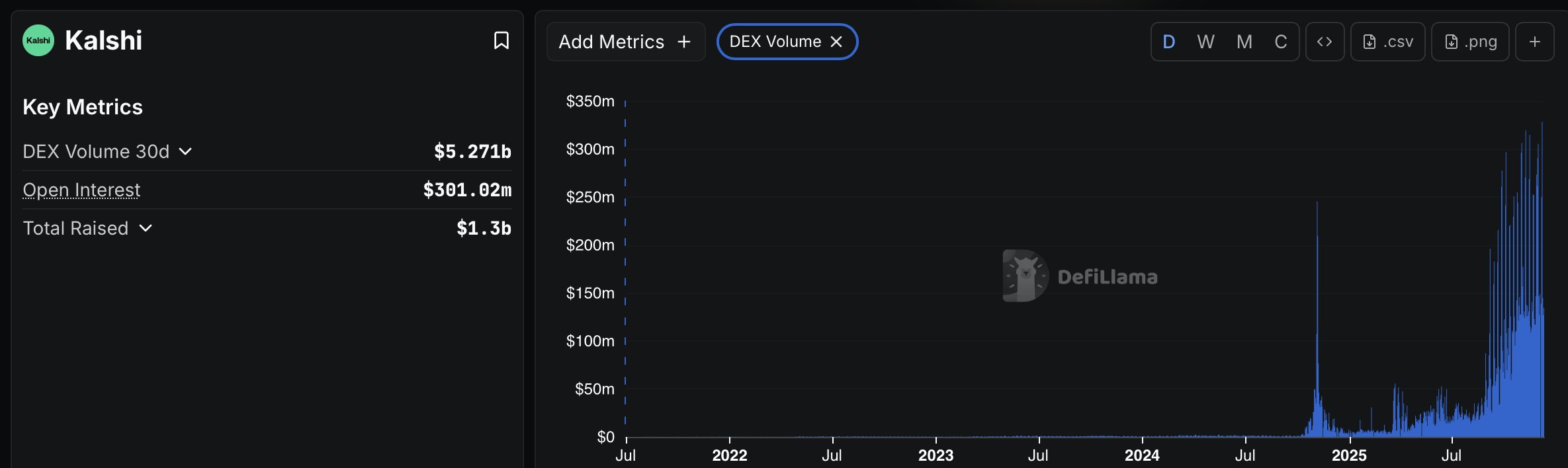

Prediction markets are emerging as a big trend in 2025. Prediction market Kalshi generated $5.27 billion in trading volume in the past 30 days, while blockchain-based Polymarket recorded just under $2 billion in the same period, according to data from DefiLlama.

Carsi trading volume. sauce: Defilama

In November, Polymarket received regulatory approval from the CFTC to operate a brokered trading platform, allowing access through registered brokers under rules governing U.S. markets.

The approval follows the conclusion in July of a CFTC- and U.S. Department of Justice-led investigation into whether Polymarket allowed transactions from U.S. users, which included an FBI raid on founder Shane Coplan’s home.

Polymarket, which uses the USDC (USDC) stablecoin to settle contracts on the Polygon blockchain, has also secured several partnerships in recent months, including with the UFC and Zuffa boxing and fantasy sports operator PricePicks, which took place in November.

magazine: Introducing on-chain crypto detectives who fight crime better than the police