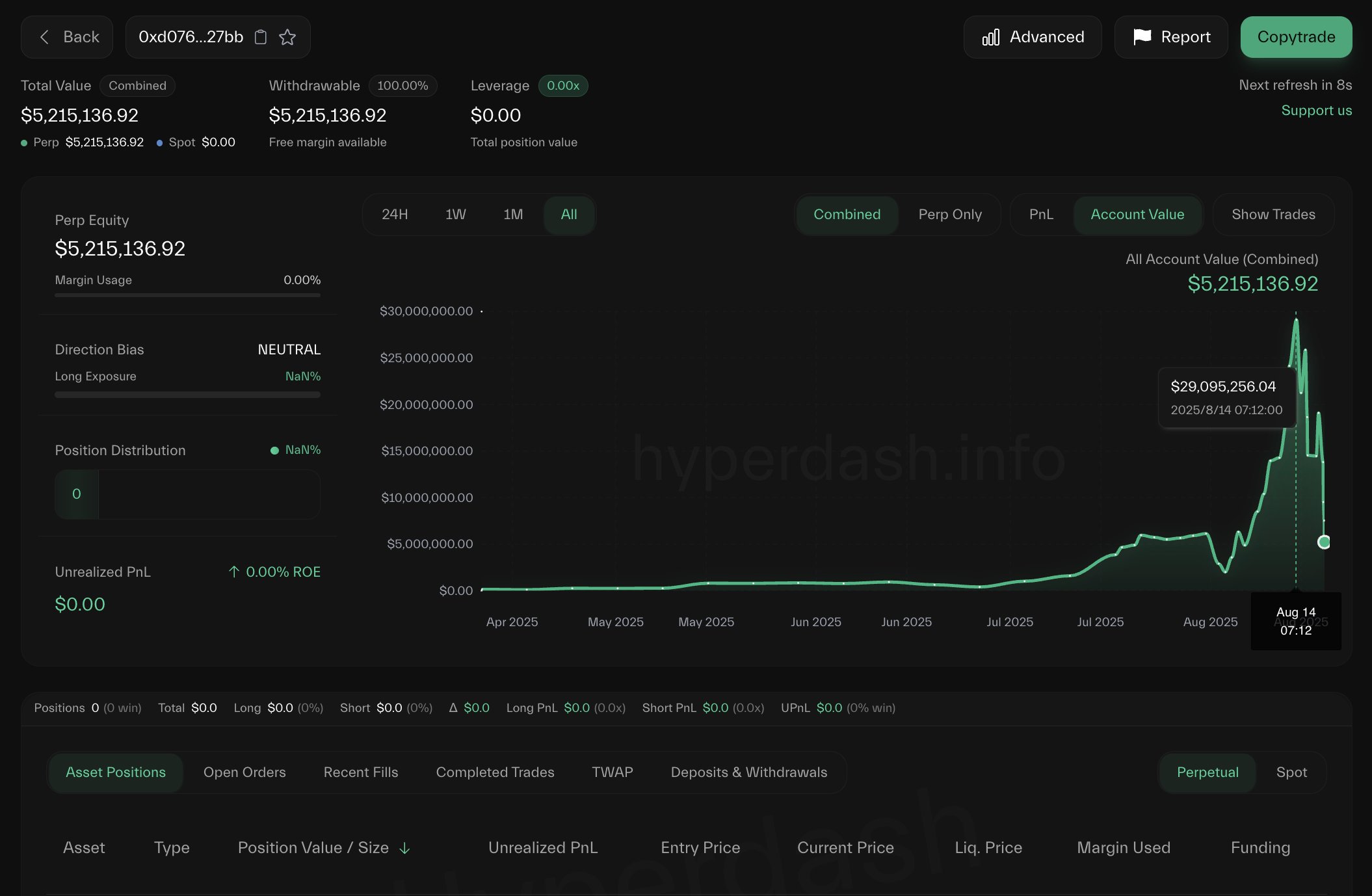

Cryptocurrency investors have turned $125,000 in stock into multi-million dollar profit trading ether in a diversified exchange, even if whales began making profits after a recent rally.

The savvy trader changed his peak initial investment of $125,000 to more than $43 million just four months after the latest market recession hit his ether (ETH) long position.

Despite the market slump, Savvy Trader closed all positions and closed a net profit of $6.86 million on Monday, generating an impressive 55x return on his initial investment.

After depositing the first $125,000 into a decentralized exchange high lipid, traders “deftly exacerbated their profits and reverted $eth’s profits to $eth to build a $103 million position,” said Lookonchain on Sunday’s X-Post.

sauce: Lookonchain

Trading patterns of whales or large investors are often monitored by traders to assess the short-term momentum of the underlying cryptocurrency.

