Ethereum prices Slided in a recent session, the latest comments from Federal Reserve officials have been added to the uncertainty. While Fed governors are calling for sudden interest rate cuts, most policymakers remain cautious about inflation risks. This sector is speculating on the market, and ETH traders are no exception. The real question: Could Ethereum collapse all the way to $500?

Ethereum price forecast: The Fed refuses to actively cut

The mixed signal of the Federal Reserve is creating turbulence across risk assets. Three policymakers emphasized that inflation was too high, citing tariffs and other pressures. Resisting aggressively reducing rates means that borrowing costs can be maintained for longer. For Ethereum, which thrives in a low-rate, fast environment, this background is bearish.

Conversely, Stephen Milan’s call for sudden cuts is consistent with market expectations for at least one interest rate cut this year. This has prevented ETH prices from being completely disassembled. Still, cracks within the Fed create volatile settings where crypto assets swing sharply in response to any policy statement.

Chart Analysis: Breakdown from Range Support

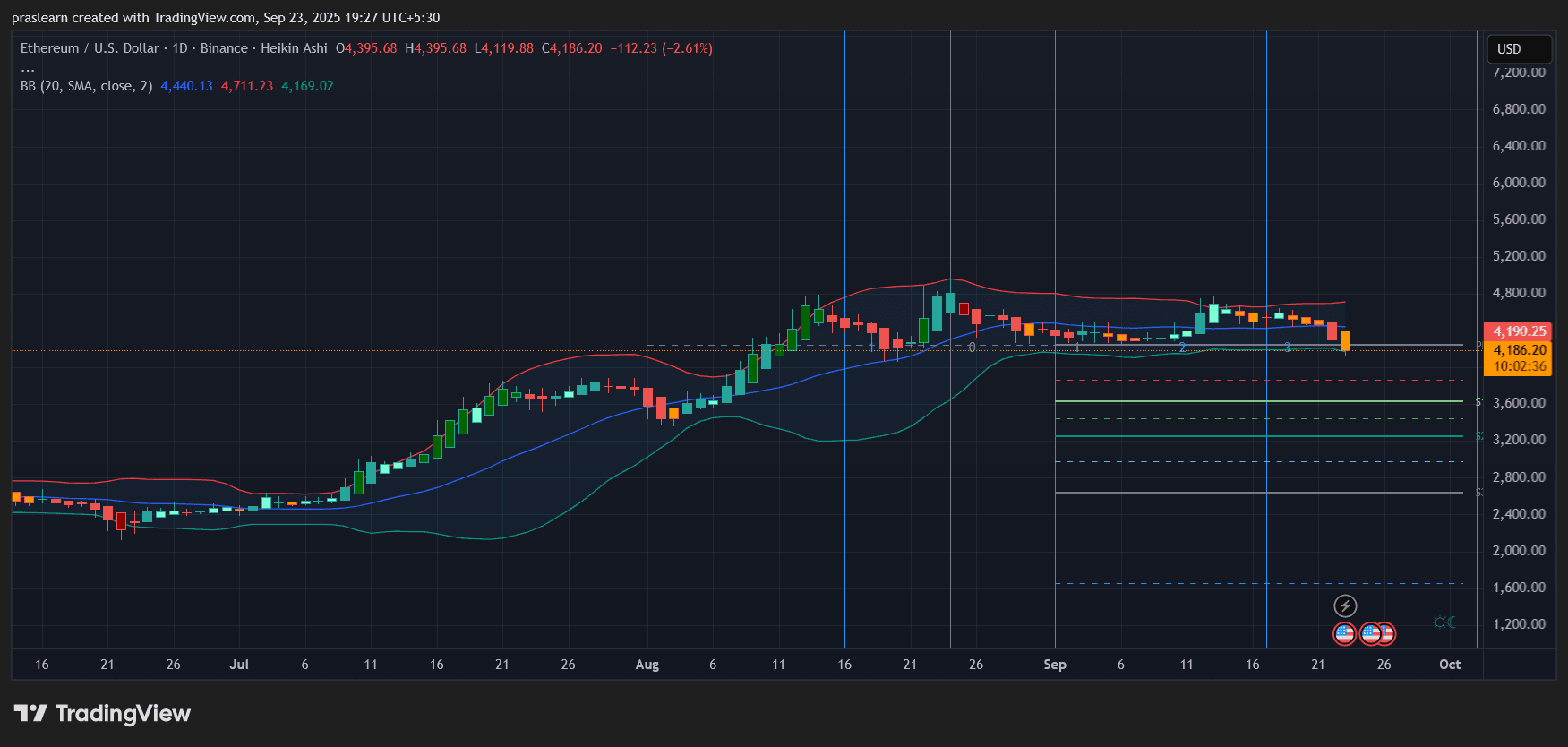

eth/usd daily charts – TradingView

Looking at the daily charts, ETH prices have clearly lost momentum. Hikin Ash Candle has a series of bearishes closed, and now prices are approaching nearly 4,180. The ETH is broken under the central bollinger band (approximately 4,440) that served as a dynamic support. This indicates an increase in sales pressure.

The Lower Bollinger Band is located near 4,169, and Ethereum Prices are currently testing the area. If not preserved, the next visible support level will be displayed around 3,800, 3,600, and 3,200 marked horizontally. Momentum indicators (not shown here, but implied by bearish candles and failed gatherings) suggest that the seller is in control.

For ETH prices to regain strength, they need to regain 4,400-4,700 zones. Until then, all bounces look more like relief than a reversal.

