The current ETH price range is supported by hype, as reflected in Coinbase’s premium. At the same time, whales prefer to accumulate in lower ranges.

Ethereum (ETH) continues to show high levels of hype as retailers still show strong interest in purchasing. Recent data shows that ETH is still trading at a Coinbase premium, suggesting that US-based traders are prepared to cover the cost of the rally.

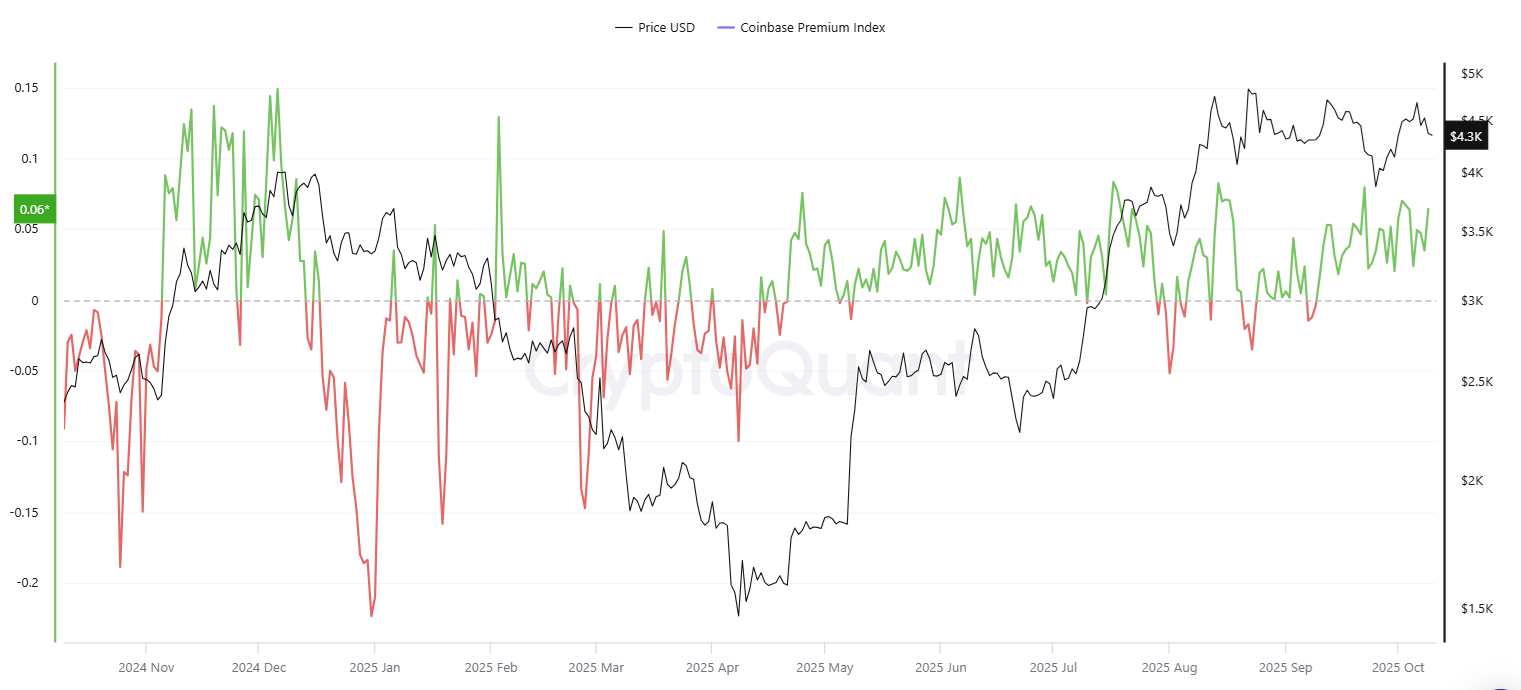

ETH is still trading at a Coinbase premium, indicating hype from US traders, but not necessarily strategic accumulation. |Source: Cryptocurrency

ETH is trading at $4,357.20 and the Coinbase premium has remained positive for the past few weeks. Coinbase prices are a proxy for US investor sentiment and measure retail behavior, not smart money. Since Coinbase is measuring direct purchases due to the hype, ETH has multiple sources of inflow including ETFs and ETPs.

The Ethereum Coinbase Premium Index has been consistently positive since early September and has remained positive despite price fluctuations and the recent drop below $4,500.

In late 2025, ETH more often traded at a premium. ETH is showing strength in the short term, but whales are located in different price ranges.

ETH has slower recovery in ETF demand

Unlike buying directly from Coinbase, ETFs inflow Recovery will be slower. Like Cryptopolitan, ETF buyers can still pour in fresh capital. reportedbut ETH buyers are more cautious.