Related: Ether Ministry of Finance swells as big companies launch record capital: fiscal redefinition

Whale movement and ETF flow

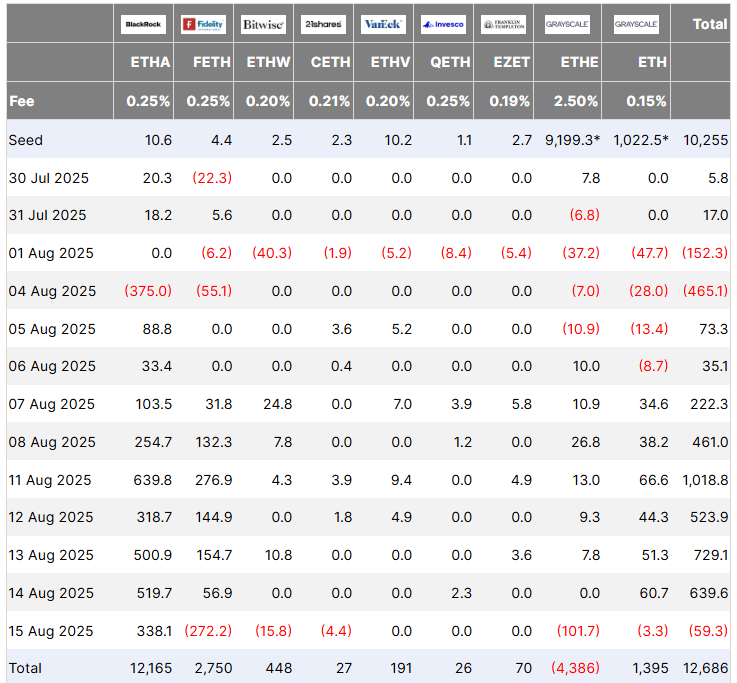

The US Spot Ether Exchange Trade Fund (ETF) heading for last weekend suspended its net positive inflow for eight consecutive days after seeing $59 million worth of outflows on Friday, Farside investors data shows.

Ethereum ETF Flow, US Dollar, millions. Source: Farside Investors

Following Friday’s ETF spill, more ether whales have begun loading profits in anticipation of potential fixes during the rest of the August break period.

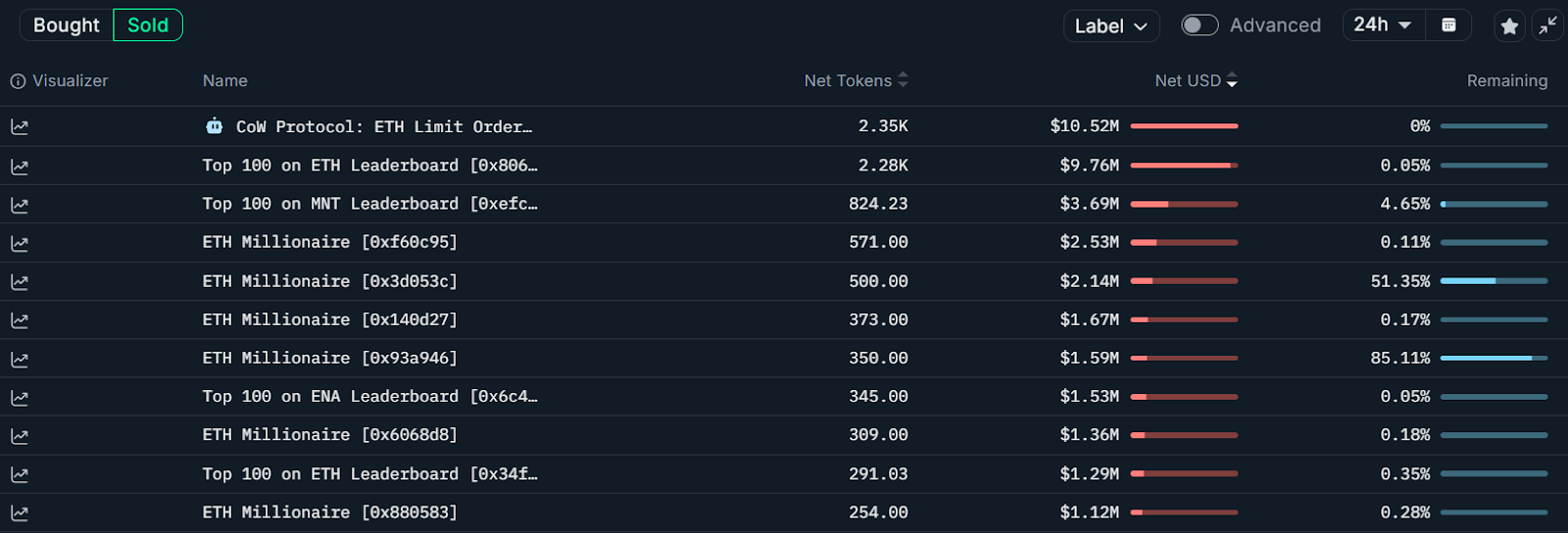

On Monday, a wallet labelled “0x806,” one of the top 100 ether traders tracked by Nansen, sold over $9.7 million in ether (the second-largest ether sale of the last 24 hours), data from data from Nansen’s data.

