Canton Network’s price has soared in recent weeks, gaining nearly 40% in a week and catching the market’s attention. The rally accelerated after Canton announced a strategic partnership with The Depository Trust & Clearing Corporation early last week.

This development has placed CC at the center of institutional tokenization discussions and sparked renewed investor interest.

Canton Network and DTCC collaborate

DTCC and Canton Network last week confirmed a partnership to support the tokenization of assets held by The Depository Trust Company on Canton Network. This initiative aims to enable a compliant, privacy-enabled blockchain infrastructure for regulated financial institutions. This move highlights our shared commitment to accelerating the adoption of digital assets.

This partnership highlights Digital Asset’s long-standing collaboration with DTCC on institutional-grade blockchain solutions. Market participants interpreted this announcement as an important validation of Canton’s architecture. As a result, demand for CCs has increased rapidly, reflecting growing confidence in their role in regulated financial markets.

Canton holder outperforms chain link

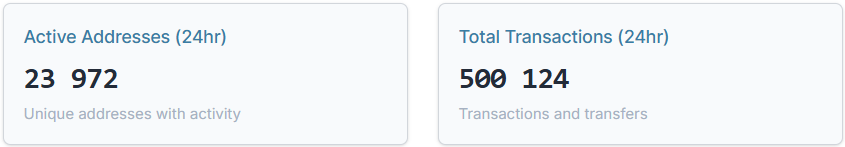

Investor participation has continued to increase throughout the past week, supporting the sustainability of the rally. On-chain data shows 23,972 active addresses in the past 24 hours. In total, these addresses performed more than 500,000 transactions, indicating strong involvement in the network.

For context, comparable activity across established tokens remains low. XRP recorded around 39,000 active addresses, Cardano around 25,000 and Chainlink nearly 4,000. This comparison suggests that the rise in CC prices is driven by actual usage rather than speculative spikes or thin liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Canton Activities. Source: Canton Scan

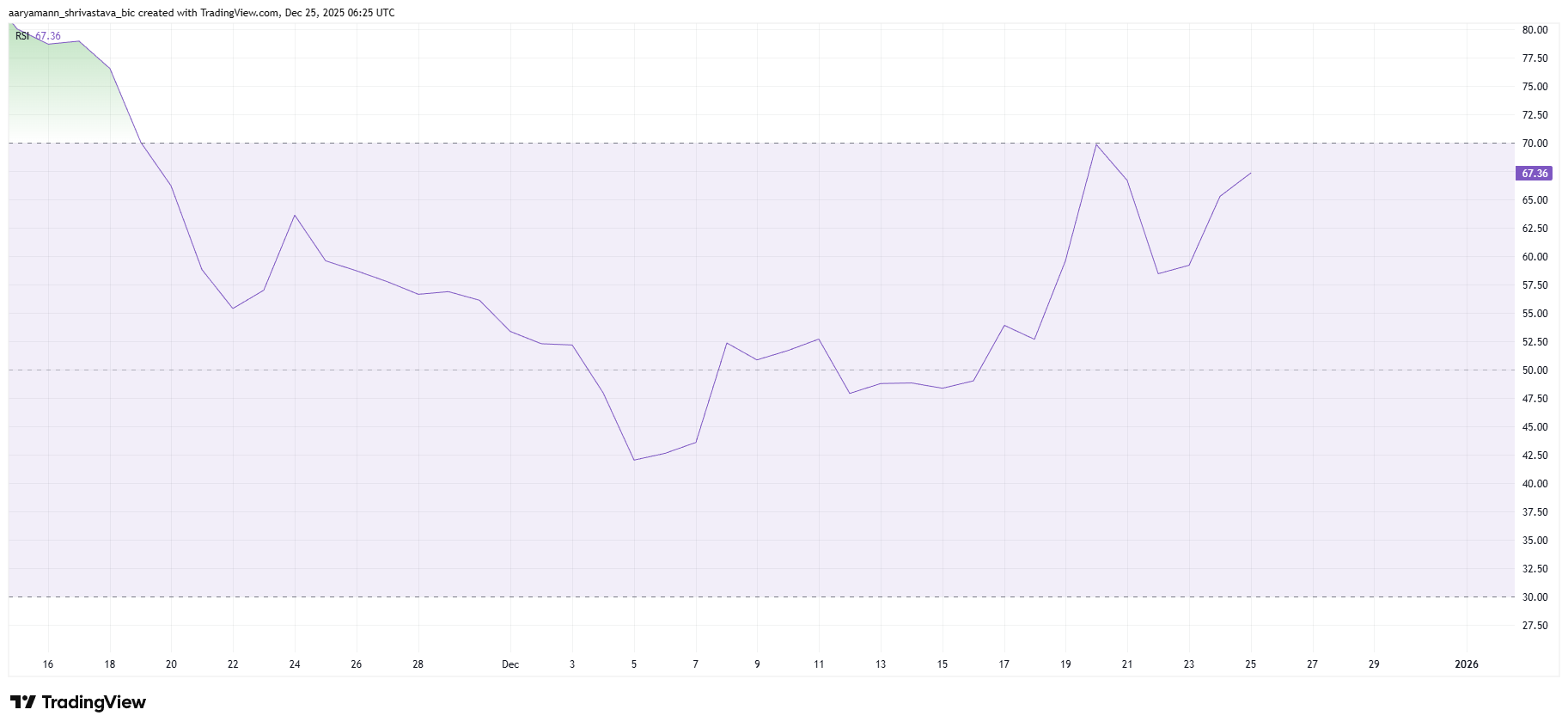

Technical indicators further support the bullish outlook. The Relative Strength Index is currently above the neutral zero line, indicating positive momentum. This positioning confirms that buyers continue to be in the lead, in line with the sustained increase in network activity and transaction volumes.

However, caution is advised as the RSI is approaching overbought territory. This situation often precedes a short-term pullback. CC’s broader uptrend technically remains intact as long as the indicator avoids a breakout of the extreme levels.

CC RSI. Source: TradingView

CC price reaches monthly high

CC price is trading around $0.106 at the time of writing, reflecting a nearly 40% weekly increase. Parabolic SAR continues to show an active upward trend. This indicator suggests that the altcoin has the potential to extend its upside if the broader market environment remains supportive.

A decisive break above the $0.109 resistance could push CC toward $0.118. Clearing that level could pave the way to $0.133. Such a move would build on the token’s recent monthly highs and strengthen the bullish structure.

CC price analysis. Source: TradingView

If momentum weakens, downside risk still remains. Overbought and profit-taking could weigh on price action. A decline below $0.101 could result in CC falling towards $0.089, invalidating the current bullish theory.

The post Canton Network (CC) overtakes top coins as price reaches 4-week high appeared first on BeInCrypto.