After a summer of careful investor sentiment and changing priorities across the sector, new numbers show that capital for crypto is beginning to cool off.

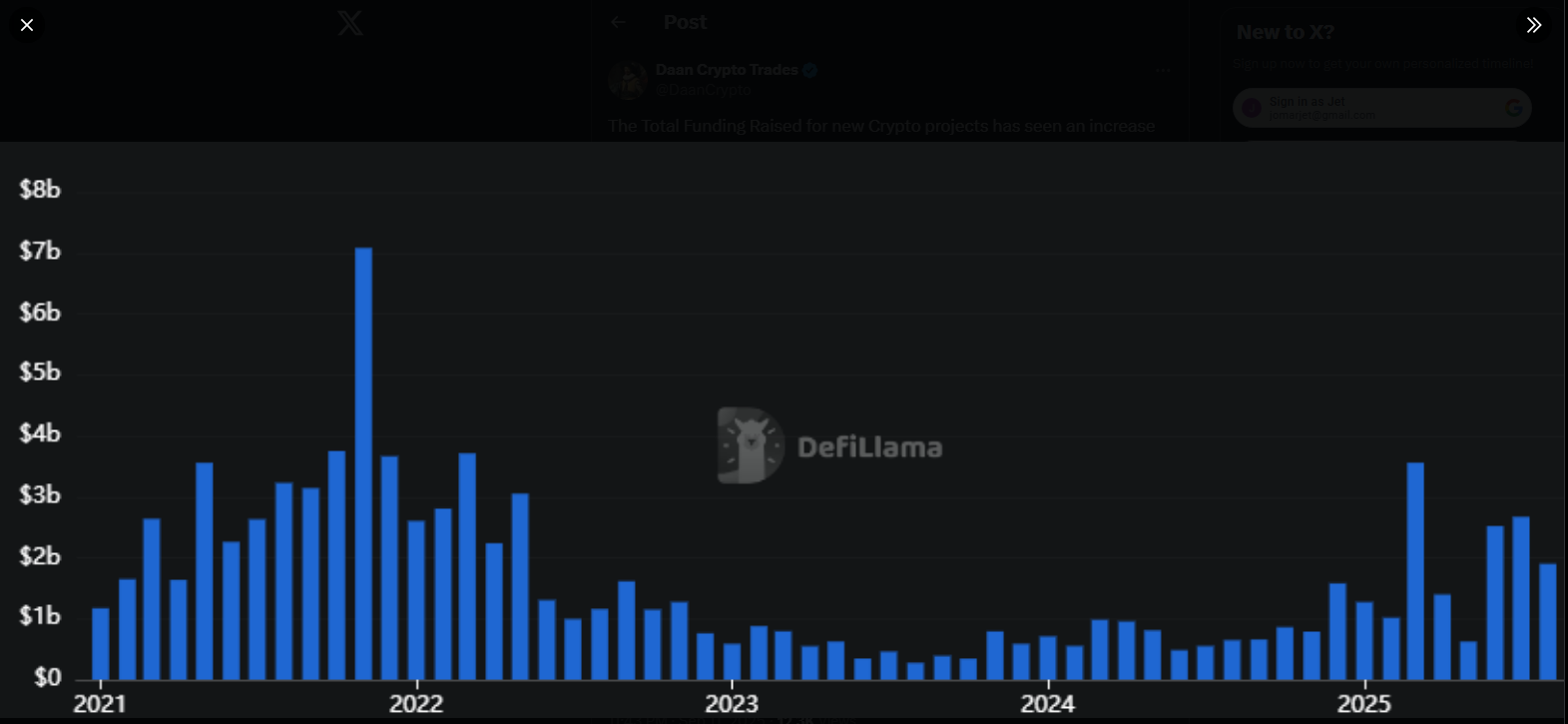

According to Defilama, overall funding for the Crypto protocol fell 30% in August, sliding to nearly $2 billion from $2.67 billion in July.

Funding Dip is still making quarterly profits

Based on the report, the third quarter total reached $4.57 billion in just two months, exceeding $4.544 billion in the second quarter. It shows that money is still moving, even if the monthly flow looks cooler compared to past peaks.

At the start of 2022, monthly salary increases reached around $7 billion. The numbers have since declined, but 2025 has shown some big spikes to keep investors alert.

Investor focus shifts to existing projects

According to market analyst Daan Crypto Trades, the funds have moved away from launching a new, non-stop chain for finance and teams that build finance and teams based on existing projects.

He points out that the new launches are hitting low ratings, which helps keep price movements quiet after the list.

Total funds raised for the new Crypto project have increased over the past few months, but are not close to what has returned to 2021 and 2022.

This cycle is about finance companies that are already being built in addition to the projects that are already there.

Most of the capitals…pic.twitter.com/nqo25qxvuo

– Dan Crypto Trades (@dancrypto) September 11th

Investment is expanding beyond defi

Defi still attracted attention in August, with money flowing through infrastructure and trading platforms. However, other sectors also saw a notable round.

The Stablecoin infrastructure was also busy, with Rain rising to $58 million. Payment solutions also raised funds. Orangex took $20 million in Series B

Korea opens VC door

After approval by the State Council and the Cabinet, South Korea’s Ministry of SMEs and startups said on September 16 that they lifted their long-standing VC funding ban.

Amendments to the enforcement order will remove any labels that have maintained exchanges and securities companies that have been classified as “restricted venture businesses” since October 2018.

Recent laws, including the Virtual Asset User Protection Act, passed in July 2025, have introduced deposit safeguards, record-keeping rules and prohibitions on unfair transactions. These measures helped persuade regulators to reopen the market.

Government support could boost local businesses

The decision to lift long-standing restrictions on South Korea’s cryptocurrency funds came with a clear message from policymakers.

Officials said the move aims to create a more transparent and responsible ecosystem and support the flow of venture capital to businesses focused on blockchain and encryption.

If VCS returns, local crypto companies can find new sources of growth capital, but investors look for projects that can provide long-term value.

Unsplash featured images, TradingView charts