Ethereum prices have experienced a horrific crash as the second-largest cipher has lost more than half its value in the past few months.

What’s next for ETH?

Technical Analysis

By Edris Dalakshi

Daily Charts

The Ethereum Daily Chart has shown a clear downward trend over the past few weeks, with prices consistently gaining lower highs and lower lows. The breakdown of several below-principal support levels, including the 200-day moving average (DMA), shows a shift in market sentiment towards bearishness.

Recently, ETH has tested a key support zone of below the psychological $2,000 level and around $1,900. If sales pressure continues, there will be an additional downside to $1,600.

The RSI also hoveres into areas that are oversold and sold, suggesting the possibility of short-term bounce. However, as long as your ETH is below the $2,400 key level, your recovery can be temporary. The Bulls will need to revive this level and the 200-day moving average to revive, but any further weakness could lead to a deeper correction.

4-hour chart

The 4-hour chart shows the downward wedge formation. This is usually a bullish inversion pattern. Prices are currently testing a $1,900 support zone. If the level is kept, you could try to push higher towards the resistance line at $2,000, or even $2,100. However, if you can’t rebound from $1,900, it can lead to wedge breakdowns, which can make everything even worse.

On the other hand, a critical breakout on the wedge with a strong volume may confirm a bullish reversal, but continuation of integration or rejection during resistance may indicate further downward pressure.

Emotional analysis

By Edris Dalakshi

Open interest

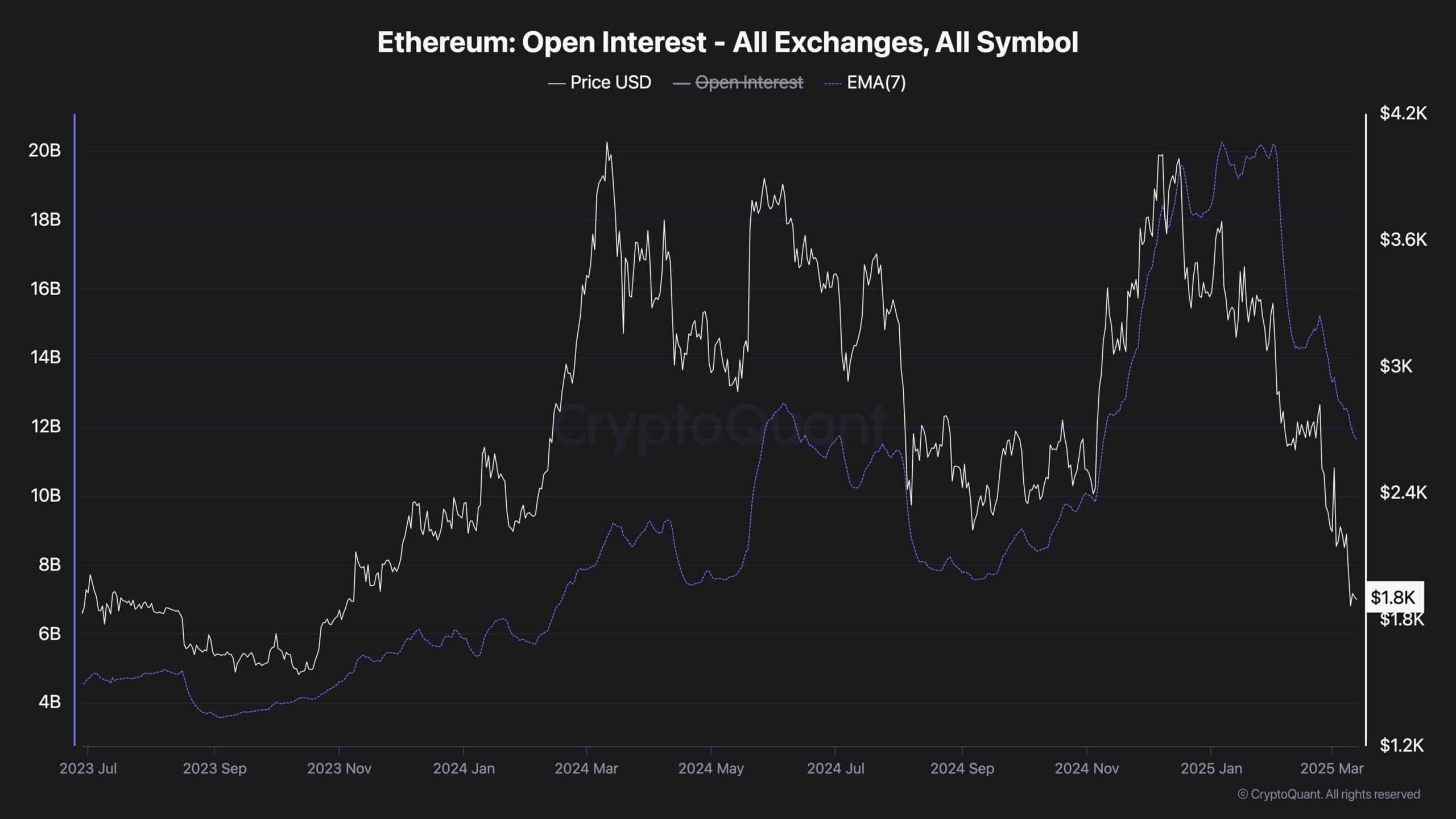

The Ethereum Open Interest (OI) chart provides valuable insight into market positioning and trader sentiment. It can be observed that both the price and OI are significantly reduced, suggesting a strong deletion event.

Historically, it shows that rapid drops have been settled, followed by rapid drops in OI. There, the over-converted long positions are washed away, often leading to even more downward momentum. Recent OI drops coincided with ETH destroying key support levels below $2,000, dropping to $1,800.

Given this data, ETH may be in a phase of decreasing speculation as traders close their positions amid uncertainty. This is consistent with a technical analysis in which ETH struggles to regain key resistance levels. However, stabilization of the OI indicates that the worst sale has ended and sets the conditions for a potential relief rally.

However, for a sustainable recovery, open interest must start to rise again with prices. Until then, further drawbacks are still possible, especially if ETH cannot hold a $1,800 support zone.