The largest ether position has been on sale for the last 24 hours. sauce: Nansen

Another top 100 ether trader, wallet 0x34F, also sold $1.29 million worth of ether, while many other whales sold millions of the world’s second-largest cryptocurrency.

Related: Bitcoin easily flips Google’s market capitalization as investors exceed $124K

According to Ryan Lee, chief analyst at Bitget Exchange, “Ethereum’s strong run could make money, limit the momentum of the immediate upward movement, and instead set the stage for integration.”

Bitcoin (BTC) and ether remain “remaining vulnerable to a more sharp swing towards emotional change,” due to growing open interest in indicating how much leveraged in the current market environment.

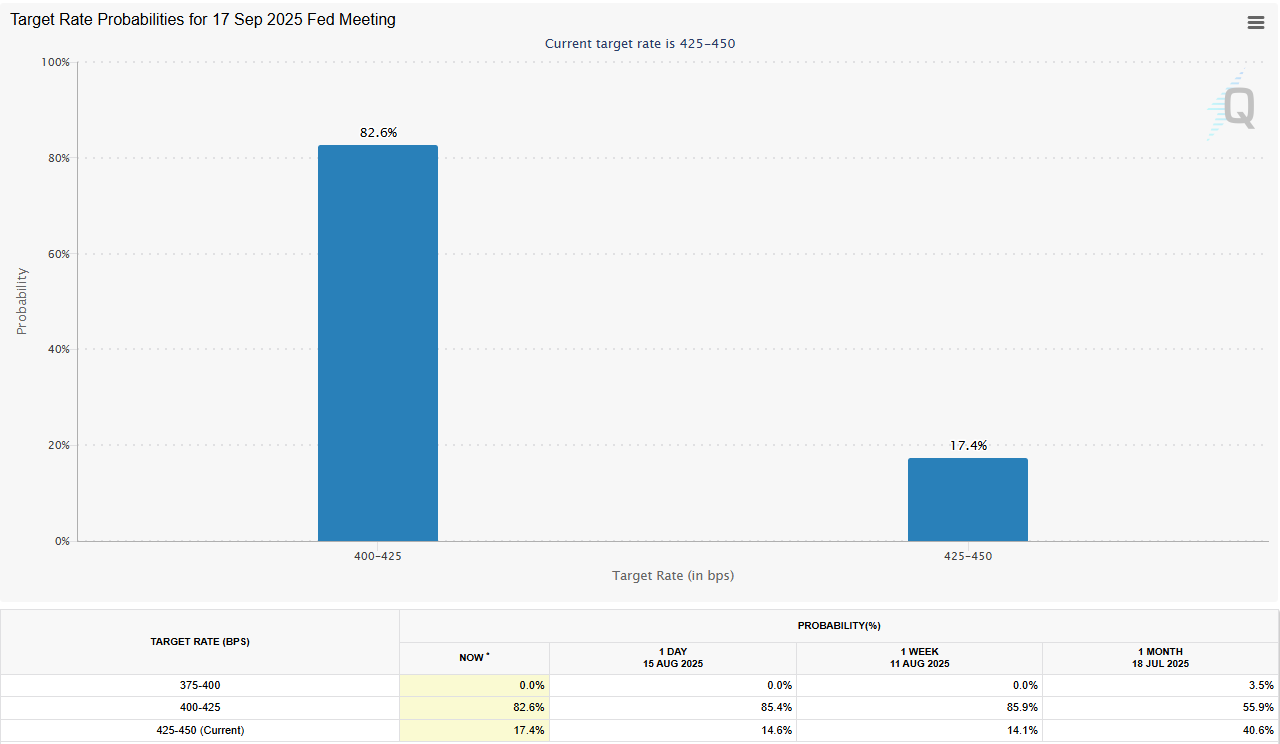

Investors should be cautious about the US Federal Reserve “Hauxcheness” and delays in anticipation of interest rate cuts, which remains a major factor in the crypto market, Lee added.

Provides the probability of the target interest rate. sauce: CME Group FedWatch Tool

According to the latest estimates from CME Group’s FedWatch tool, the market is priced at the next Federal Open Market Committee meeting on September 17th with an 82% chance that the Fed will be stable.

https://www.youtube.com/watch?v=20zfedqdkl8

magazine: How Ethereum Finance Companies Can Cause “Defi Summer 2.0”