China’s decision to ban high-tech giants from purchasing Nvidia chips could be more than just trade restrictions. This may be Beijing’s declaration that the country’s semiconductor industry has reached a critical inflection point where it no longer needs to compete with American AI hardware.

today, Financial Times Chinese internet regulators reported that the country’s tech companies are requesting that Nvidia AI chips be stopped, citing three sources familiar with the issue. The ban appears to be part of the ongoing US-China trade war, with Nvidia CEO Jensen Huang telling London reporters today that “two countries have a bigger agenda.”

However, on a practical level, this move forces companies like Bytedance and Alibaba to fundamentally rewire AI infrastructure. This must abandon testing on Nvidia’s RTX Pro 6000D processor.

More importantly, it demonstrates the belief of Chinese regulators that homemade chips such as Huawei, Cambricon have closed enough performance gaps to maintain the country’s artificial intelligence ambitions.

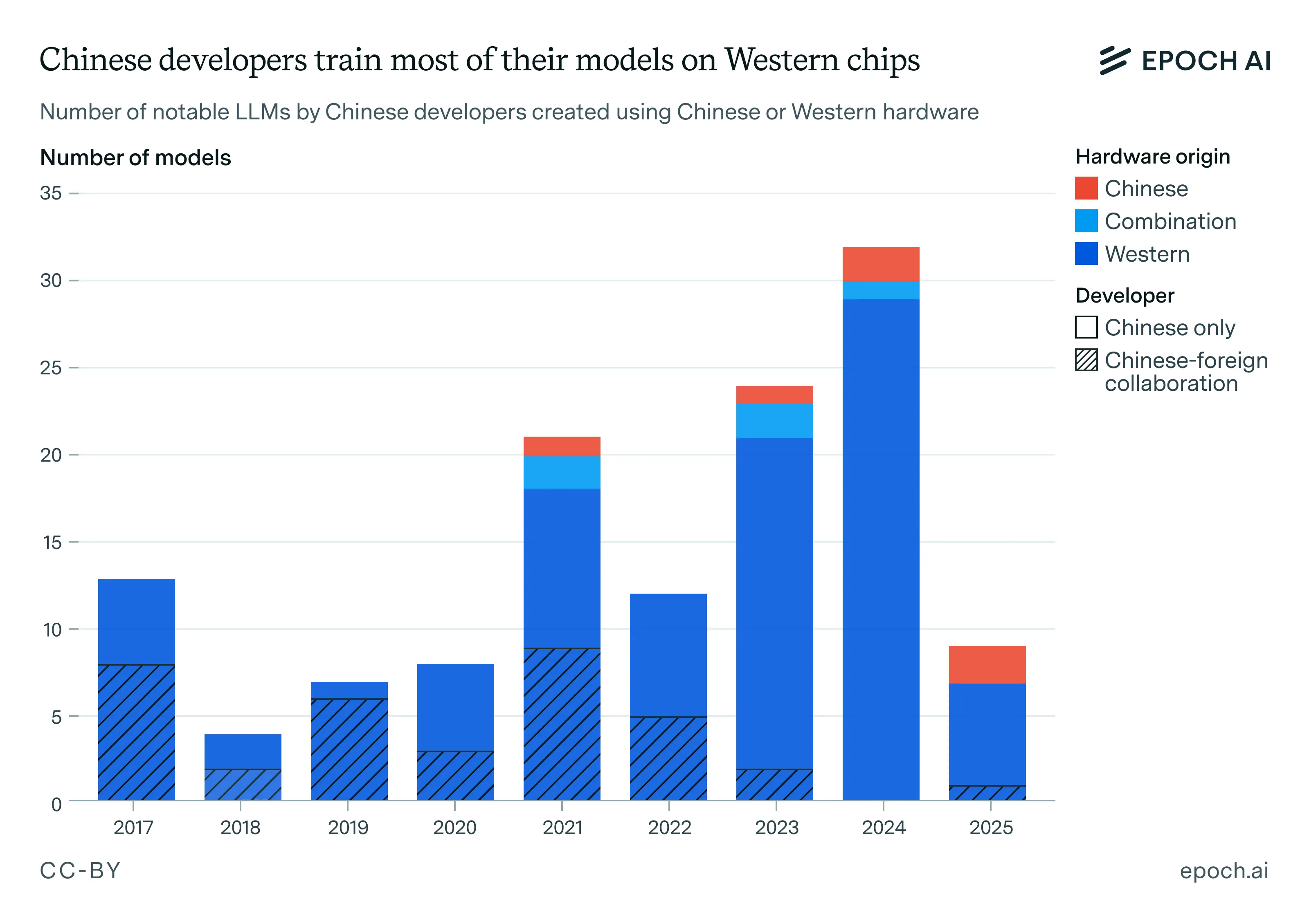

Chinese researchers published 23,695 AI-related publications in 2024, exceeding the total production volumes of the US (6,378), the UK (2,747), and the European Union (10,055). According to Financial TimesBeijing recently concluded that AI processors match or exceed the capabilities of NVIDIA products permitted under US export controls. This is an unbelievable rating just two years ago.

Image: Epoch AI

The reported directive arrived as Chinese companies have ordered tens of thousands of Nvidia units and are forcing abrupt halts of verification work with suppliers. The RTX Pro 6000D is Nvidia’s last important product allowed in the Chinese market by the Donald Trump administration.

In the case of Nvidia, the ban eliminates the rest of the market that once generated up to 17% of total revenue. The company’s stock has dropped by around 4% today, with analysts previously calculating potential losses of between $8 billion and $16 billion per year from China’s trade restrictions. The company’s AI Data Center chip’s Chinese market share has already plummeted from 90% to 50% as domestic competitors gain traction.

Nividia stock price data. Image: TradingView

