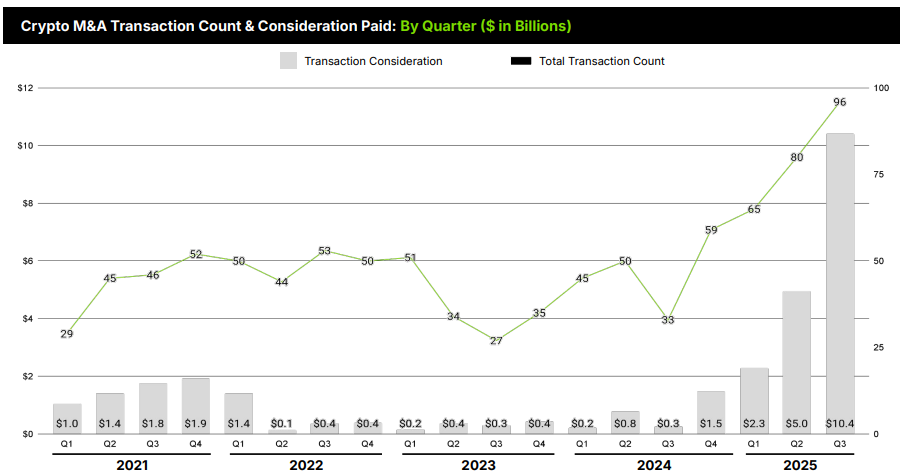

Cryptocurrency-related mergers and acquisitions (M&A) volume exceeded $10 billion in the third quarter of this year, according to a new report from Architect Partners. This is the largest total ever recorded in this field.

This figure is double the previous record high of $5 billion set earlier this year and represents a 30-fold jump compared to the same period in 2024.

Why virtual currency M&A transactions are so popular

To put this number in perspective, this single quarter roughly equals the total value of M&A transactions from Q1 2022 to mid-2025 (approximately $11 billion).

Cryptocurrency M&A transactions from Q1 2021 to Q3 2025. Source: Architect Partners

Taking this into account, Architect Partners said the sharp rise signals a clear break from the prolonged slump that followed the previous market cycle. We also showed how the current crypto-promoting environment is driving industry growth.

“The company is firmly emerging from the ‘crypto winter’ and is reaching a more disciplined, mature state where founders who can clear the diligence threshold are raising meaningful checks,” the company said.

Architect Partners has outlined five key forces driving the current wave of crypto mergers and acquisitions during this period.

According to the report, companies involved in M&A transactions are focused on bridging traditional finance and digital asset services to efficiently expand their businesses. We are also working to meet stricter compliance and licensing standards, expand our cryptocurrency payments infrastructure, and improve our treasury management strategies to better handle liquidity and volatility.

It is therefore not surprising that Digital Asset Treasury’s reverse mergers accounted for approximately 37%, or approximately $6.2 billion, of total disclosures during the reporting period.

Top crypto M&A deals in Q3 2025. Source: Architect Partners

This shows that institutional investors are increasingly using these trades to gain crypto exposure while maintaining listings on traditional stock exchanges.

Momentum continues in the fourth quarter

Several new deals have already closed this quarter, and the momentum shows no signs of slowing down.

Incidentally, crypto prime broker FalconX is reportedly finalizing a deal to acquire asset management company 21Shares. Coinbase, the largest U.S. exchange, also acquired Echo through its acquisition, while Kraken recently completed its acquisition of derivatives platform Small Exchange.

For industry observers, these developments signal deeper structural changes. Big Whale co-founder Rafael Block said the current wave marks the beginning of a new competitive order.

“We are entering a new phase of a wave of consolidation for the crypto industry. The strongest players have the capital, licenses, and vision to scale. Others are exhausted by the bear market and are becoming attractive acquisition targets,” he said.

Bloch also pointed out that traditional financial institutions such as banks are accelerating their entry into emerging industries by investing in crypto infrastructure companies.

He said this shows a clear recognition that tokenization, custody and digital trading are becoming integral to modern portfolios.

“This is not just a few deals, this is the beginning of a tectonic shift.Over the next year, we can expect dozens of acquisitions, partnerships, and mergers that will reshape how cryptocurrencies connect with traditional finance,” he added.

The post Crypto Mergers and Acquisitions Reaches All-Time High at $10 Billion appeared first on BeInCrypto.