Dow Jones has fallen into Trump’s threat to more countries, with tech stocks getting better, but the crypto market has seen Bull Run.

Stocks are falling as Trump escalates trade tensions again and the code is doing well. On Friday, July 11th, the Dow Jones fell 286 points (0.64%) and the S&P 500 fell 0.30%. With Crypto and Tech stocks getting relatively better, the high-tech Nasdaq lost just 0.08%.

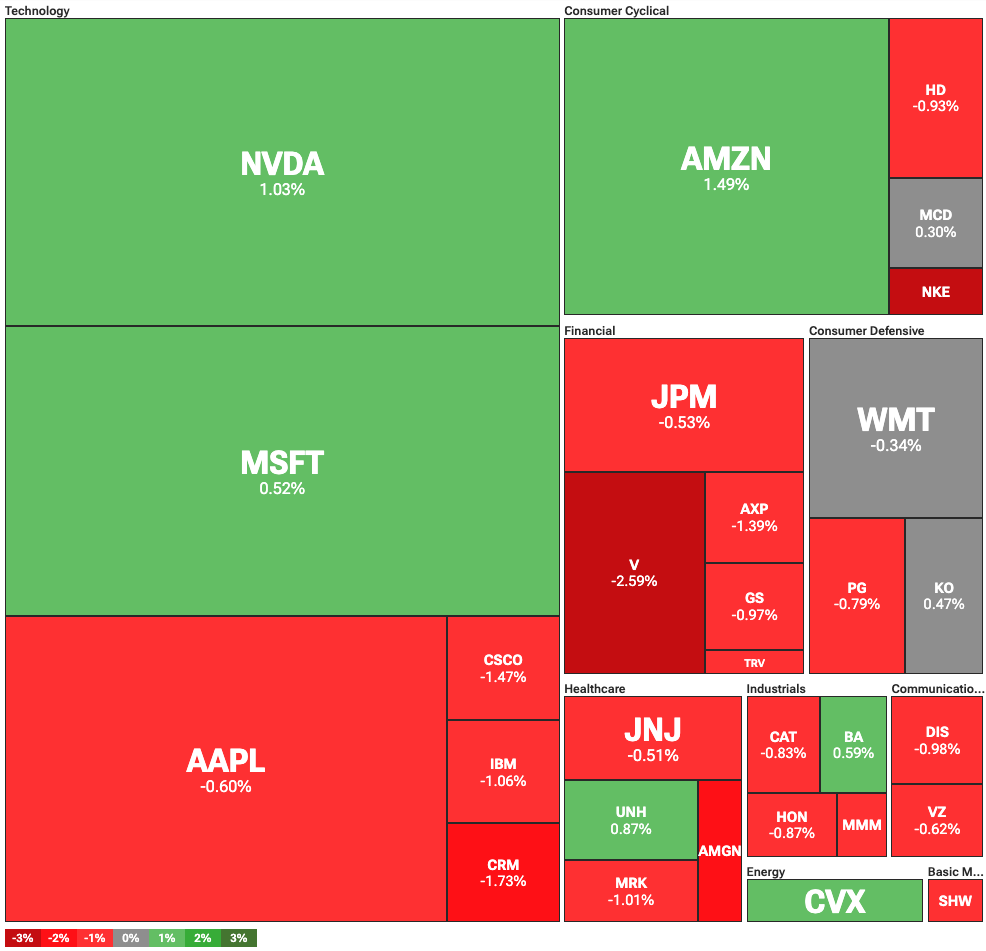

Dow Jones Industrial Average Heat Map for July 11th | Source: Tipranks

Interestingly, Bitcoin (BTC) was much more resilient than the stock market. The token hit a new all-time high of $118,856 for the third day in a row, spinning 4% in 24 hours. Altcoins such as Ethereum (ETH) such as XRP (XRP), Dogecoin (Doge), Cardano (ADA) deliver double-digit profits.

You might like it too: Russian oil companies rely on Bitcoin, Ethereum and Stubcoin for China-India deals: Report

Trump threatens new tariffs in Canada

Investors were concerned about the impact of President Donald Trump’s latest threat on Canada. Trump has announced a 35% tariff on Canadian goods, but is currently facing a 25% rate. Still, some products are exempt from oil, gas and potash.

These major industrial products are currently regulated under the USMCA agreement and are subject to 10% customs duties. Canada is one of the largest trading partners in the United States and is the country’s leading exporter of energy and raw materials.

You might like it too: How a fall in oil prices will boost crypto markets

Other tariff news reports that the Vietnamese government was surprised by the 20% tariff announcement on the country. According to Bloomberg, the country is hoping to lower the rate in the range of perhaps 10-15%.

Vietnam is a major exporter to the US, with the country and the third largest trade surplus. Over the years, it has taken over several export industries from China to the US, introducing electronics, textiles and footwear as major categories. Previous administrations saw this move as an advantage, as Vietnam is more geopolitical than China.

read more: Stubcoins and oil are cards’ macro weapons, says Debele CEO