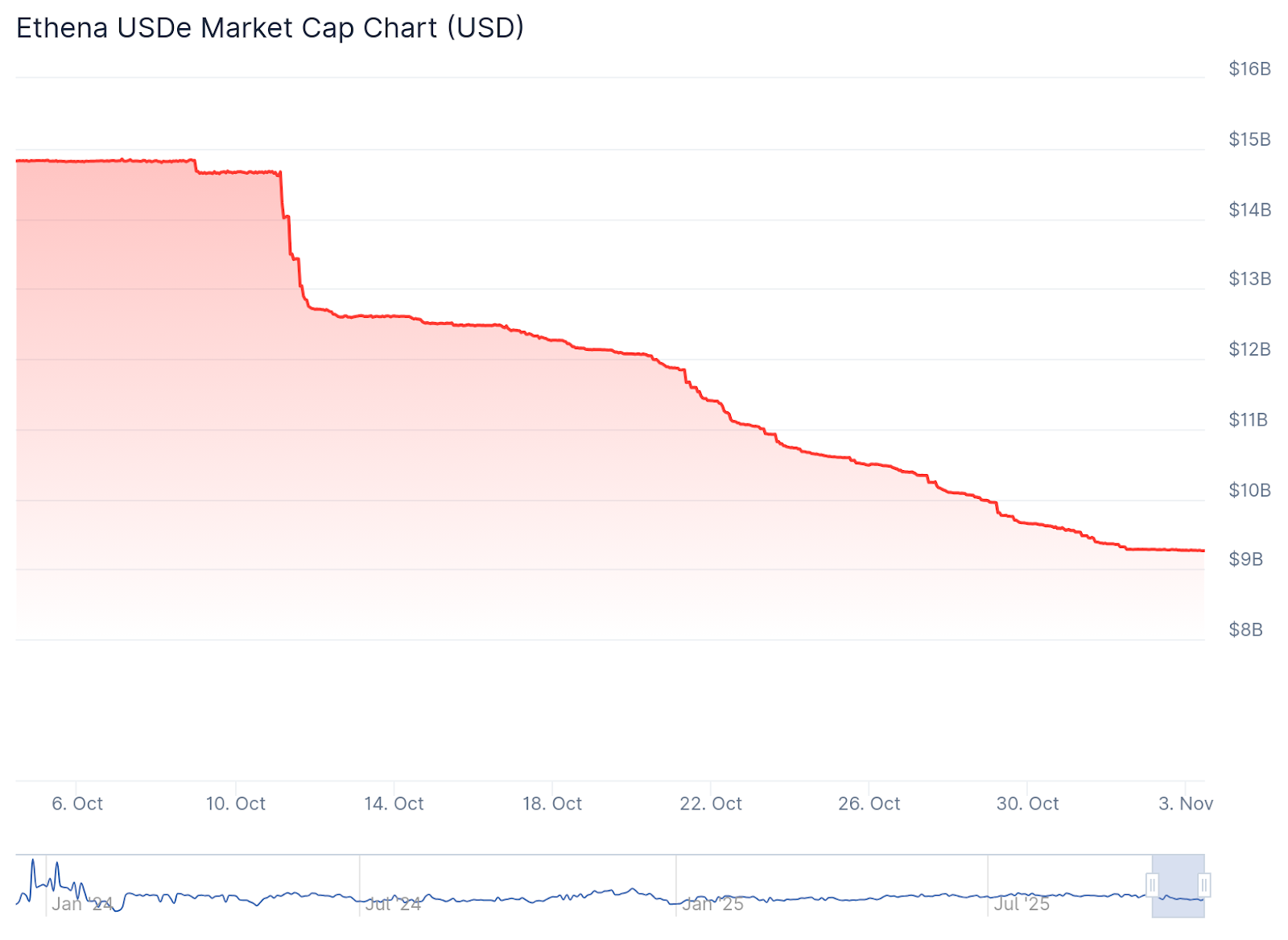

Ethena Labs’ synthetic dollar-pegged token Ethena USDe (USDE) has lost more than $5 billion in market capitalization since the October 10 market crash after the asset underwent a massive stress test.

Before the “Black Friday” flash crash (which wiped out over $19 billion of leveraged positions across the market, making it the largest liquidation event in crypto history), USDE’s market capitalization was over $14.6 billion.

Ethen USDe’s market capitalization plummeted by about $2 billion between October 10 and 11 as investors rushed to redeem their USDE and exchanged the tokens for the underlying collateral. According to Ethena Labs’ documentation, each redemption of USDE consumes the returned USDE, which could reduce the overall token supply and, in turn, market capitalization.

As Blockworks analysts noted in an Oct. 15 post to the Ethena Governance Forum, “approximately $1.9 billion in USDe redemptions were processed between Oct. 10 and 11.” Analysts added that the large volume of redemptions were processed quickly and noted that Ethena’s mechanism showed “extremely high resilience.”

“(Redemptions) were $1.6 billion in one day and $1.9 billion in the two days before and after the crash, and it’s realistic to think that the majority of these redemptions took place within hours.”

Ethena USDe lost another $3 billion in market capitalization over the remainder of October, reaching approximately $9.2 billion at press time.

Ethena USDe market capitalization in October. Source: CoinGecko

Binance flash crash

The nearly 40% drop in market capitalization is the steepest decline since Etena USDe’s launch in late 2023. Although it is difficult to say the exact reason for the mass redemptions, the token gained attention after October 10, when the price on Binance, the largest centralized cryptocurrency exchange (CEX), dropped to around $0.65 at one point.

As The Defiant previously reported, USDE’s dramatic price crash below $1 on Binance (which did not occur on other platforms) triggered a wave of liquidations on CEX, resulting in widespread criticism of Binance’s pricing oracle settings. Notably, with Curve Finance and other decentralized protocols, the price of USDE remained close to the $1 peg during market volatility.

In an Oct. 12 blog post, Binance distanced itself from the accusations, instead saying that the exchange’s core futures, spot matching engine, and API trading “remained operational” during the crash.

Sam McPherson, CEO and co-founder of Phoenix Labs, suggested in a November 2nd X post that some of USDe’s decline may be related to overleverage, noting that the token is “overleveraged by 15 billion.”

“As I said, the more organic size of USDe is around $6 billion to $7 billion, so whenever the market turns around, it will reflexively fall back to organic size,” McPherson wrote.

Defiant reached out to Ethena Labs for comment on this change, but did not receive a response as of press time.

As The Defiant previously reported, in late September, just one day after CEX began offering 12% annual interest on USDE through its Binance Earn product, USDE deposits on Binance skyrocketed to $735 million.