Today’s Bitcoin price is trading around $107,400 after steadily rising from its recent low of nearly $99,500. The Bulls have regained important ground by over $106,000, but a strong zone of resistance, just below $109,000, is beginning to put pressure on current rally. As momentum slows down and price action is compressed, traders are looking to breakouts or pullbacks in the next 24 hours.

What will happen to Bitcoin prices?

BTCUSD Price Dynamics (Source: TradingView)

Bitcoin rebounded sharply from the $99,500 zone, surpassing the resistance of local trendlines and recovering support beyond the $104,000-105,000 range. The daily structure remains bullish, with BTC returning within the rising channel, currently testing the centerline at nearly $107,000. The price is close to pivot resistance at $109,870, with the R4 zone at $114,956, both matching previous rejection points.

BTCUSD Price Dynamics (Source: TradingView)

However, the daily supply zone between $108,000 and $110,000 continues to go even further upside down. The current candle formation suggests indecisiveness, and if this area cannot be broken and closed, another integrated leg could be set. In the higher time frame, the Bulls still control macro trends, but volume is important to see continuance from $114,000 to $125,000 levels.

Why is Bitcoin prices rising today?

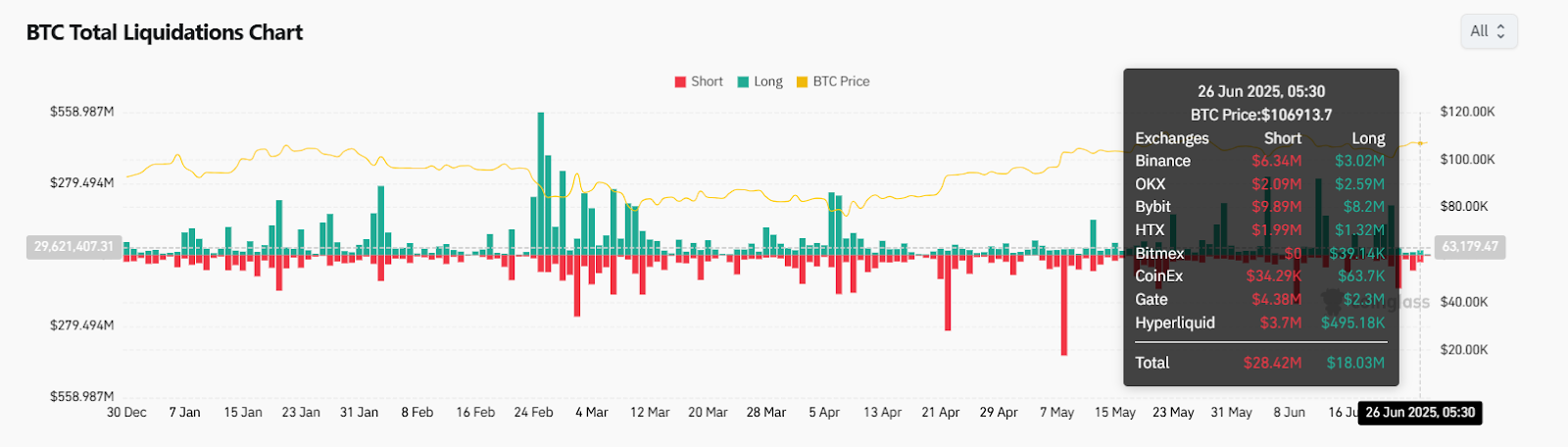

Push Hight is supported by key structural recovery and liquidation data. The four-hour chart confirms that Bitcoin’s price action exceeds $105,000, leading to a short liquidation spike found in the liquidation heat map. The liquidation heatmap closed over $28.42 million in shorts across the exchange on June 26th at $18.03 million.

BTCUSD Price Dynamics (Source: TradingView)

On the 30-minute chart, the RSI stands at 52.22, with the MACD histogram recovering to the positive region, indicating a mild bullish bias.

BTCUSD Price Dynamics (Source: TradingView)

VWAP and parabolic SARs in this time frame are also below current prices, suggesting that the Bulls are still maintaining short-term momentum. However, the RSI is beginning to flatten, but the MACD line is still under the signal line. It suggests a decrease in strength towards resistance.

When the Bulls hit the ceiling, the bitcoin signal indicates divergence

BTCUSD Price Dynamics (Source: TradingView)

In the 4-hour view, the volatility of Bitcoin’s price is compressed under the upper bollinger band, which is close to $108,672. The spread of the candle tightens when it is located between EMAs, priced at 20-200. Both are actively stacked, but now they are showing convergence.

BTCUSD Price Dynamics (Source: TradingView)

The supertrend remains green above $104,448, reinforces bullish structures, while DMI shows a decline in ADX (15.24) and stenosis +Di/-DI, indicating signaling that weakens momentum.

Support remains well established at $103,996, with low liquidity clusters nearly $99,515, providing stronger support if deeper pullbacks emerge. Bitcoin will need to exceed $104,800 in the next 24 hours to keep the Bulls in control.

BTC price forecast: Short-term outlook (24 hours)

BTCUSD Price Dynamics (Source: TradingView)

If Bitcoin’s price is tightly closed at $107,600 and can push over $108,800 with confirmed volumes, the next upside target will be close to $109,870, followed by $114,950. However, if you fail to clear the $108,600-109,000 resistance zone, you will be pulled back to $105,300 and then you could return to the $103,900 support area.

On the downside, a break below $103,500 puts pressure on the $99,500 base. In lower time frames showing early signs of distribution and early signs of mixed RSI/MACD signals, Bitcoin may fall into the short-term range unless the breakout resolves neatly.

Bitcoin Price Prediction Table: June 28, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.