“We can only serve the market if the country wants us,” Nvidia CEO Jensen Huang said in London on Wednesday. “I’m disappointed in what I’m seeing. But they have a bigger agenda to work well between China and the US. I understand that.”

Timing reveals Beijing’s growing confidence in the semiconductor sector. The Chinese chip maker is planning to triple its AI processor output next year, with Huawei’s Ascend 910 series leading the price. Individual Chinese chips do not match Nvidia’s most advanced products, but cost-effectiveness allows companies to cluster multiple units to allow for comparable performance.

“The message is now loud and clear,” said an executive at a high-tech company that was influenced by the influence. Financial Times. “Previously, if the geopolitical situation improved, people wanted to update Nvidia’s supply. Now it’s all decks that build a domestic system.”

China vs. America: The fight for AI domination

This ban accelerates what many consider to be inevitable. A branching global AI ecosystem with Chinese and Western companies developing along separate technology tracks, with large costs on both sides.

For reference, OpenAI’s AI model GPT-3 training consumed an estimated 1,287 MWh (megawatt hours) of electricity, roughly equivalent to the energy consumption of an average American home over 120 years. The estimated coding platform, Baeldung, shows that the company’s latest model, the GPT-5, may have acquired 3,500 MWh.

Chinese companies using less powerful domestic chips can have higher power costs for large language models and longer training timelines. Conversely, Western companies lose access to not only the Chinese market, but also large datasets and real-world AI applications.

The world’s largest volume of publications, the AI research community is increasingly focusing on efficiency rather than raw computing power.

This is the way the DeepSeek R1 was born, and this is how models created at a portion of the investment costs thrown by Western AI giants like Openai, Google, or humanity can be released and open sourced models that can break cutting edge products offered at premium prices.

We live in a timeline where non-US companies continue to live out Openai’s original mission. That makes no sense. The most interesting results are most likely.

