Activities in March intensive exchanges have slowed overall, following the trends throughout Q1. The coded derivatives remained more resilient, shrinkage reduced, and the moon ended.

In March, centralized trading of all crypto assets slowed down, following the overall trend of losing volume across Q1. Derivative trading was more resilient, with only 5% contracted.

The central exchange brought global traffic primarily from crypto-friendly regions. The March outflow reflects bearishness and outflow from the Korean and US markets. Binance’s traffic and activity reflects robust levels of interest from other global markets.

Despite influx from whales and sales pressure for Bitcoin (BTC) and sales pressure for Ethereum (ETH) and Solana (SOL), Spot Trading lost 16.6%. Also, spot exchanges featured less liquidity in the form of stability, but most of the excess liquidity still supports derivative trading.

In March, all central exchanges have decreased, total balance Sinks from 48B or higher tokens of 45B.

US-based traders drive exchange outflows of spot volumes and crypto derivatives

Loss of momentum has primarily affected three exchanges – crypto.com (down 43.9%), bibit (down 52.6%), and Bitfinex (down 31.1%). A portion of the spot trading traffic moved to HTX, with volume increasing by 29.4% for the month.

Derivative exchange activities returned to Kraken, which rose 28.3% in March. Traffic traveled from crypto.com and lost 39.3% of the derivative activity. Both Crypto.com and Coinbase lost traffic, informing us of the US trader’s outflow. Nevertheless, the US-based market is First quarter of 2025.

Transportation to the Crypto exchange has dropped by 3% in the past month. Exchange activities in spot and derivatives markets are also not sorted based on market makers or bots. Some of the more dramatic trading spikes could be unusual or intentional bot-driven transactions.

The exchange also separated itself based on local traffic inflows. Vinanence saw relatively small outflows while acquiring transportation from India, Vietnam and South Korea. Meanwhile, Coinbase reflects the loss of confidence among US traders trying to eliminate the effects of the US presidential election.

The outflow of spot traders is also attracting attention in the DEX market. Currently, the decentralized market accounts for around 10% of CEX spot trading. Nevertheless, the unstable market presented opportunities for dangerous, decentralized betting. In March and early April, high lipids turned into one of the busiest dexes Daily volume.

Binance holds the most vibrant asset flows

Binance was one of the most active asset flows. CEX is one of the leading venues for derivative trading and sees some of the biggest liquidation of daily life.

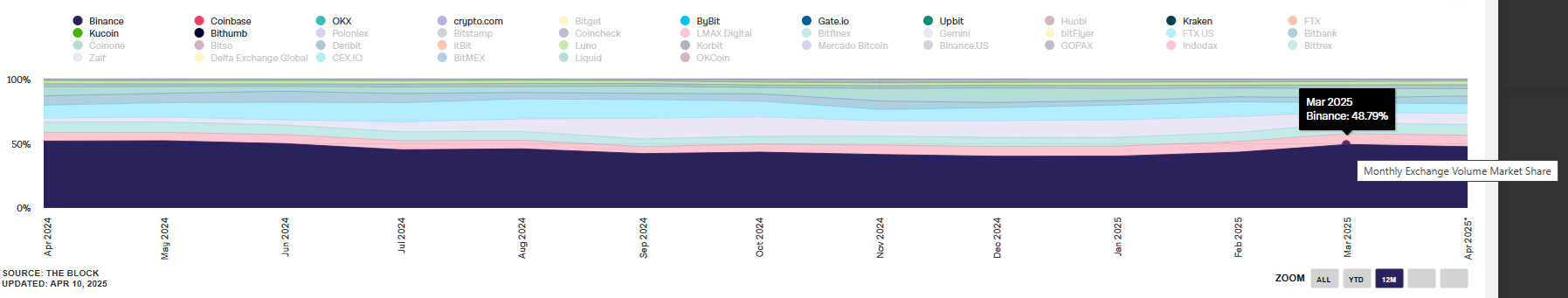

Based on the open position, Binance remains a proxy for the entire derivative, Futures Market. CEX is also a benchmark for spot volumes. 29.5% Marketwide, including small and niche exchanges. In the case of spot volume, Binance was the leader. data By New Shedge.

Binance has remained a leader in the central exchange of both spot derivatives and crypto derivatives activities. |Source: IntotheBlock

CEX also saw the most vibrant influx of BTC, ETH and Stablecoins. This exchange has a more consistent balance with a robust supply of coins and tokens. In March, Binance saw a net spill in BTC, but is now regaining the balance available.

Despite ongoing activities, March was the slowest month ever. Binance controlled all other exchanges in terms of trading volume, but overall activity continued to decline in performance in January and February.