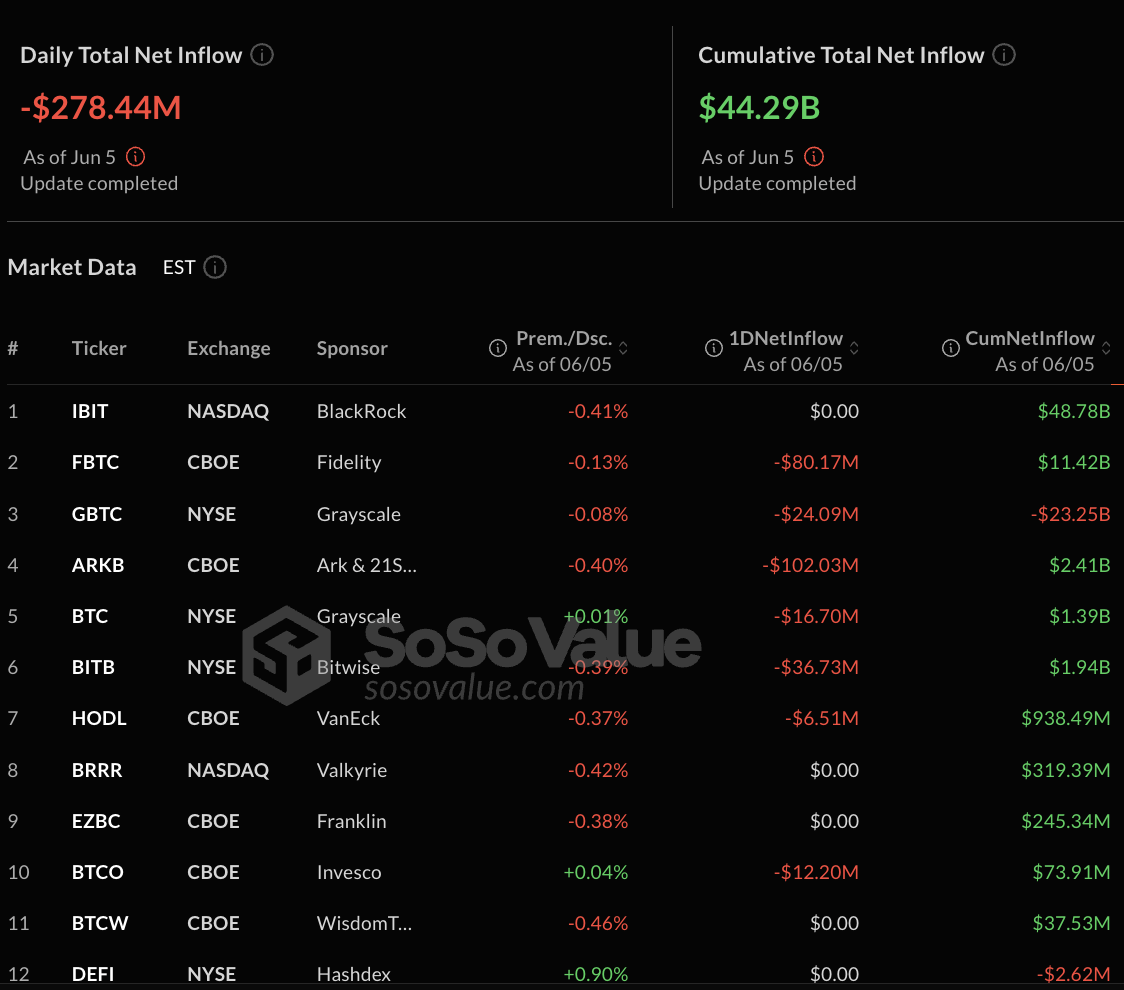

Something unusual has just happened in the Bitcoin ETF space, and it’s not the way you can expect it. As seen in the Sosovalue Chart, BlackRock, the main attraction of Bitcoin ETF flows, recorded accurate zero dollars on June 5 with IBIT net inflows.

That’s not a typo. There’s no money or money. And the silence is greater than it appears.

Meanwhile, the rest of the market was still not at all. In fact, the total net outflow across all US Bitcoin spot ETFs reached a whopping $278.44 million, making it one of the worst days for ETF flows in recent memory.

Big names like Ark’s Arkb saw a brutal $102 million jump, and Fidelity’s FBTC wasn’t gone to $80 million. Even Grayscale’s GBTC continued its familiar red pattern, dropping another $24 million that day.

This came when Bitcoin itself was sliding down the charts. Binance’s BTC/USDT price was under $101,000, which spent most of June 5th in the grind, before bouncing slightly to the next session.

It felt like a day when sentiment quietly disappeared from the room. The reason was pretty loud, but that’s the topic of another article.

What makes this moment particularly strange is that IBIT is the gold standard for stable influx and is almost immune to the immunity of market noise. A flat day may not sound dramatic, but it suggests something being brewed on the scene when BlackRock sits it and when everyone else is pulling cash.

Whether this is just a breather or the beginning of a bigger pullback, one thing is clear.