Coinbase, the largest U.S. cryptocurrency exchange by trading volume, is days away from officially announcing its expansion into prediction markets and tokenized stocks, according to Bloomberg.

Coinbase plans to announce the launch of a prediction market and tokenized stocks next week, Bloomberg reported Thursday, citing anonymous sources familiar with the matter.

The exchange plans to host a livestream on Dec. 17 to introduce new products, but it is not clear whether prediction markets or tokenized stocks will be included, the report said.

The news comes nearly a month after technology researcher Jane Manchun Wong reported that Coinbase was preparing a landing page for tokenized stocks and prediction markets powered by Karsi. However, the company has not officially released the product yet.

Coinbase signs prediction market partnership with Kalshi

Bloomberg’s report comes on the same day that Coinbase became a member of the Coalition for Prediction Markets (CPM), a group of prediction market operators announced by Calci and Crypto.com.

“Coinbase’s mission is to bring economic freedom to the world. Prediction markets inherently democratize fact discovery and the pursuit of truth,” said Faryal Shizad, Coinbase’s Chief Policy Officer.

He also emphasized CPM’s ambition to work with policymakers to ensure continued access to these markets for the American people.

sauce: Tarek Mansour

Founded in 2018 by MIT graduates Tarek Mansour and Luana López Lara, Kalshi allows users to trade the outcomes of real-world events the same way they trade financial assets.

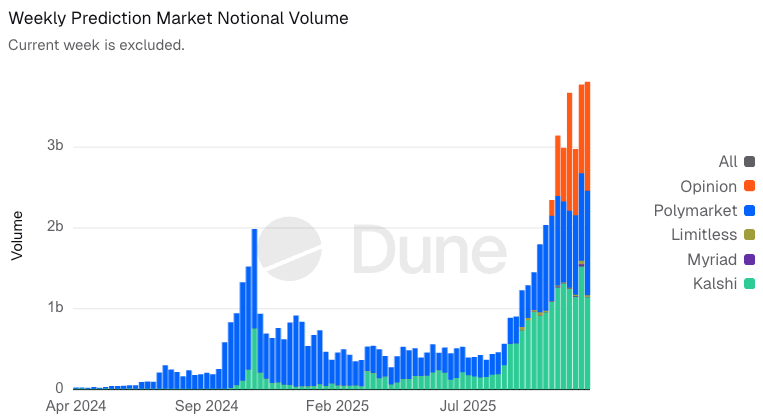

The platform has emerged as a leading prediction market operator alongside rivals such as Polymarket and Opinion, with weekly trading volume of around $1 billion, according to Dune Analytics’ Dunedata statistics.

Coinbase’s entry into prediction markets comes amid a boom in the sector, with weekly trading volume hitting a record of nearly $4 billion last week, but some experts question the accuracy of the reported numbers.

Prediction market weekly trading volume. Source: Dune

Rival exchanges are competing to roll out prediction markets, with Crypto.com announcing a dedicated platform to integrate with Trump Media in October.

Related: CFTC gives prediction markets freedom on data and record-keeping rules

On Wednesday, Gemini, the exchange founded by the Winklevoss twins, won approval from the Commodity Futures Trading Commission to offer prediction markets in the United States.

Cointelegraph reached out to Coinbase for comment on its prediction markets and push for tokenized securities, but did not receive a response in time for publication.