Ethereum price forecast: Could ETH prices really drop to $500?

From a purely technical standpoint, the crash to $500 looks extreme. Ethereum prices have multiple support layers before such collapse is considered. To reach $500, Ethereum must break down at levels 3,000, 2,000, and 1,200.

That said, we cannot rule out the Black Swan scenario. If the Fed accidentally inflation and causes a deep recession, it could drain liquidity and lower all risk assets. Combine it with a code-specific shock. This can face catastrophic shortcomings, such as large-scale replacement failures and regulatory oppression. However, aside from such events, a slide to $500 appears unlikely in the short term.

Which traders should you see?

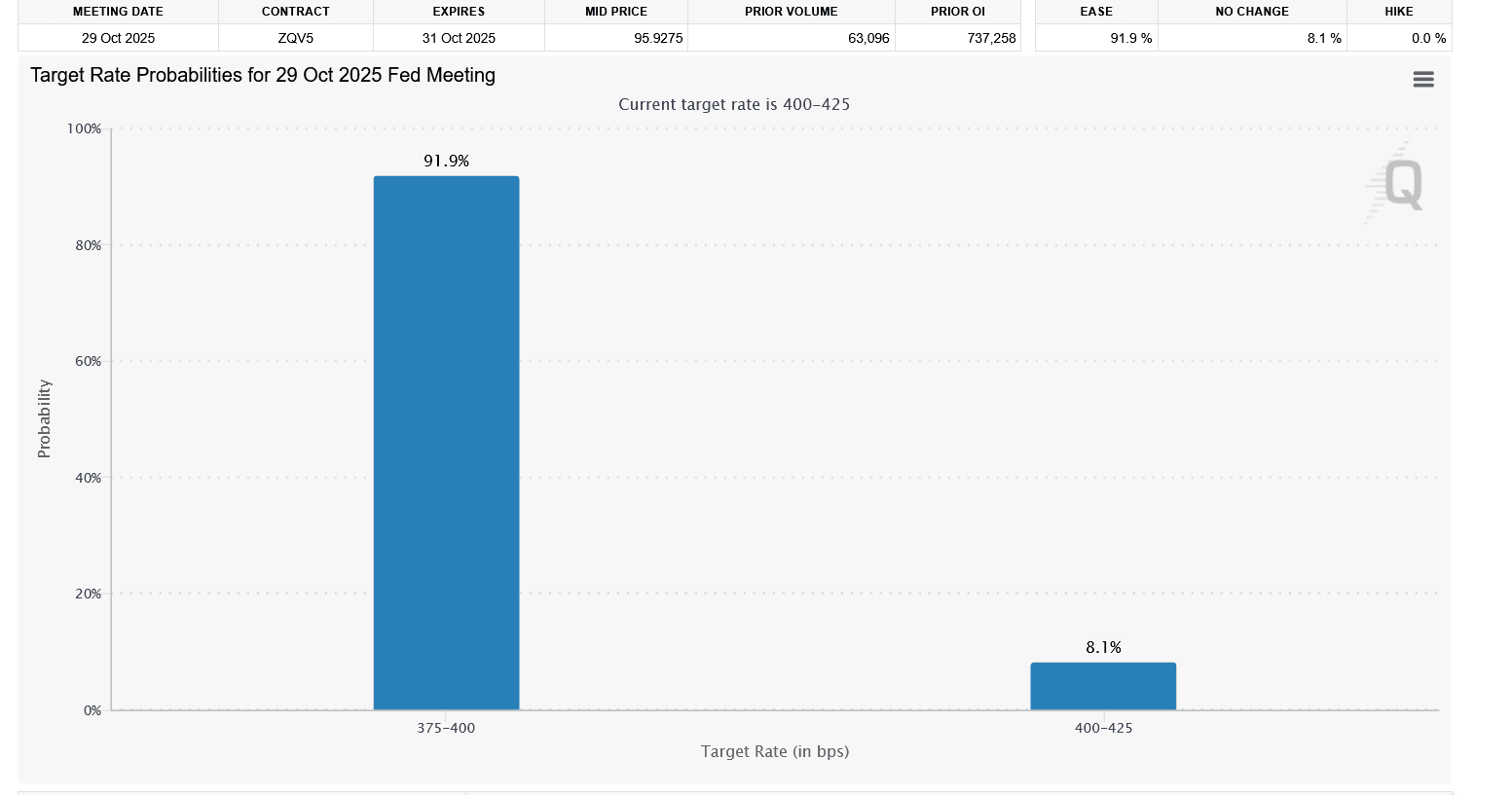

- Fed’s October meetingThe market is priced with a near 90% chance of another reduction. If the Fed is surprised that it holds interest rates, ETH can lower another leg.

- Support Zone: Immediate support is 4,169, followed by 3,800 and 3,600. A failure via 3,200 indicates a deeper problem.

- Macro data: Inflation prints and job data promote Fed sentiment. Softer numbers could ease pressure on the ETH.

- Cryptospecific catalysts: SEC Action, ETF News, or Ethereum Upgrade Delays can accelerate volatility.

Ethereum prices are under pressure from both macro uncertainty and technical weakness. The story of the crash to $500 makes for a dramatic headline, but this chart doesn’t support such a charge unless an extraordinary event takes place. More realistically, $ETH could revisit the 3,200-3,600 range if the Fed keeps interest rate cuts down.

For now, traders need to respect bearish trends, but they realize that calling $500 is more fear-driven than chart-driven.