Not only is the barrage of open source models deepseek-r1…pic.twitter.com/m7eznemcoy

– Jim Fan (@drjimfan) January 20, 2025

Fighting software aspects

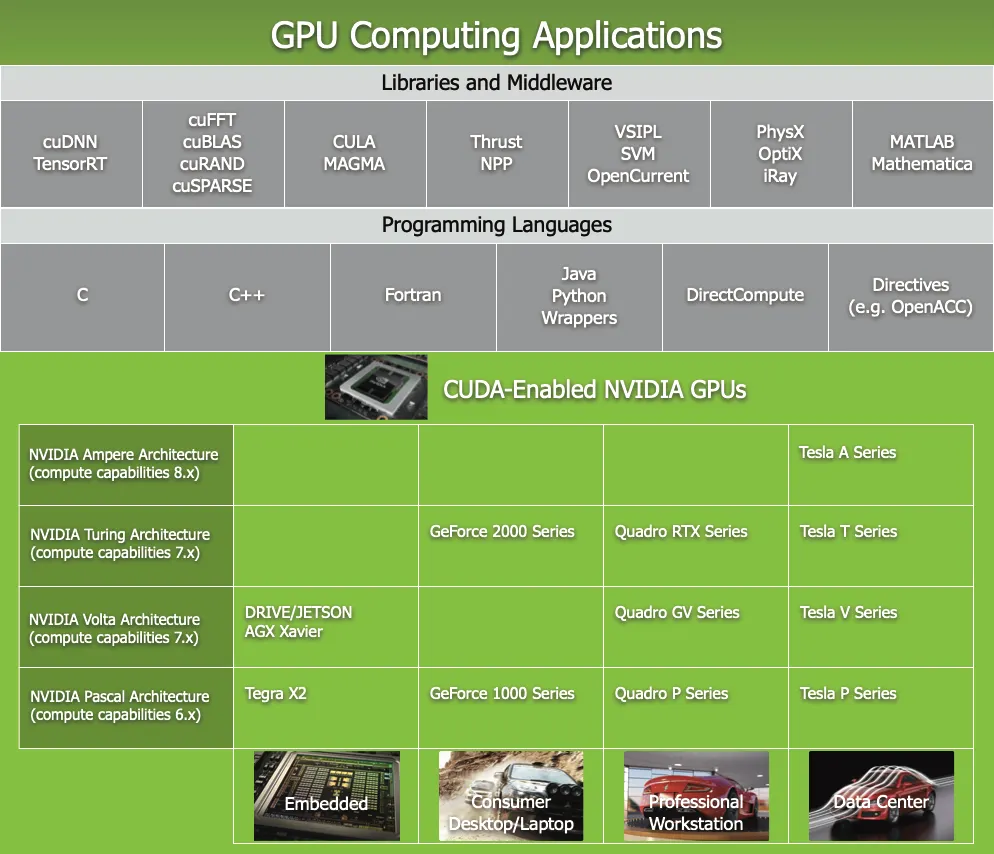

Splitting also affects the broader technology stack. AMD’s ROCM platform and other options are challenging CUDA’s dominance by offering open source alternatives that work across a variety of hardware architectures.

CUDA is a concurrent computing platform and programming model created by NVIDIA, allowing software to use the large-scale processing power of its own GPU for tasks such as artificial intelligence and scientific computing, making these operations faster and more efficient. It is a standard currently used for AI training, and developers are working with this technology by default.

China’s emphasis on developing CUDA alternatives could potentially accelerate the creation of hardware-independent AI frameworks by breaking NVIDIA’s software lock-in, which leaves behind technically superior hardware like AMD’s GPUs underutilized in AI applications, potentially benefiting the industry as a whole.

For now, if the card does not run CUDA (i.e. it’s not Nvidia), it’s better to go back to the game and quit AI training for adults.

Image: nvidia

The country’s large-scale AI research production has created a foundation for rapid iteration and improvement. Chinese universities such as Tsinghua and Peking have emerged as Global AI Research Powerhouses, and according to Peking University, ranked eighth in the world for AI research output ahead of institutions such as Facebook AI Research and Princeton.

“The top level consensus right now is that there is enough domestic supply to meet demand without having to buy Nvidia chips,” an industry insider said. Financial Times.

Nvidia warned analysts to exclude China from future financial forecasts, writing down what was essentially one of the fastest growing markets. The company continues to explore options, but political dynamics now allow commercial considerations to be overridden.

The ban goes beyond previous regulatory guidance from the government, which simply encourages businesses to leave Nvidia. Before the ban, Trump agreed to have Nvidia sell Nerfed chips in exchange for 15% of the profits from these sales.