Ethereum is trading near key support after months of steady selling pressure. The 4-hour chart shows a solid downtrend with lower highs and lower lows. Price rejected the 0.786 Fibonacci level near $3,047 and never regained momentum.

As a result, the seller tightened its control thereafter. $ETH It lost the 0.618 level at $2,768. This breakdown accelerated the decline towards $1,742, which now provides major structural support.

Technical structure remains bearish below $2,050

$ETH Although it recently rebounded from $1,742, it remains below a major resistance cluster. Currently, the $1,900 to $1,850 zone is serving as the immediate short-term demand.

However, failure to sustain this area increases the risk of a retest of $1,742. A full break below that level could expose $1,650 and even $1,600.

On the upside, $2,036 to $2,050 forms the first resistance zone. Additionally, $2,134 marks a small Fibonacci resistance near the 0.236 retracement.

$ETH Price dynamics (Source: Trading View)

If the recovery continues, the next barrier will be the 0.382 level at $2,377. Additionally, the 0.5 retracement at $2,572 represents a major trend shift zone.

Related: Bitcoin Price Prediction: BTC Open Interest Falls as Bears Take Control

The Ichimoku cloud remains overhead, reinforcing consolidation within a broader bearish structure. The DMI indicator is showing pressure cooling selling. However, buyers still lack decisive momentum.

Derivative reset signals: prudent positioning

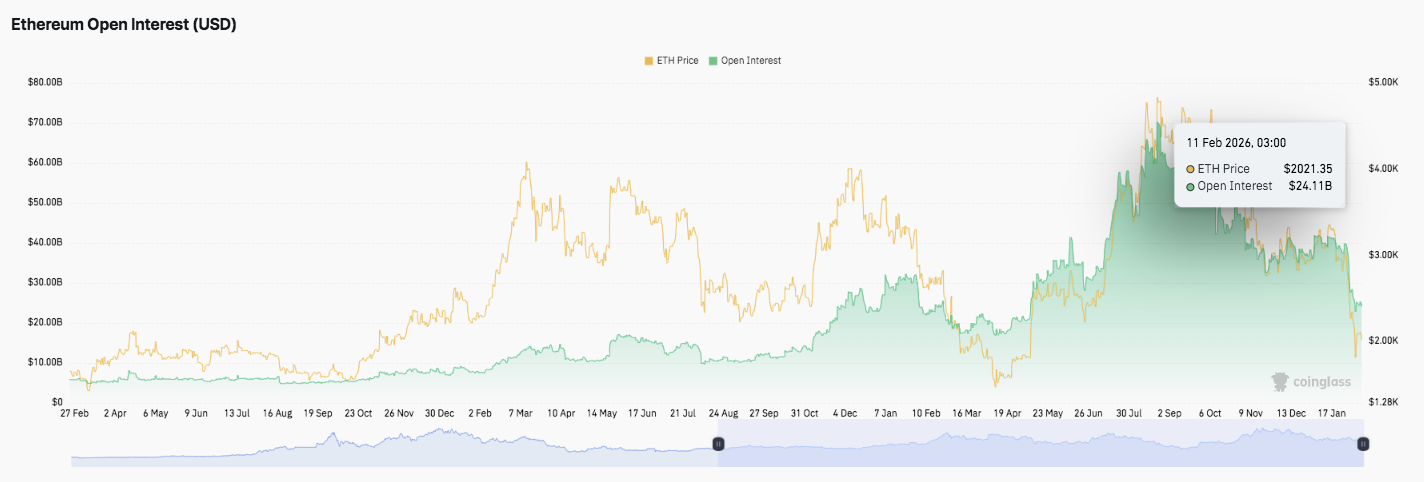

Source: Coinglass

Ethereum’s open interest expanded aggressively through mid-year, peaking at nearly $60 billion. The surge reflected rising leverage and strong speculative appetite. Importantly, recent data shows that open interest is shrinking towards $24 billion. This unwinding suggests liquidation, trimming positions, and reducing leverage exposure.

Spot flow data also highlight persistent distribution trends. Red net flowers dominated a wide area from mid-year to early winter. Several large outflow spikes have coincided with price declines, indicating signs of exchange deposits. In addition, occasional green spikes suggest selective accumulation at the local bottom.

Related: LayerZero (ZRO) Price Prediction: Can LayerZero Clear $2.46 and Extend Rally?

Recent net inflows remain slightly negative, with new outflows at nearly $47 million. Therefore, traders appear to be cautious regarding key technical levels.

Robinhood expands Ethereum utility with Layer 2 testnet

Robinhood Chain’s public testnet is now live 🛠️

Developers can now build on financial-grade Ethereum Layer 2, built on @arbitrum, designed to support tokenized real-world and digital assets.

Start building with Robinhood Chain’s core foundation: https://t.co/yHCQRh5x3j…

— Robinhood (@RobinhoodApp) February 11, 2026

Against this backdrop, Robinhood has launched a public testnet of an Ethereum-based Layer 2 chain built on Arbitrum. The network aims to support tokenized stocks, ETFs, and other real-world assets. Additionally, developers can now build publicly ahead of the mainnet launch, scheduled for later this year.

Robinhood aims to enable 24/7 trading and self-custody through its cryptocurrency wallet. Additionally, users can bridge assets across chains and access DeFi applications on Ethereum.

Ethereum base layer upgrades continue to increase capacity and reduce costs. As a result, Layer 2 networks are increasingly focused on specialized applications rather than pure scaling. Robinhood’s move reflects this change and highlights the evolution of the Ethereum ecosystem.

Technical outlook for Ethereum price

The key levels remain well-defined as Ethereum trades within a broader bearish structure. Price continues to respect the swing low of $1,742, which represents important structural support.

Top level: The immediate resistance level is between $2,036 and $2,050, which coincides with the Ichimoku lower boundary. A break above $2,134 (0.236 fib) would indicate improving momentum. If the bull can maintain his strength, $ETH It could extend to $2,377 (0.382 Fib) and then $2,572 (0.5 Fib), indicating a major trend shift level.

Lower price level: $1,900 to $1,850 remains the first demand zone to protect. Below that, $1,742 is the main structural support. If you look at the breakdown, it could be $1,650 or even $1,600.

Technical conditions show that Ethereum is consolidating below the cloud after a sharp retracement from the $3,047 rejection zone. Momentum indicators reflect waning selling pressure, but bulls lack certainty. This structure is similar to a compression phase within a broader downtrend, and volatility can increase rapidly in either direction.

Will Ethereum rebound?

Ethereum’s near-term outlook depends on whether buyers defend $1,900 and resolutely recover $2,050. A sustained move above $2,134 would change short-term sentiment and pave the way for $2,377. However, if you fail to hold $1,900, an additional $1,742 sweep is likely.

For now, $ETH It is located in a very important area. Derivatives positioning has cooled and spot flows remain cautious. Therefore, confirmation from strong volumes and inflows will determine whether Ethereum builds a recovery foundation or extends the correction phase.

Related: Cardano Price Prediction: ADA Tests Multi-Month Lows As Open Interest Falls and Outflows Continue

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.