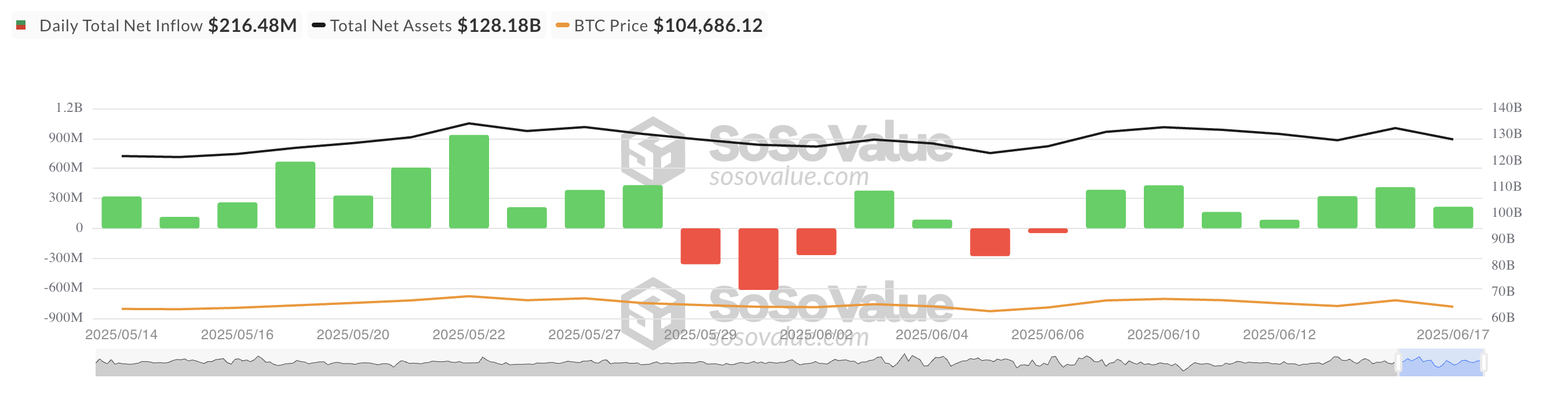

On Tuesday, the Bitcoin Exchange Sales Fund (ETF) recorded an inflow of over $200 million. This marked a net positive inflow into these funds, but represents a sharp drop from the $421 million we saw the previous day.

Cooling benefits will arise as BTC slipped to a low low of $103,371 on Tuesday, signaling investors’ careful attention. As decline continues, the influx of ETFs may be even weaker as institutional sentiments continue to hit.

BTC ETF shows a daily influx slump

On Tuesday, the US-registered Spot Bitcoin ETF recorded a net inflow of $22,648 million, indicating that investors’ profits remained intact. However, this shows a 47% steep decline from $412 million posted the previous day, indicating a slower momentum.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

The influx flooding coincided with a decline in BTC prices during the day trading session. As demand fell, it fell to an intraday low of $103,371. The recession is heavily sluggish with market sentiment, and fresh capital appears to be stagnating as it enters BTC-related ETFs.

Yesterday, BlackRock’s IBIT led the pack with the highest daily inflow, bringing its total historic net inflow to $50.67 billion, totaling $639.19 million.

Meanwhile, Fidelity’s FBTC witnessed the largest net outflow of these ETFs, with $2846 million withdrawing the fund.

BTC faces new pressure

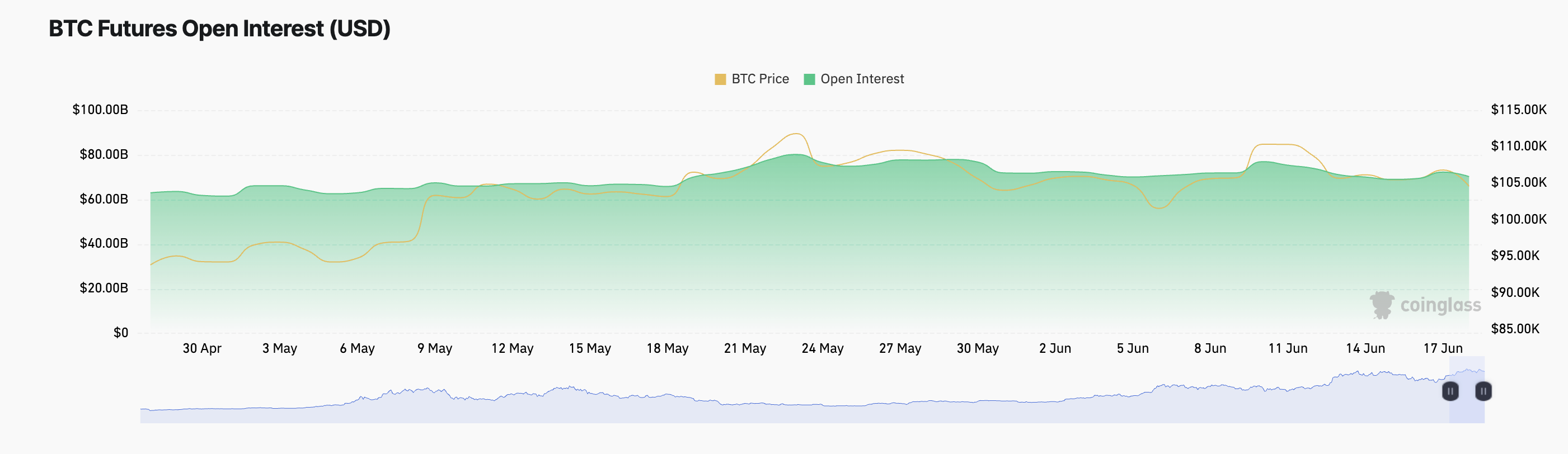

Today, BTC is cutting another 2% as the broader crypto market faces new sales pressure. The price decline is accompanied by Coin’s open futures interest (OI) DIP, suggesting a slower leveraged trading activity.

