Tomorrow is Thanksgiving, so Crypto Daybook Americas will not be published. I’ll be back on Friday.

Written by Omkar Godbole (all times Eastern Time unless otherwise noted)

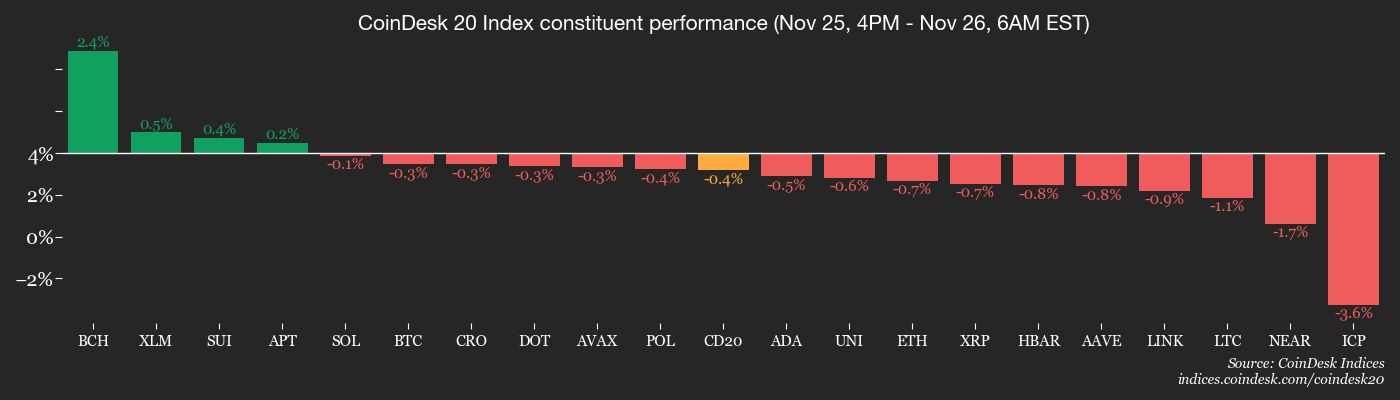

The cryptocurrency market has been in a “sleepy” state for the past 24 hours. Bitcoin BTC$87,830.49 The CoinDesk 20 Index (C20) barely moved as it bounced aimlessly between $86,000 and $88,000. Meanwhile, the CoinDesk 80 Index posted a modest 1% gain, indicating strength in the broader altcoin market.

If you zoom out, the photo looks even more lackluster. Bitcoin is down 7% since the beginning of the year, while the 10-year US Treasury note, the less exciting bond, is up 2.5%.

What this means is that it would have been smarter to park your cash in boring old bonds this year. And that’s despite massive BTC purchases by the Digital Asset Treasury. Sorry, maximalists.

From a macro perspective, the outperformance of the durable safe-haven 10-year bond is a wake-up call for other risky assets, including stocks. This is directly related to the theme we discussed last week. Institutional outflows from Spot Bitcoin ETFs could lead to smoke ahead of expected macro firestorm.

To be sure, the scenario could change towards the end of the year, especially if the Fed sends out an overtly dovish message with an expected 25 basis point rate cut early next month, pushing the dollar index (DXY) lower. But for now, the index is undeterred by dovish Fed expectations and is trying to establish a foothold above its 200-day simple moving average (SMA).

The flow of options does not have a clear direction.

Earlier this week, there was a spike in hedging activity around the $80,000 Bitcoin input, followed by heavy block trades that hinted at a possible reboot of the range above $100,000 by the end of the year. A massive $220,000 call buy on Tuesday initially looked bullish, but was combined with a $40,000 call buy, suggesting traders’ real bet was on volatility fireworks, Greek.Live told CoinDesk.

All of this points to a difficult trading environment in the short term.

That being said, there is one piece of bright news that has gone largely unnoticed. New U.S. banking rules ease capital requirements for low-risk assets such as U.S. Treasuries. The capital cuts are expected to help banks maintain liquidity, increase lending and potentially increase dealers’ ability to intervene in the government bond market in times of stress.

James Thorne, chief market strategist at Wellington Altus Private Wealth, said the move was a clear sign that “deregulation is on the way.” Be alert!

More information: For an analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today.

what to see

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- cryptography

- The Bitwise Dogecoin ETF (BWOW) is scheduled to begin trading on the NYSE Arca.

- CTC-1, the first constellation of satellites to run the SpaceCoin (SPACE) protocol, will launch from Vandenberg Space Force Base in California.

- macro

- 7.30am: UK Chancellor of the Exchequer Rachel Reeves introduces the 2025 Budget in the House of Commons, setting out tax and spending plans for the UK tax year 2026-2027. Watch it live.

- 8:30 a.m.: U.S. September durable goods orders month-over-month forecast. 0.3%.

- 8:30 a.m.: Number of new unemployment insurance claims in the United States for the week ending November 22 (estimated) The number of unemployment insurance claims for the week ending November 15 was 225,000 (1,974,000 the previous week).

- Revenue (estimated based on FactSet data)

token event

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- Nomina (NOM) will host a trader call at 10:30 a.m. on cross-DEX opportunities and PERPS market outlook.

- unlock

- Activate token

- Bitrue’s Minswap (MIN) list is the MIN/USDT pair.

conference

For a more comprehensive list of this week’s events, see CoinDesk’s “Crypto Week Ahead.”

