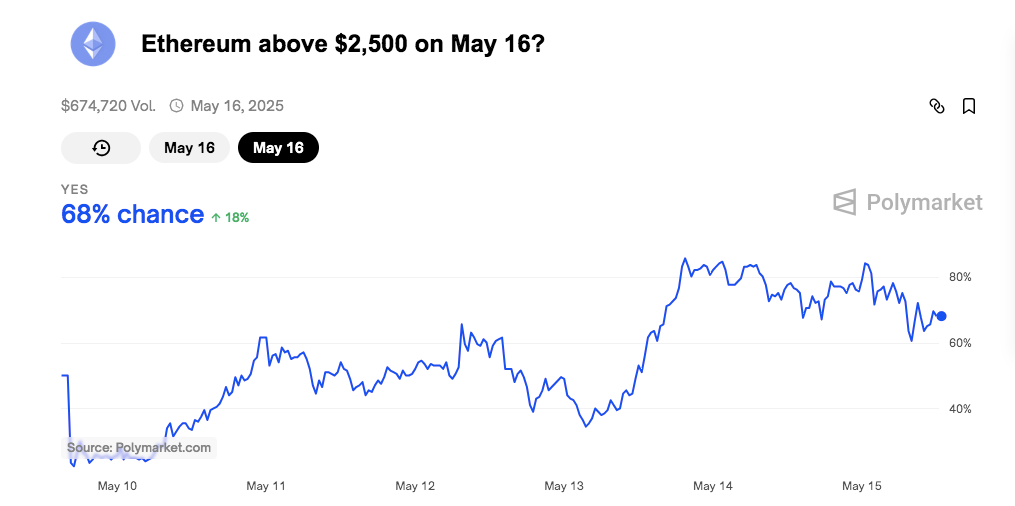

Ethereum’s market sentiment has changed markedly as Polymarket’s forecast market shows that cryptocurrency is 72% likely to exceed $2,500 on May 16, 2025.

This jump represents a 22% spike in trader trust, driven by recent daily growing optimism and increased trading activity. Emotional changes reflect a broader trend in which traders are recalibrating their outlook, based on both technical indicators and market psychology.

Polymarket forecasts show a large number of investors’ convictions

Source: polymarketcap

In addition to the increased odds, the market is gaining a lot of attention. The trading volume for this particular forecast reached $674,720, indicating strong participation and conviction among speculators.

Interestingly, this surge to confidence suggests that despite Ethereum’s short-term dip, investors may be focusing on long-term fundamentals rather than daily fluctuations.

Related: ETH Outlook is brighter: hedge funds shift to prefer Ethereum

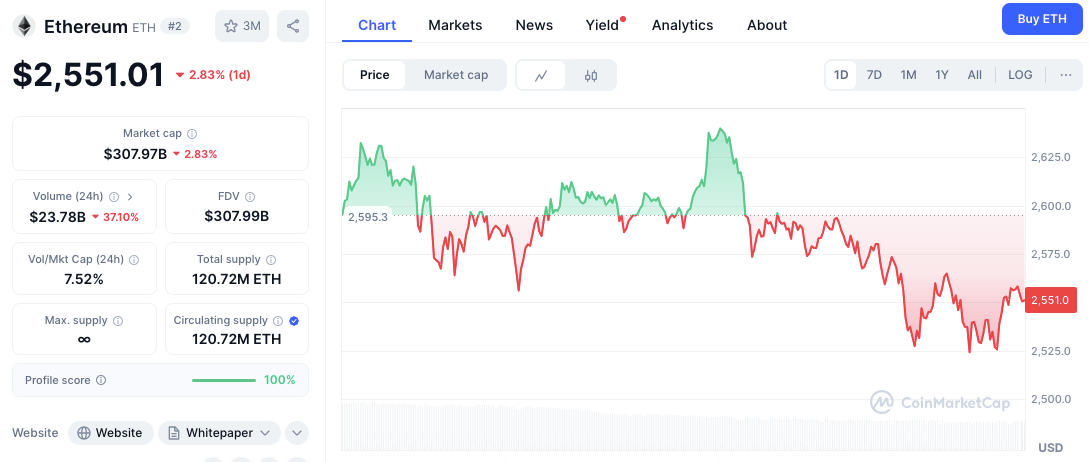

ETH Price Action and important technical levels to watch

At the time of writing, Ethereum is trading at $2,554.71, indicating a daily decline of 2.86%. The drop follows a sharp turnaround from the recent high of nearly $2,650. The chart pattern shows a series of highest and lowest values in a series. This generally indicates a short-term trend of bearishness. However, the larger picture may tell a different story.

The levels of support and resistance are more defined. Immediate resistance is $2,595, with a level that has recently refused to advance prices. Additional resistance was $2,625, at local height before the current pullback. If the Bulls can push prices above this zone, they could mark the start of a short-term gathering.

On the downside, the main support was $2,525, and the price bouncing back earlier. The more important level is $2,500. This zone carries both psychological weight and technical importance. Faults below this could open the door to further losses and could erode recent bullish feelings.

Momentum Indicator: ETH, MACD, over-acquired by RSI, is still bullish

ETH/USD Daily Price Chart, Source: TradingView

From an indicator perspective, the RSI is currently 72.25, placing it on territory where Ethereum has been over-acquired. This suggests that short-term pullback or price integration is possible. Although excessive conditions often precede market corrections, they do not always indicate long-term debilitating.

Related: ETH prices remain strong above $2.5,000 despite the wild exchange flow and a huge $1.2 billion withdrawal

Meanwhile, the MACD remains in bullish alignment, with the MACD line above the signal line. The crossover shows ongoing upward momentum, but a drop in price action could quickly weaken this signal. The narrow gap between these lines can indicate a shift in momentum if price support is not retained.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.