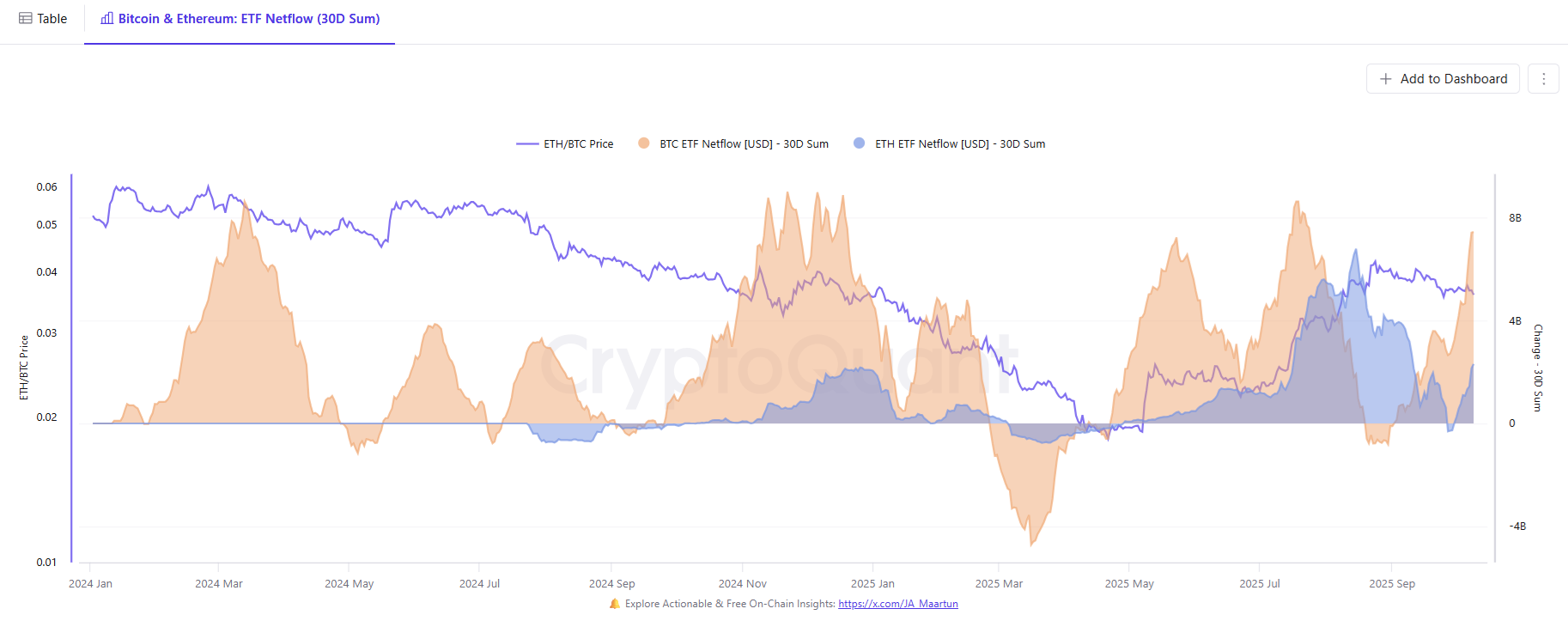

With BTC once again taking the top spot, the demand for ETH through ETFs is decreasing. |Source: Cryptocurrency

ETF net flows are much stronger for BTC, while ETH is still trying to regain one of its recent peaks. In 2025, ETH experienced its first stable two-week period with much stronger inflows compared to BTC, but the trend has reversed.

ETH is also flowing into the accumulation wallet, which still has over 27 million tokens remaining. The market is watching for a return to even more robust demand that could come from staking ETFs.

Will ETH correct further?

Recent developments in ETH suggest that a correction could be coming soon. Strategic whales are still watching for accumulation in the much lower $2,200-$1,800 zone. However, the market has enough enthusiasm to avoid a drawdown.

The ETH whale was already in that price range before the recent rally. Most government bonds and some ETP reserves were built at lower price points.

ETH open interest is slightly lower at $27 billion, but traders are reluctant to abandon the token. ETH is still part of the altcoin season, so traders are still waiting for a short-term breakout. Price movements have also been subdued as attention has shifted to the story of BNB, SOL, and other altcoins. ETH has lost some mindshare to these coins after gaining traction in September.

In the short term, ETH is still driven by derivatives trading, rebuilding long- and short-term liquidity between $4,200 and $4,400. Based on the short liquidity generated, the squeeze could be as high as $4,500. However, ETH has not shown enough momentum and is still seeking liquidity for an even bigger breakout. ETH market dominance is 12.4%, a step back from recent levels of 13%.