- Day 2 of 3: Financial Moguls London Summit 2025

- November 26: Digital Securities and Digital Cash Summit Frankfurt

- Day 1 of 3: Excellence in Digital Banking International Summit 2025 (Amsterdam)

market movements

- BTC fell 0.28% to $86,779.61 on Tuesday at 4:00 PM ET (24h: -0.48%%).

- ETH fell 0.91% to $2,903.77 (24h: +0.81%)

- CoinDesk 20 fell 0.31% to 2,857.32 (24h: -0.17%)

- Ether CESR comprehensive staking interest rate increases by 2bps to 2.86%

- BTC funding rate is 0.0069% (7.5303% p.a.) on Binance.

- DXY rose 0.14% to 99.81

- Gold futures rose 0.41% to $4,194.40.

- Silver futures rose 2.15% to $52.74.

- The Nikkei 225 rose 1.85% to close at 49,559.07.

- The Hang Seng rose 0.13% to close at 25,928.08.

- FTSE rose 0.21% to 9,629.60.

- The Euro Stoxx 50 rose 0.58% to 5,606.20.

- The DJIA rose 1.43% to close at 47,112.45 on Tuesday.

- The S&P 500 rose 0.91% to close at 6,765.88.

- The Nasdaq Composite Index rose 0.67% to end at 23,025.59.

- The S&P/TSX Composite Index rose 0.97% to end at 30,900.65.

- The S&P 40 Latin America Index rose 1.32% to end at 3,094.79.

- US 10-year government bond interest rate rose 0.6bps to 4.008%

- E-mini S&P 500 futures rose 0.33% to 6,803.75

- E-mini Nasdaq 100 futures rose 0.46% to 25,201.00.

- The E-mini Dow Jones Industrial Average index rose 0.19% to 47,268.00.

bitcoin statistics

- BTC Dominance: 58.61 (+0.19%)

- Ether/Bitcoin ratio: 0.0335 (-1.12%)

- Hashrate (7-day moving average): 1,040 EH/s

- Hash Price (Spot): $36.10

- Total fees: 3.14 BTC / $274,424

- CME futures open interest: 131,460 BTC

- BTC Gold Price: 20.9oz

- BTC vs. Gold Market Cap: 5.83%

technical analysis

Daily chart of the dollar index, including the 200-day simple moving average (SMA). (Trading View)

- This chart shows the daily price movement of the dollar index and its 200-day simple moving average (SMA) line.

- Despite a series of weak US economic indicators, including ADP payrolls, and a sharp increase in the probability of a December Fed rate cut, DXY is trying to gain a foothold above the 200-day SMA.

- This is a classic bullish scenario. Markets that ignore bad news often signal that a big rally is on the horizon.

crypto assets

- Coinbase Global (COIN): Tuesday close at $254.12 (-0.72%), unchanged from pre-market.

- Circle Internet (CRCL): $70.11 (-3.62%), +0.67% to end at $70.58

- Galaxy Digital (GLXY): $25.48 (+2.82%), +0.82% to end at $25.69

- Bullish (BLSH): $40.5 (-2.41%), +0.49% to close at $40.70

- MARA Holdings (MARA): Ended unchanged pre-market at $11.17 (-0.36%)

- Riot Platform (RIOT): unchanged pre-market, closing at $14.39 (+3.67%)

- Core Scientific (CORZ): Closed at $15.55 (-1.27%)

- CleanSpark (CLSK): $11.82 (+2.96%), -1.86% to close at $11.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): Ended at $43.65 (+1.23%)

- Exodus Movement (EXOD): Closed at $14.65 (-3.49%)

crypto asset company

- Strategy (MSTR): Closed at $172.19 (-3.83%), -0.57% at $171.21

- Semler Scientific (SMLR): Ended at $20.32 (-2.66%)

- SharpLink Gaming (SBET): Closed at $9.93 (-1.49%), -0.1% at $9.92

- Upexi (UPXI): Ended at $2.99 (+6.41%)

- Lite Strategy (LITS): Closed at $1.84 (+0.55%)

ETF flow

Spot BTC ETF

- Daily net flow: $128.7 million

- Cumulative net flow: $57.59 billion

- Total BTC holdings ~1.31 million

Spot ETH ETF

- Daily net flow: $78.6 million

- Cumulative net flow: $12.83 billion

- Total ETH holdings ~6.2 million

Source: Farside Investors

while you were sleeping

- Key Bitcoin price points for traders to track now (CoinDesk): Traders are focusing on key price levels near $88,000 and $102,000 as indicators of trend reversal, but a decline below $83,000 could confirm further downside risk for Bitcoin.

- Bitcoin plunges in 2026, surges in 2028: JPMorgan’s IBIT-linked structured notes fit into halving cycles (CoinDesk): The bank’s new investment product ties potential payouts to Bitcoin’s four-year cycle, offering capped protection if BTC declines in 2026 and amplifying profits if it rises by 2028.

- Traders are flooding the market with risky bets. Robinhood’s CEO is their cult hero. (Wall Street Journal): By prioritizing high-risk, high-return products like options, cryptocurrencies and prediction markets, the company has regained momentum and helped turn co-founder Vlad Tenev into a retail trading icon.