This was $70.24 billion at press, down 3% over the past day. This pullback indicates that traders will reduce exposure and, in some cases, close positions. This is a trend that reflects the attention of a growing market.

BTC futures are open to interest. Source: Coinglass

Open profit refers to the total number of unresolved futures contracts that have not yet been resolved. If a price falls during such a decline, it indicates that the trader is closing his position rather than opening a new position. This is a sign that it weakened convictions among BTC futures traders and reduced speculative appetite.

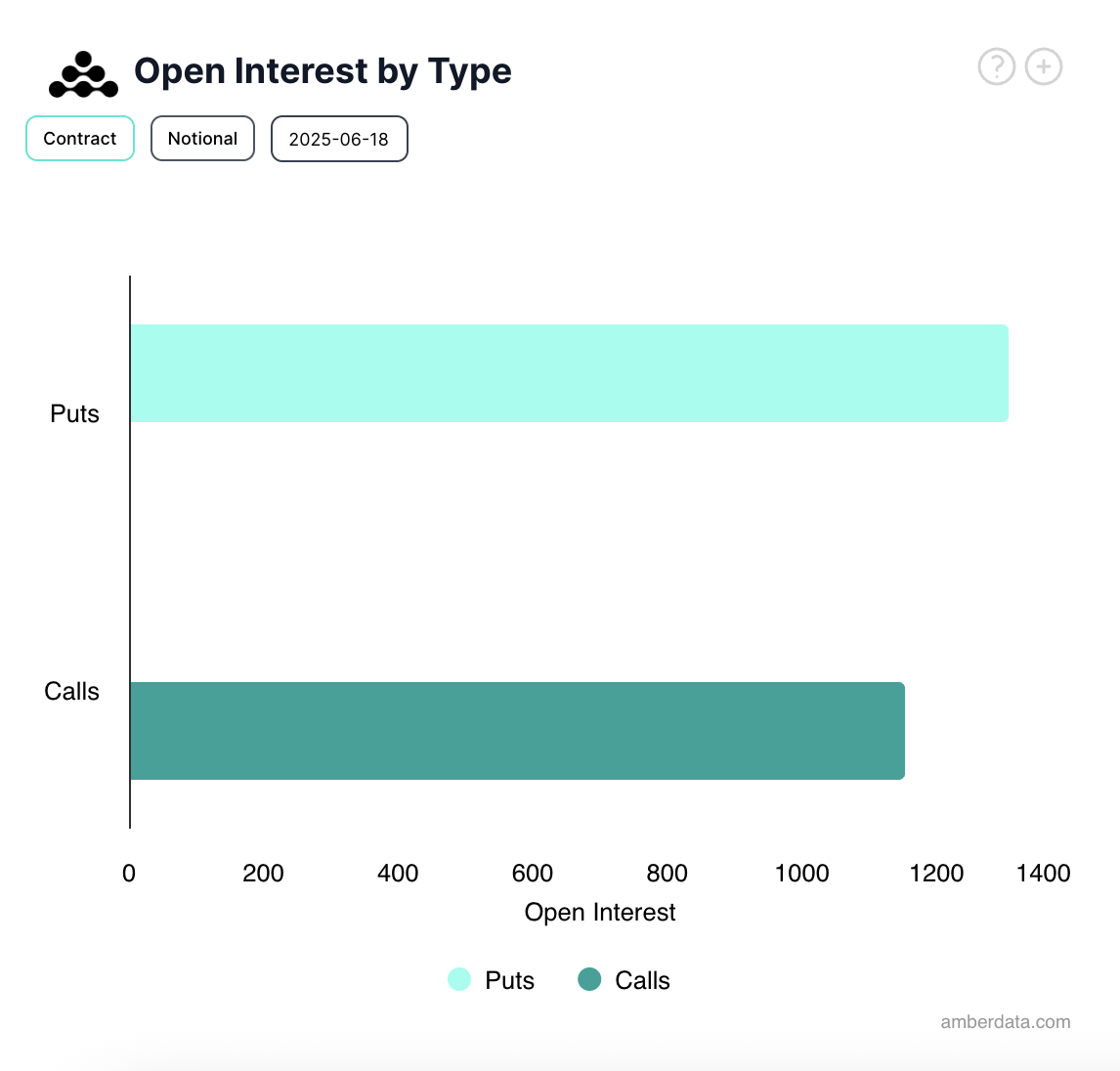

Furthermore, bearish sentiment continues to dominate the options market, as evident from the growing demand for contracts that have called for a call, according to Delibit. This imbalance suggests that more and more traders are positioning themselves to profit from the further negative aspects of BTC prices.

Interested in opening Bitcoin options. Source: Deribit

The combination of cooling ETF inflows, a decline in open interest, and a bearish slope in options markets has not faded institutional profits, but the decline in capital flows and trading behavior suggest that many investors are preparing for further downside, or at least waiting for a more clear signal before re-entering the market.