Ethereum today costs around $4,355, a little lower than after the rough progression in August between $4,200 in support and $4,800 in resistance. The market is rising within the channel, with traders splitting on whether the next big move is a breakout or a correction.

Recent data shows how vulnerable the balance is. The whale stream shows that net spills were $12.8 million on August 30, with much sales pressure still underway, and leveraged positions at nearly $4,200 are also at risk of liquidation. At the same time, ETF inflows of $27.6 billion and more institutional staking indicate there is structural demand.

This conflict between short-term volatility and long-term resilience defines the outlook for September. Ethereum’s next move will depend on whether the Bulls are able to defend key support or whether sellers can drive deeper retracements.

Ethereum Price retains channel support as the indicator tightens

ETH Price Dynamics (Source: TradingView)

Ethereum price action remains within the uptrends since July. Support is tiered at around $4,200, and resistance capping is close to $4,800. The midpoint of the approximately $4,500 channel served as a pivot zone with repeated momentum shifts.

ETH Price Dynamics (Source: TradingView)

On the daily chart, the parabolic SAR is close to $4,957, which enhances the overhead of the resistance cluster. Meanwhile, the 20-day EMA, close to $4,420, and the 50-day EMA, around $4,200, offer a short-term demand zone. A break below $4,200 exposes an area between $3,800 and $3,600 where the historic liquidity zones align.

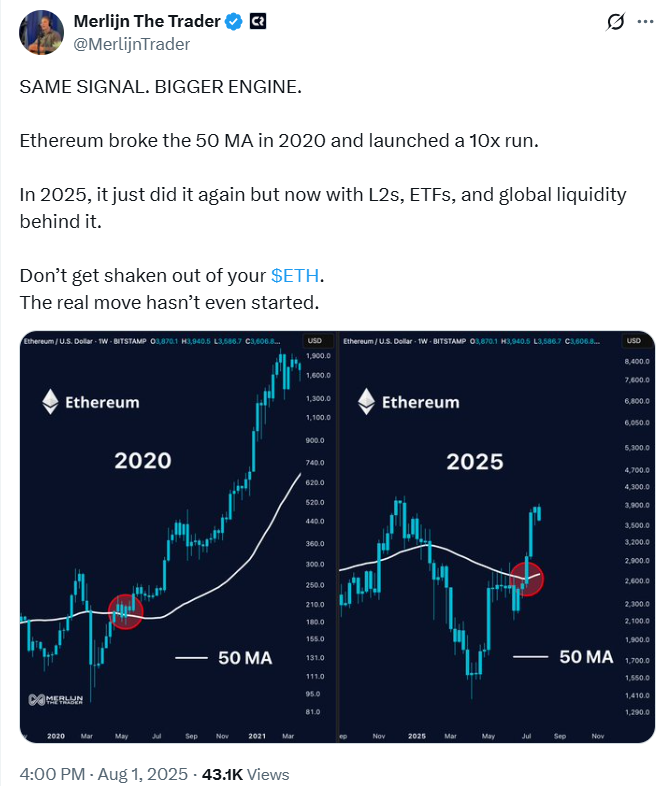

Momentum indicators suggest caution. The four-hour chart shows the bollinger band narrower, pointing to the impending expansion of volatility. The RSI approaches neutral levels, but the MACD flattens after signaling fatigue from the August rally. X’s analysts observed similarities to the 2021 breakout pattern, explaining trader Merlijn as “a retest where legends buy, and a breakout where fate is made.”

Ethereum repeats history

2021 showed a pattern.

2025 shows us opportunities.Retest is where legends buy it.

A breakout is where property is created. $eth is not complete. I’ve just started. pic.twitter.com/81tvrnlp70-Merlin The Trader (@merlijntrader) August 29, 2025

Whale activity and ETF flow drive inconsistent signals

Ethereum’s fluidity dynamics have become increasingly complicated. Whale behavior amplifies volatility, with some entities actively accumulating while others carry out rapid sales. In the third quarter, whales pushed over 9% since October 2024, but the recent spill highlights vulnerability. A $37 million sale of single whales in August caused a 10% stay.

ETH Spot Inflow/Outflow (Source: Coinglass)

Spot exchange data strengthens the gap. On August 30th, ETH recorded a net spill of $12.8 million. At the same time, institutional staking added structural demand. Currently, almost 30% of Ethereum’s supply is piled down, with a $17.6 billion corporate allocation following a clear act.

The influx of ETFs also emphasized adoption. The data shows a net inflow of $27.6 billion into Ethereum products this year, supporting the narrative of institutional acceptance. These influxes provide resilience to whale-driven volatility, but risk remains rising given the long, $2 billion-taking positions approaching the liquidation threshold.

The Bulls target $4,800, while the Bears warn about a breakdown of $4,000

The market is polarised between bullish and bearish stories. The Bulls claim that structural strength has been confirmed when Ethereum consolidation exceeds $4,200. With TVL exceeding $200 billion and improved regulatory clarity, we consider $4,800 as our next target. A breakout above this level can cause momentum to $5,200, potentially $6,000 per year end.

The Bears counter that Ethereum price volatility remains tied to leverage and whale flows. If ETH falls below $4,200, it highlights a vulnerable $2 billion open long position. That level of violation caused a cascade liquidation, similar to a $3 billion wipeout earlier this month, bringing the price back to $3,600. The negative risk cannot be dismissed as the Bollinger band is tightened and Netflows is negative.

This tension leaves Ethereum traders in the holding pattern, and both scenarios are plausible in response to the next liquidity shock.

Ethereum Short-Term Outlook: Breakouts or Breakdowns?

Ethereum’s price forecast heading into September depends on whether buyers can recover momentum to more than $4,450. A closure above this level will bias towards a $4,800 retest, with a potential extension of $5,200.

Conversely, if you can’t hold $4,200, you’ll be exposed to deeper support at $3,800 and $3,600. The presence of heavy leverage below $4,200 amplifies the risk of sharp flashes if sales are enhanced.

For now, Ethereum price updates indicate a market in equilibrium, with structural inflow offset by fragile liquidity conditions. Traders will use closely positioned positioning to watch whales’ activities and measure their next critical movement.

Ethereum Prediction Table

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.