After a sharp breakout of over $3,000, Ethereum rallied towards $3,800, supported by strong momentum and bullish market conditions. The rally pushes ETH to a level not seen since early 2025 and supports major resistance.

However, signs of short-term fatigue are beginning to emerge, increasing the likelihood of a cooldown phase before it becomes more continuation.

Technical Analysis

Shayan Market

Daily Charts

On the daily charts, ETH remains a strong uptrend, far surpassing both the 100-day and 200-day moving averages, both located around $2,500. The recent breakout from the $2,800 zone has caused clean gatherings, with prices trading around $3,660 after a temporary touch on $3,800.

The RSI peaked above 78, suggesting that the move has been bought in large quantities and is now beginning to cool down. An important level to look at is the $3,300 area, which can act as a breakout zone and as support if prices are pulled back. As long as ETH is above that level, the macrostructure remains bullish.

However, the assets are stagnant just under $4,000 resistance, with the latest daily candles showing the top core, indicating sales pressure. If the Bulls can’t push beyond $3,800 in strength, they may see a deeper pullback to the $3,300 range. This is a healthy retest before continuing. The advantage is that the previous high of $4,107 remains the next major target, but it requires a clean breakout and daily closings above $3,800 to see the movement.

4-hour chart

In the 4-hour time frame, ETH shows a bearish divergence between price and RSI. The price has increased to $3,800, but the RSI is forming a lower high, suggesting that momentum is declining. The RSI has now dropped to around 50, losing short-term bullish pressure. The asset is currently consolidated within a tight range of $3,500 to $3,800, with multiple rejections from the latter region.

A breakdown below $3,500 will open the door to compensate for $3,200. This is the closest and powerful support. That level is lined with the origins of previous 4H structures and recent movements. So, ETH is likely to consolidate or retreat in the short term as the market cools down until it exceeds $3,800 in persuasive candles and volume.

On-Chain Analysis

Ethereum Funding Rate

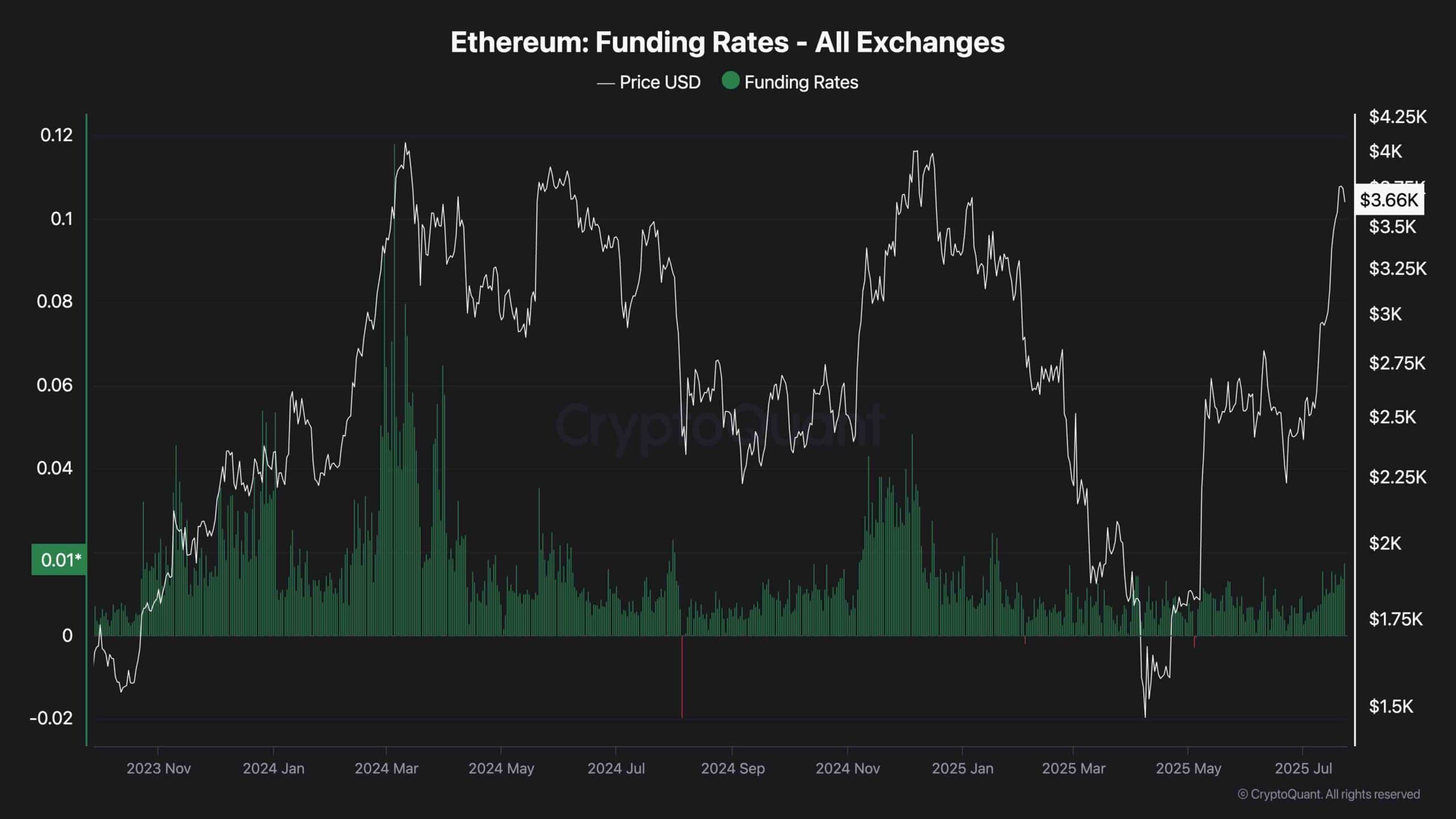

From an emotional standpoint, Ethereum’s recent gathering is supported by rising funding rates across all major exchanges and is supported by growing speculative interest. The funds are positive and continue to rise, indicating that longer positions are becoming more dominant as traders chase their breakouts. However, it is important to note that despite this increase, funding rates are far from the extreme highs seen at the top of major markets in the past.

During the peak of previous cycles, funding has surged aggressively, reaching levels that usually preceded sharp corrections or long apertures. Currently, fundraising remains relatively moderate, suggesting that although emotions are becoming more bullish, they are not yet at the euphoric stage. This gives Ethereum a breathing chamber to continue further, unless the rate escalates too quickly. A sudden spike could be an early warning of overheating conditions, so traders should look to fund dynamics.