Bitcoin prices currently sit at a critical level that could shape the market direction in the coming weeks. Buyers and sellers are trapped in a tough battle, and the market appears to be at the edge of a potential breakdown.

Technical aspects of BTC prices

By Shayan

Daily Charts

On the daily charts, Bitcoin has recently slipped under the big upward channel that has been driving uptrends over the past few months. The inability to exceed $120K is a bearish signal, and with the risk of a $110,000 support and a 100-day moving average currently breaking, the market could drop sharply towards the $100K zone, where the 200-day moving average also exists.

The RSI holds below 50, further confirming bearish momentum and strengthening cases of ongoing shortcomings. At this stage, only a strong wave of purchasing pressure could prevent deeper decline and stabilize the market.

4-hour chart

The four-hour chart shows a clear false breakout and rejection over $1.16 million resistance, indicating that even low-interest rate forecasts are not enough to trigger new rally. This is a sign of bearishness. This is because markets are often not actively responding to good news, which suggests fundamental weakness.

Currently, the $111,000 support has collapsed, paving the way for a quick decline to the key $100K zone. Previous accumulations between $105,000 and $110,000 could generate interest and temporary support for purchases, but the overall market structure shows that there is a higher probability of further downsides.

On-Chain Analysis

Minor Reserve (30-day moving average)

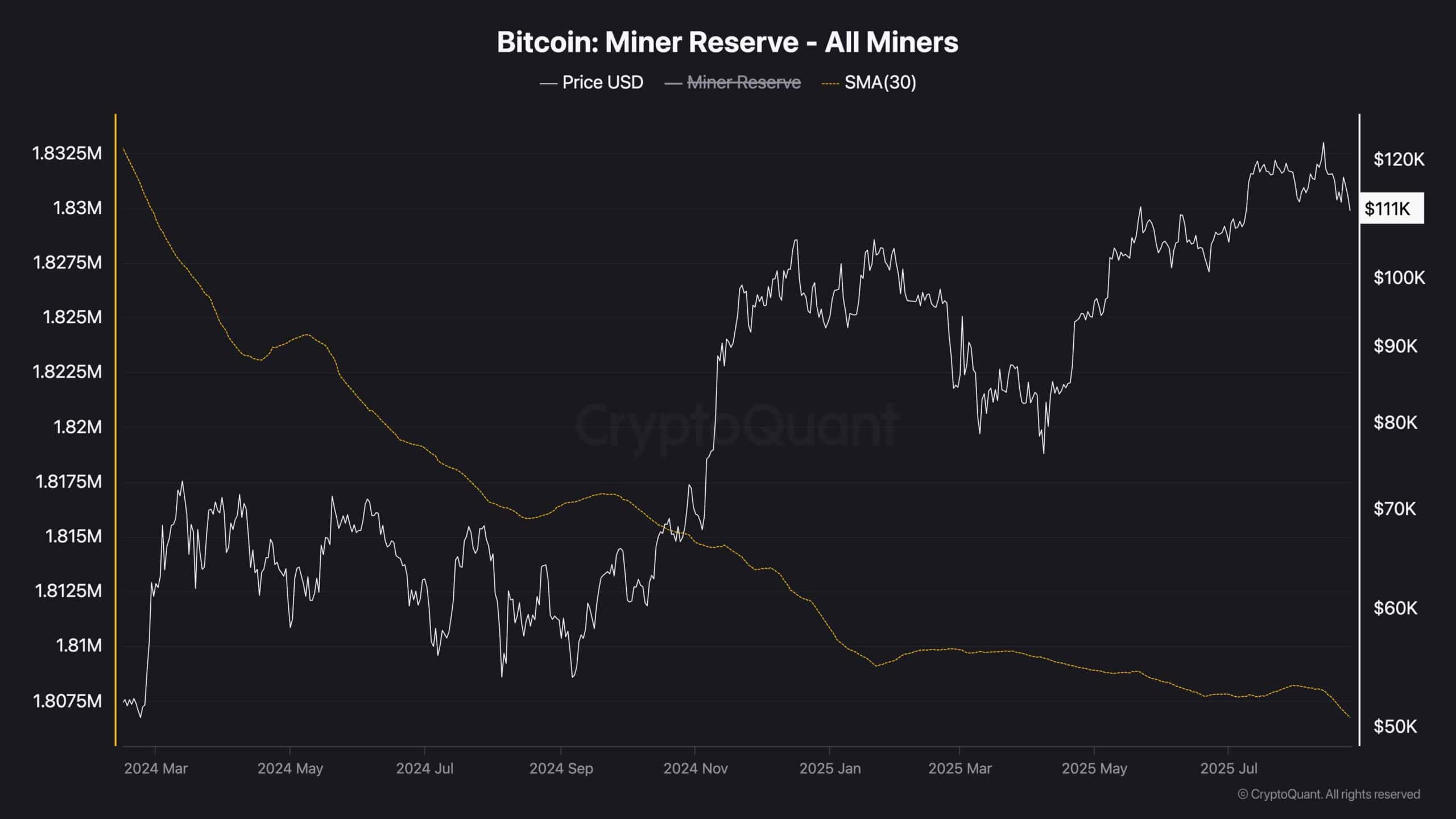

Bitcoin Miners have consistently sold their holdings over the past few years, primarily to cover operational costs. This stable outflow adds extra sales pressure to the market and allows you to weigh price performance.

Recently, the decline in miner reserves has accelerated, indicating an increase in sales activity. This supply surge could be one of the factors contributing to the recent recession following Bitcoin’s new all-time high altitude a few weeks ago. If this trend continues and demand cannot absorb additional supply, the market may face deeper lower pressures.