At the time of press, Bitcoin price was $112,999, up from last week’s $110,500. While BTC defends channel support, the stock market is regaining trust, so rebounds occur. Traders are monitoring whether inflow and macro correlation can bring prices back to $115,000.

Bitcoin defends support for Bullmarket

BTC price dynamics (Source: TradingView)

Daily charts show that BTC is at the bottom edge of the Rising Channel, with a bloom market band of around $107,800-$108,000 offering additional support. This level has stopped repeated declines and continues to maintain the overall uptrend.

Currently, resistance is $113,200-113,500, with 50-day EMA crossing the recent level of rejection. A break above this zone will ensure momentum is $115,000 and potentially $117,500. If it falls below $110,500, the downside risk is $107,500 and the 200-day EMA approaches $104,400.

EMA adjustments still support buyers, but momentum remains fragile. Prices have been narrowed down to $112,280 during the 20-day EMA and $104,372 for the 200-day base, starting a vital battle in the coming days.

On-chain flow signal accumulation

BTC On-Chain Activity (Source: Coinglass)

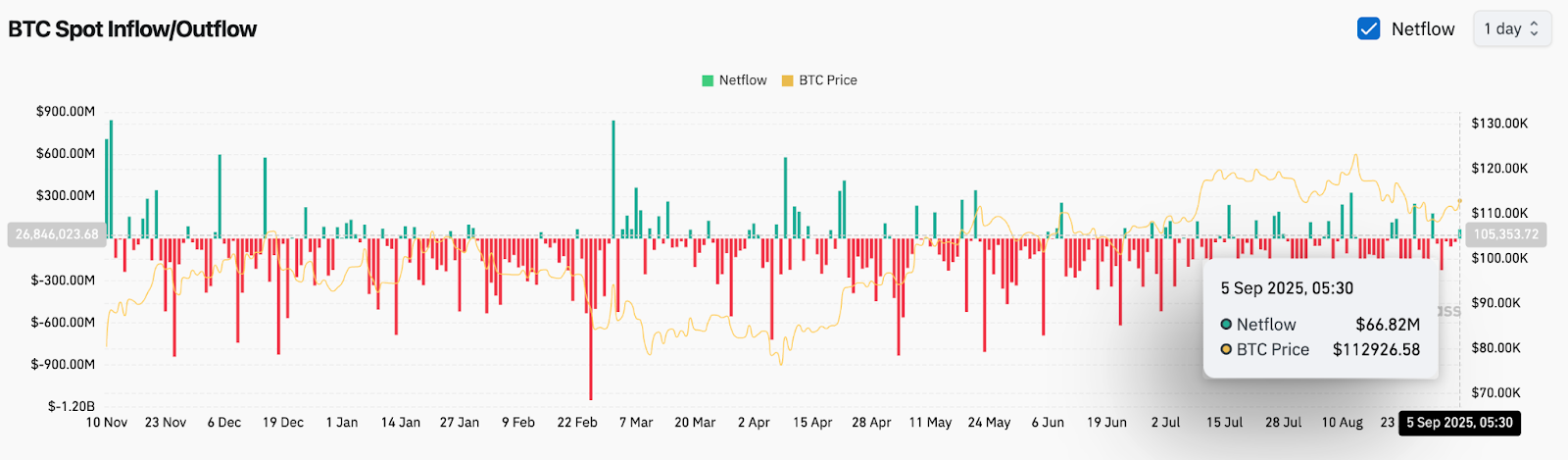

Chain-on-chain spot data, which recorded a net inflow of $66.8 million on September 5, reversed the sustained outflow for several weeks. A return of positive flow suggests that traders are gradually restructuring at current levels.

However, the peak in March remains modest compared to above $600 million. Analysts warn that convictions will fade and that more than $200 million inflows are needed to promote a strong breakout. Still, the shift to online purchases will provide early support for the $110,000 floor.

NASDAQ correlations encourage confidence

The US stock market is rising sharply.

Bitcoin continues soon! pic.twitter.com/2oyyect71y

– Crypto Rover (@rovercrc) September 5, 2025

Macro emotion added fresh catalysts. Crypto Strategist Crypto Rover highlighted the recurring pattern of NASDAQ surges and leading Bitcoin. Past cycles show that BTC usually delays stocks a few weeks before the rally resumes.

The correlation narrative has boosted bullish positions, and if the Nasdaq uptrend continues, many traders are looking at $120,000 as the next potential magnet. Although crypto-specific influx remains tentative, broader risk appetites across stocks could provide tailbone.

Technical outlook for BTC price

The main levels of resistance are stacked overhead. Clearing $113,500 will unlock $115,000, followed by $117,500 and $123,600 at the top of the channel. Without tearing these caps, the BTC could continue to be integrated within the current band.

On the downside, immediate support is $110,500. Deeper obstacles could reconsider the $107,800 and $104,400, which are important to maintain a long-term bull market structure.

Outlook: Will Bitcoin go up?

Bitcoin’s recent outlook depends on whether the correlation between the modest inflow and the Nasdaq can push it through a $113,500 resistance. Technical compression suggests that a critical movement is approaching, and the trend for the wider channel remains intact.

As long as BTC is above $110,500, analysts are looking at the upward target at $115,000 and $117,500. However, a breakdown below $107,800 weakens bullish cases and changes focus to $104,400. For now, the bias remains cautiously optimistic, along with macrotail winding, which supports price stability.

BTC forecast table

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.