Key takeout

- BTC continues to trade more than $105,000 despite the ongoing Middle East crisis.

- Traders are focused on the outcomes of today’s FOMC meetings and may move through the market.

The cryptocurrency market has been bearish since the Israeli and Iran crisis began. However, Bitcoin and other major cryptocurrencies have not recorded significant losses as many have expected.

Bitcoin, the leading cryptocurrency by market capitalization, has lost 1.4% of its value in the last 24 hours and is trading in a $105,000 region. Over the past seven days, BTC has lost only 4% of its value. This is an impressive feat considering the scale of the conflict affecting Bitcoin’s past performance.

The holding of $105,000 indicates that investors remain bullish despite current market conditions. Despite the continued fluctuating prices of BTC, I will manage it safely Bitcoin wallet It is the key to robust protection of your digital assets.

Traders turn their attention to today’s FOMC meeting

The Israeli-Iran conflict continues to take the central stage, but today’s main headline is the FOMC conference. The US Federal Reserve discusses the future pathways of interest rates and the impact of tariffs and Middle Eastern turmoil on the economy.

Analysts expect that I’ve tried not to change the interest ratehowever, other important signals may move through the market. Investors were looking to see if the Fed would stick to previous forecasts for two interest rate cuts this year. If so, expect Bitcoin prices to go up in the short term.

Commenting on this, Aditya Bhave, economist at Bank of America, said.

“The Fed’s main message at the June meeting is to stay comfortable in standby mode. Investors need to focus on Powell’s soft labor data, recent benign inflation prints, and the risks of sustained tariff-driven inflation.”

BTC could raise up to $108,000 amid in institutional demand

Bitcoin prices were able to hold the $105,000 level due to growing demand for institutions. So far, Metaplanet and Strategy have added thousands of Bitcoins to their Treasury Department. Additionally, the US spot Bitcoin ETF recorded an inflow of $486 million on Monday, showing strong demand among financial institutions.

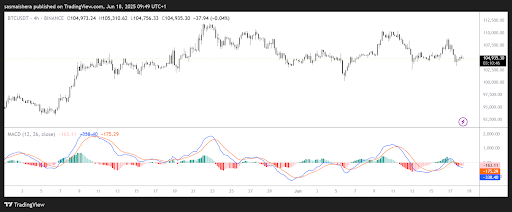

After retesting key support at $103,430 on Tuesday, the 50-day index moving average (EMA) was retained, allowing Bitcoin to gather towards the $108,000 level in the short term.

The Relative Strength Index (RSI) momentum indicator for the daily chart hover around 50 neutral levels, indicating indecisiveness among traders. Meanwhile, the moving average convergence divergence (MACD) indicator is still within bearish territory, but could crossover if the Bulls hold their position.

Once Bitcoin recovers its FVG level at $108,064, it could retry $111,000, the highest ever price in the coming days.